The SPDR Portfolio S&P 500 ETF (NYSEARCA:SPLG) already had a low expense ratio, but it got even more affordable when it slashed its expense ratio by 50% at the beginning of August. According to Bloomberg, SPLG is the lowest-cost large-cap blend S&P 500 ETF offering, with a gross expense ratio that got lowered to 0.02% from a previous 0.03%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This rock-bottom expense ratio means that an investor will pay just $2 in expenses when putting $10,000 into SPLG, making it the type of cost-effective ETF an investor can build their portfolio around. Assuming that the fee remains at 5% and that the fund returns 5% per year going forward, this investor would pay just $6 in fees over the course of three years, $11 over five years, and a paltry $26 over an entire decade.

While the old adage says that you get what you pay for, that’s not necessarily the case for SPLG, which gives investors plenty of bang for their buck. Let’s take a closer look at this $19.6 billion S&P 500 (SPX) ETF.

What is SPLG ETF’s Strategy?

SPLG is an ETF from State Street (NYSE:STT) that seeks to provide results that “correspond generally to the total return performance of the S&P 500 index,” according to State Street. The company also describes SPLG as “one of the low-cost core SPDR Portfolio ETFs, a suite of portfolio building blocks designed to provide broad, diversified exposure to core asset classes.”

History shows that investing in the S&P 500 has been a winning proposition over the long term. The S&P 500 has averaged double-digit annualized returns of 10.15% for more than six decades since it assumed its current form of owning 500 stocks in 1957, and you can’t really argue with that type of track record.

Clearly, the S&P 500 has been a long-term winner, making SLPG a viable long-term holding. Also, in terms of affordability for investors, you can’t really beat SPLG.

Solid Returns

As of the end of July, SPLG had returned 20.2% year-to-date and 12.4% over the past year. Over the past three years, it posted an impressive annualized total return of 13.7%. Looking further out, SPLG’s five-year and 10-year annualized returns of 12.2% and 12.6%, respectively, aren’t too shabby either. Going back to its inception in 2005, SPLG has managed to post a double-digit annualized return of 10.0%.

The fact that this strong performance encompasses multiple bear markets, including the great financial crisis and the COVID-19 crash of 2020, shows the power of long-term investing and investing in high-quality, broad-market ETFs.

SPLG’s performance is admirable, to begin with, and even more so when considering the fact that there are plenty of ETFs with exponentially higher expense ratios in the neighborhood of 0.35%, 0.50%, and even 0.75% or higher that can’t match SPLG’s performance over the years.

SPLG’s Holdings

In addition to its best-in-class affordability and excellent long-term performance, SPLG offers strong diversification by investing in the entire S&P 500. This broad-market ETF holds 504 stocks, and its top 10 holdings account for just 30.2% of the fund. You can check out SPLG’s top 10 holdings below using TipRanks’ holdings tool.

The nice thing about investing across the S&P 500 is that it gives investors exposure to the breadth and depth of the entire U.S. economy. State Street says that the index “represents approximately 80% of the U.S. market.”

SPLG’s largest holdings are some of the U.S.’s largest and most innovative companies, including tech mega-caps like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG), Meta Platforms (NASDAQ:META), and Tesla (NASDAQ:TSLA). These are the stocks that comprise the “magnificent seven” that have propelled the markets to new heights in 2023.

And there is plenty more than just tech here. SPLG’s top 10 holdings are rounded out by Warren Buffett’s investment conglomerate Berkshire Hathaway (NYSE:BRK.B) and health insurance giant UnitedHealth Group (NYSE:UNH).

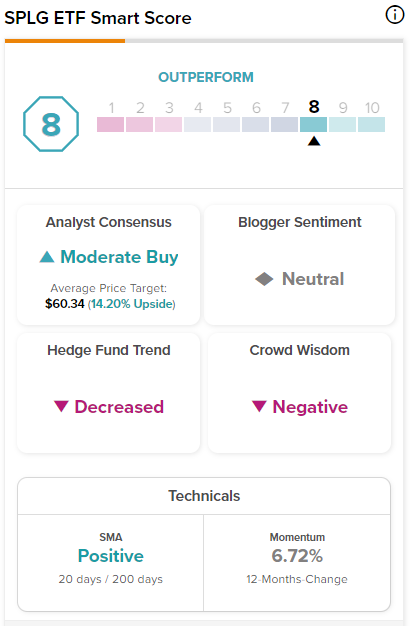

These top holdings feature strong Smart Scores across the board. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. The score is data-driven and does not involve any human intervention. Seven of SPLG’s top 10 holdings feature outperform-equivalent Smart Scores of 8 or higher.

SPLG itself features an Outperform-equivalent Smart Score of 8.

Just outside the top 10, you’ll find no shortage of familiar, blue-chip names, including healthcare leaders like Johnson & Johnson (NYSE:JNJ), Eli Lilly (NYSE:LLY), Merck (NYSE:MRK), and AbbVie (NYSE:ABBV), consumer staples mainstays like Coca-Cola (NYSE:KO), Pepsico (NASDAQ:PEP) and Procter & Gamble (NYSE:PG), plus household names from the financial sector including JPMorgan Chase (NYSE:JPM), Visa (NYSE:V), and Mastercard (NYSE:MA).

Is SPLG Stock a Buy, According to Analysts?

Turning to Wall Street, SPLG earns a Moderate Buy consensus rating based on 399 Buys, 97 Holds, and 10 Sell ratings assigned in the past three months. The average SPLG stock price target of $60.34 implies 14.2% upside potential.

This Long-Term Winner Continues to Look Attractive

SPLG’s rock bottom expense ratio of 0.02%, its strong long-term performance, and its diversified portfolio that gives investors exposure to the breadth and depth of the entire S&P 500 make this long-term winner an attractive investment opportunity. There are plenty of more expensive ETFs out there that can’t hold a candle to SPLG’s annualized returns, making this look like a solid building block for investors to build portfolios around.