Analyst James Zaremba mainly covers retail and service sector stocks in the UK and the U.S. markets – and he’s typically bullish on the sector, as more than 75% of his stocks are rated as Buys.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Here are two stocks from his kitty.

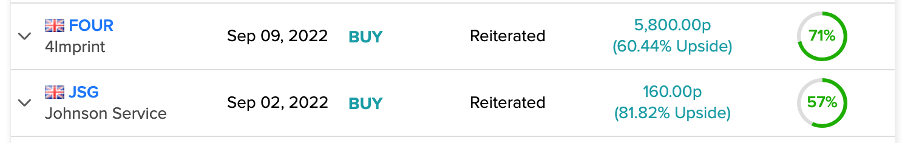

Customised gift retailer 4Imprint Group (GB:FOUR) and textile services company Johnson Service Group (GB:JSG) have solid upside potential in their share prices. Zaremba has more than a 50% success rate on both these stocks.

Zaremba is an equity research analyst at Barclays covering small and midcap stocks.

He joined Barclays in 2014 after working with Deloitte.

He is ranked 1,359 out of 7,974 analysts on TipRanks and 2,727 out of 22,123 total experts. The TipRanks Expert Centre provides a list of a wide range of analysts covering stocks from different sectors. Their recommendations can lead investors to make informed decisions.

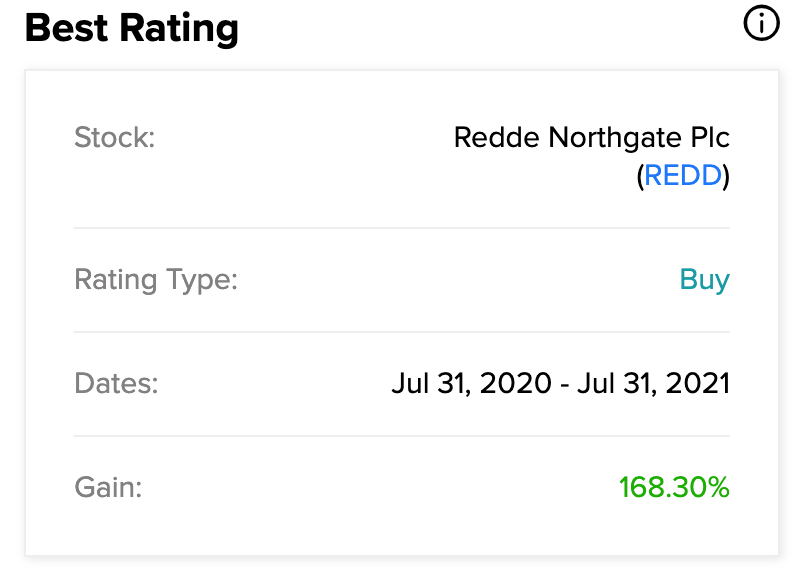

As per the TipRanks star rating system, Zaremba is a four-star rated analyst with a success rate of 48%. He has an average return of 9.2% per rating.

However, his highest return so far was from the renting and leasing company Redde Northgate (GB:REDD) on which he generated a return of 168.3% between July 2021 and July 2021.

Let’s see the two stocks in detail.

4Imprint Group

4Imprint is a retailer of customised products for gifting and branding purposes, serving mainly in the U.S. and Canada with a smaller market in the UK. The company’s product range includes stationery, toys, wellness, technology, and more.

The company, in its half-year results that ended on July 2, 2022, reported a 58% growth in its revenues of $515.54 million. The highlight of the results was pre-tax profit, which jumped to $43.9 million from $3.37 million in the last year.

The numbers were highly supported by 1,46,000 new customers added and a total of 886,000 orders completed during the period.

4Imprint has a track record of being a consistent performer in revenues and profits, which is the USP for investing in the stock. The company is witnessing huge demand for its products and it is confident in hitting its target of $1 billion in sales in this financial year.

