The global market turmoil has reversed investor sentiment from extreme greed to fear. With liquidity tightening and the possibility of recession, risky asset classes have nosedived.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Within equities, growth stocks have been the worst hit. It’s important to remain cautious amidst multiple uncertainty factors. However, the deep correction in some growth stocks possibly provides a great entry opportunity.

EV stocks have been in the limelight in the last few years. With multi-year tailwinds, stocks from the industry are worth considering. Rivian Automotive (RIVN) is one name that can be considered after a deep correction.

Rivian stock had a euphoric listing, and surged to highs of $179.50 in November 2021. However, the rally fizzled out relatively quick. The downturn has been painful for investors and RIVN stock currently trades at $25.

I believe that current levels are attractive for the medium-to-long term. There are multiple growth catalysts for the company, and the stock can be trading meaningfully higher in the next few years. I am bullish.

Strong Financial Profile

With a plunge in equities and a decline in risk-on trade, an important factor to discuss is fundamentals and liquidity.

Of course, the plunge in Rivian stock has been painful for investors. However, the company managed a public offering when broad sentiments were bullish.

As a result, Rivian has a robust cash buffer of $17 billion as of March 2022. With the company having some ambitious growth plans, the cash buffer will ensure that there is no need for any external financial in the next 24 months.

Just to put things into perspective, Rivian already has a manufacturing facility in Normal. In December 2021, the company announced a second manufacturing facility in Georgia with a capacity to deliver 400,000 vehicles on an annual basis. This facility is expected to be completed in 2024 with an estimated cost of $5 billion.

When the Normal and Georgia factories are operational, Rivian will have a total capacity of 600,000 vehicles. The key point is that the company has the finances in place for this expansion.

Strong Order Backlog

For Q1 2022, Rivian produced 2,553 vehicles. During the same period, Rivian delivered 1,227 vehicles. Among positives is the fact that the company has reaffirmed the guidance to produce 25,000 vehicles in 2022. Even with supply chain issues.

Another positive to note is that Rivian reported an order backlog of 90,000 R1 vehicles as of May 9. The company’s pick-up and SUV orders have been swelling without any meaningful investment in advertising.

It’s also worth mentioning that the current order backlog is just for the U.S. and Canada. With nearly 70% of new vehicle sales in the U.S. being pick-ups and SUVs, the company’s backlog growth is likely to remain robust. Given the financial flexibility, international expansion is likely soon.

Furthermore, the company’s electric delivery van already has an order backlog of 100,000 vehicles from Amazon (AMZN). Estimates indicate that the global electric delivery van market is expected to grow at a CAGR of 17% through 2030. Therefore, the order with Amazon is just the beginning for the company in the commercial EV business.

On the flip-side, it’s likely that cash burn will sustain for Rivian in the next few years. For Q1 2022, the company reported adjusted EBITDA loss of $1.1 billion. The markets are however likely to focus on growth in deliveries. With operating leverage, the company has the potential to deliver robust cash flows.

Wall Street’s Take

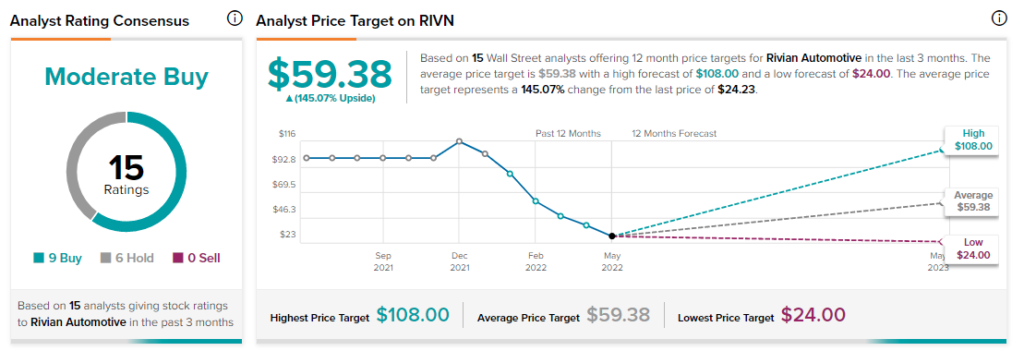

Turning to Wall Street, Rivian has a Moderate Buy consensus rating based on nine Buys, five Holds, and one Sell rating assigned in the past three months. The average Rivian price target of $61.69 implies 145.1% upside potential.

Concluding Views

Rivian is still at an early growth stage and that makes RIVN stock worth considering among emerging names in the EV industry. The company has ambitious manufacturing expansion plans, and the financial flexibility to execute the plan.

Competition in the EV industry has been intensifying. This is a potential risk factor. However, with presence in the retail and commercial segment, coupled with a global addressable market, the company is positioned to gain market share.

Another risk factor is a potential recession in 2023. This can impact the company’s order backlog growth. Again, these are temporary headwinds and the stock seems to have discounted a slowdown.

With geopolitical tensions, the focus is on a shift to renewable energy and reduced dependence on Russia for energy. One way to achieve this is through accelerated adoption of EVs. Rivian is likely to benefit from sustained growth in U.S. and Europe.

When market sentiments turn bearish, there tends to be an overreaction in growth stocks or high-beta stocks. It seems that Rivian stock is a victim of panic selling, and looks attractively valued at current levels.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure