Even in the midst of a cost-of-living crisis, gambling stocks are on the up, propelled in part by a surge in online gambling during COVID lockdowns – we’ve picked two London-listed stocks which are tipped for the top.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

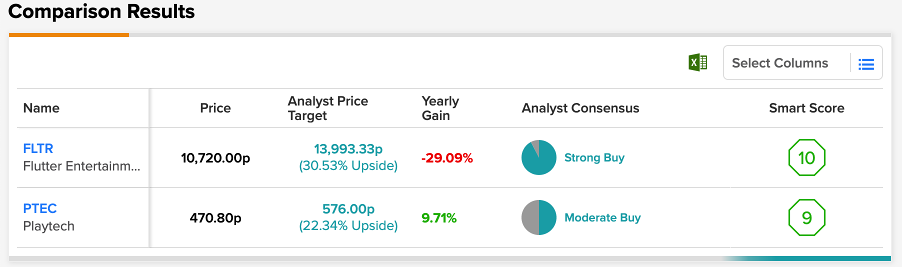

Gaming company Flutter Entertainment (GB:FLTR) and gambling software company Playtech (GB:PTEC) are both gambling stocks on which analysts are bullish.

We have used the TipRanks stock comparison tool, to list and compare the gaming stocks based on analyst ratings and target prices. This tool can be used by investors to compare up to seven stocks at a time on different parameters.

Let’s discuss the stocks in detail.

Flutter Entertainment Stock

Flutter is gaming and sports betting company with some popular brands such as FanDuel, Sportsbet, Betfair and PokerStars under its umbrella.

The company’s operations are diversified globally, which provides a cushion during difficult times in the UK.

Last month, the company declared its interim results for 2022 with revenue growth of 9%, driven by average monthly players which increased by 14%.

However, pre-tax earnings were down by 19% to £476 million.

The company posted fairly solid growth in the U.S. market. The region is a hub for sports betting customers and Flutter’s market share has grown to 51% in the market with the market-leading FanDuel’s products.

With the beginning of football season in the U.S., Flutter is well-placed for solid top-line growth in this market. The company expects its revenues in the US market to be ahead of its guidance range of £2.3 billion and £2.5 billion in the second half of 2022.

Is Flutter Entertainment a good stock to buy?

According to TipRanks’ analyst rating consensus, Flutter Entertainment stock has a Strong Buy rating. It has 13 recommendations including 12 Buy and one Hold.

The FLTR target price is 13,993p, which represents a 30.5% change in the price from the current level. The price has a low and high forecast of 12,800p and 15,800p, respectively.

Playtech Stock

Playtech is a leading gaming and betting software developer, providing solutions for casinos, bingo, poker, sports betting, and more.

Being the backbone of the gaming industry, the company is strategically placed to ride out tough economic times.

The company’s stock has been on a roller coaster since November 2021, when it received a takeover deal from Gopher Investment. The deal was later dropped in July this year, pushing the shares down by 18%.

In its annual results for 2021, the company posted a 12% growth in revenues driven by B2B business in the U.S. In the B2C segment, Snaitech, which was acquired by Playtech in 2018, drove the company’s online performance with revenue growth of 45%.

Snaitech is the leading sports betting company in Italy.

Considering the company’s strong business momentum with some long-term partnerships, management is highly positive about the fiscal year 2022 numbers.

Playtech share price forecast

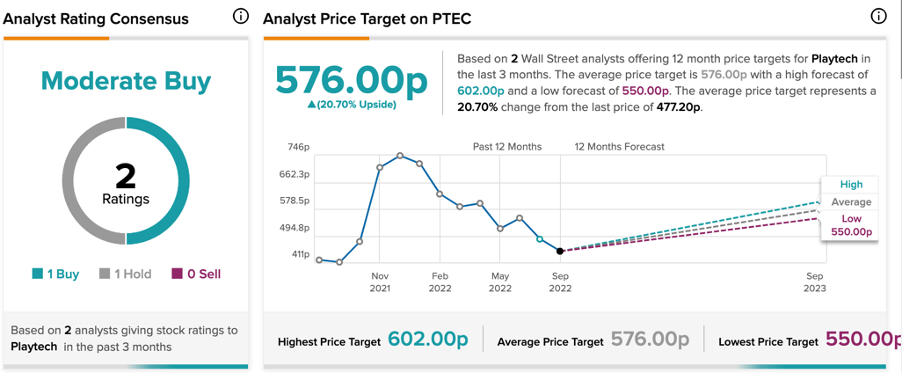

According to TipRanks’ analyst rating consensus, Playtech stock has a Moderate Buy rating.

The PTEC price target is 576p, implying an upside of 20.7%. The analyst price target has a high forecast of 602p and a low forecast of 550p.

Conclusion

The gaming industry presents an attractive investment option because of its tremendous growth. However, these stocks are also volatile in nature, thanks to strict regulations and tough competition in the industry.