4Imprint’s stock price forecast

Zaremba recently reiterated his Buy rating on the stock with a target price of 5,800p, which has an upside of 60%.

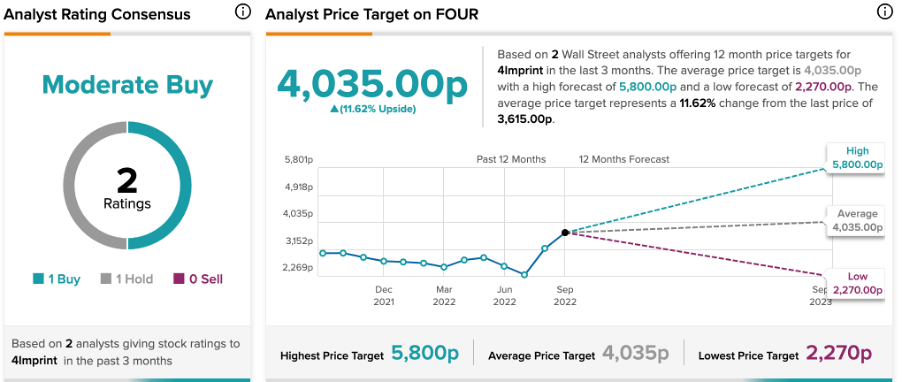

According to TipRanks’ analyst rating consensus, 4Imprint stock has a Moderate Buy.

The FOUR price target is 4,035p, with a high forecast of 5,800p and a low forecast of 2,270p. The average price target shows an increase of 12% from the current price level.

Johnson Service Group

Johnson Service Group is a leading retailer of workwear and protective wear across the UK. The company also provides textile services to the hotel industry.

The company’s first-half revenue for 2022 grew by 77% to £176.2 million. The revenue surpassed pre-COVID levels, with a huge improvement in organic growth. The company is further on track to achieve higher volumes as the hotel industry’s operations are back to normal.

With its market-leading position comes an advantage of pricing power. The company increased its prices to offset higher costs along with some operational efficiency measures.

Considering its strong performance, the company reinstated its dividends at 0.8p per share. JSG also launched a share buyback programme for £27.5 million which came as a cheerful surprise for the shareholders.

Is Johnson Service stock a Buy?

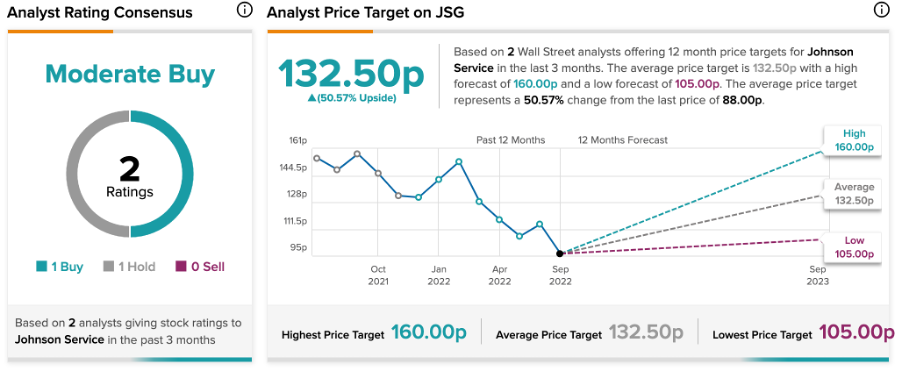

According to TipRanks, Johnson Service stock has a Moderate Buy rating, based on one Buy and one Hold recommendation.

The JSG price target is 132.5p, which is 50.5% higher than the current price.

Zaremba recently lowered his target price from 175p to 160p and maintained a Buy rating on the stock. He has a success rate of 57% on JSG.

Conclusion

These companies are backed by solid fundamentals and are on track to achieve their growth numbers. Considering Zaremba’s grip on the sector, these stocks look like a perfect opportunity to invest.