After finishing in the black on Friday, markets started this week with additional gains – although year-to-date the S&P 500 has slipped back into the bear territory. The recent high volatility comes in the wake of the Fed’s interest rate hike last week, and the intention to keep rates high as it battles to curb inflation.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It’s hard to tell where the markets are heading right now, but at least according to market expert Ed Yardeni, we’re already near the bottom of the bear market. Yardeni believes that the Federal Reserve is not likely to raise interest rates much further, and that the bad news on interest rates has already been taken into account.

“It seems to be that we’re in a bottoming process. I think that the market has certainly discounted a great deal of what the Fed is going to do,” Yardeni noted.

If Yardeni is right, then investors have an opportunity now to live up the oldest of all investing advice: buy low, sell high. Plenty of stocks fit the ‘bottom fish’ profile; we’ve pulled up two from the TipRanks database, stocks with Strong Buy consensus ratings and about 70% share price declines this year. In fact, the analysts see them both surging over 90% in the coming year. Let’s take a closer look.

Thoughtworks Holding (TWKS)

We’ll start in tech, where the digital consulting firm Thoughtworks brings adaptive expertise to its clients. The firm’s services include digital strategizing, design, and software engineering, which combine to make Thoughtworks a valuable partner for enterprise clients and tech disruptors. The company has a footprint in 17 countries, and among its clients counts such major names as Paypal, Daimler, and Bayer.

For bottom fishing investors, the first thing to know about Thoughtworks is that the stock is down 70% so far this year. The second thing to know is that even though the share price is down, the company has reported a modest sequential revenue gain in each quarter of this year so far.

In the most recent quarterly report, from 2Q22, the company showed a top line of $332.1 million, for a 3.8% sequential gain and a stronger 27.5% year-over-year gain. The company’s adjusted diluted EPS rose 10% year-over-year, from 10 cents in 2Q21 to 11 cents in 2Q22. On the balance sheet, Thoughtworks in Q2 was able to repay $100 million of its standing debt, reducing the total to $406.1 million, and boasted cash and liquid assets of $274.5 million. The company also has access to $165 million in borrowing capacity, in a revolving credit line. Thoughtworks has scheduled its 3Q22 report for this coming November 14.

Analyst Daniel Perlin, chiming in from RBC Capital, describes TWKS shares as ‘constructively positioned’ heading into the Q3 earnings release, with currency exchange issues due to the rising dollar presenting the strongest headwind.

“Despite the potential challenges associated with FX volatility and a tight labor market, we believe that current valuations offer an attractive entry point given TWKS’ unique position to capture share in a large and growing total addressable market with an attractive underlying business model with strong projected growth,” Perlin opined.

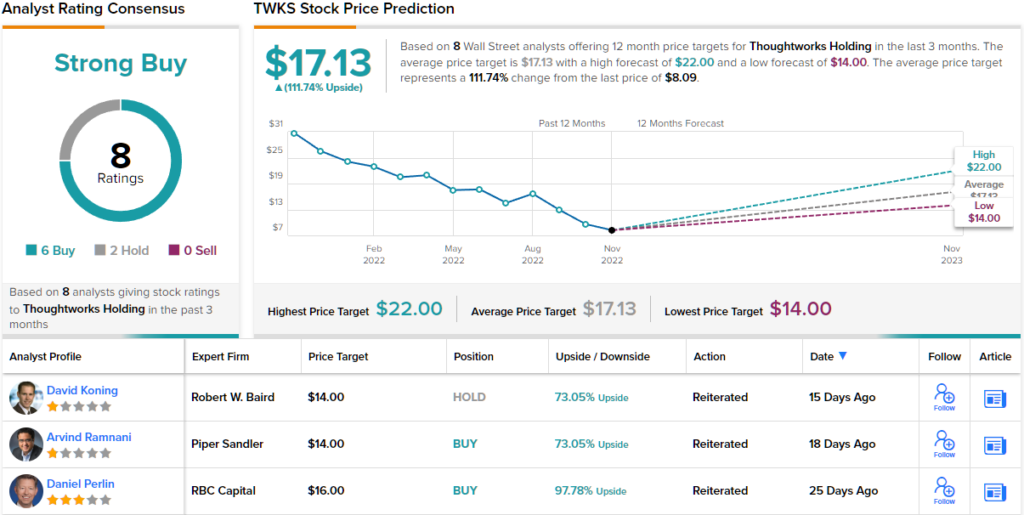

All of the above makes it clear why Perlin is now standing with the bulls. The 5-star analyst rates TWKS an Outperform (i.e. Buy) while his $16 price target implies an upside of ~98% for the year ahead. (To watch Perlin’s track record, click here)

Overall, 8 Wall Street analysts have weighed in on Thoughtworks shares, and their reviews include 6 Buys and 2 Holds – for a Strong Buy consensus rating. The stock is currently selling for $8.09 and its $17.13 average price target implies ~112% gain in the coming months. (See TWKS stock forecast on TipRanks)

Cryoport, Inc. (CYRX)

We’ll now shift to the world of healthcare and look at Cryoport, a company that has built out a solid niche in the field of cold. That is, in the cold storage and transport of biological tests and samples. These are highly perishable, time sensitive items, and reliable cold storage and courier services are essential to the labs, medical offices, and research facilities using Cryoport’s capabilities. These capabilities include liquid nitrogen dry products shippers, and refrigerated transport solutions for various materials in the 2 degrees to 8 degrees Centigrade range. Cryoport’s transport services are end-to-end, and the company backs it with extensive cold chain experience and 24/7 customer support.

Cryoport occupies an essential niche in the healthcare industry, but that doesn’t insulate the company from economic and situational headwinds. Lockdowns in China have put pressure on the company’s product supply and manufacturing chains; the strong dollar, and the consequent negative impact on foreign exchange, cost the company $2.6 million in Q3; and the effects of inflation and tighter money are visible in scaled-back customer orders for freezers and refrigerators despite high demand for cryogenic bottles (Dewars).

These headwinds were partially balanced by the reopening, in March, of the company’s Prague, Minnesota plant (part of its 2020 MVE acquisition), which had been severely damaged by a fire early last year.

Overall, the pressures have pushed shares in CYRX down by 70% this year – and the recent 3Q22 report showed both a revenue and earnings miss and reduction in full-year guidance, further exacerbating the share decline.

At the company’s top line, the revenues of $60.5 million were up ~7% from the last year’s quarter, but nearly $9 million below the consensus forecast. On earnings, the GAAP EPS came in at a 15-cent loss, 7% worse than had been expected. While these indicators were bad, the company’s forward guidance seems to be what spooked investors; Cryoport reduced its full-year revenue guidance by 10% at the midpoint, to the range of $232 million to $238 million. This guidance was also well below the $251.7 million forecast.

Through all of this, BTIG analyst David Larsen continues to take an upbeat stance on Cryoport’s prospects, noting: “While the quarter was disappointing we would encourage investors to buy on weakness, as we believe that management has good control over the business, and we view the headwinds in the quarter as being temporary.”

“Since the MVE plant in China that had been locked down has re-opened, and since demand for Dewars is high, we would expect some relief with MVE to build. We also like how there has been no weakness with Dewars shipping, and we believe it’s only a matter of time before demand for large refrigerators picks back up. Management has a plan to shift CRYOPDP services to countries other than Eastern Europe. We like the actions that management is taking,” the analyst added.

Looking forward from here, Larsen rates CYRX stock a Buy, and his price target of $40 implies an impressive one-year upside potential of 130%. (To watch Larsen’s track record, click here)

Clearly, the headwinds here have not deterred the Street’s analysts, as all 6 of the recent analyst reviews on CYRX are positive, for a Strong Buy consensus rating. The stock has a trading price of $17.38 and its average price target of $34.67 suggests a gain of 99% in the next 12 months. (See CYRX stock forecast on TipRanks)

Would you like to identify the stocks that have received the most bullish recent ratings from the Street? Check out the TipRanks’ Analysts’ Top Stocks tool. The tool also reveals which stocks have dropped over the last three months- enabling you to pinpoint the best stocks trading at compelling levels.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.