Pharma giant Pfizer (PFE) has been on quite a roll over the past couple of years. The release of its coronavirus vaccine, Comirnaty, and its antiviral Paxlovid has been a game changer, helping it rake in billions in revenue. Many had thought its two cash cows would have stopped pumping money by now, but the opposite has ensued. Moreover, with its investments to reduce dependence on its two growth drivers, we believe there is a massive growth runway ahead for PFE stock. Hence, we are bullish on PFE stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Pfizer had been struggling to grow its sales before the pandemic. Its sales dropped from $54.7 billion to $40.9 billion between 2012 and 2020. However, once its Covid 19 vaccine was approved for mass distribution, its sales went to the moon. It grew sales by a colossal 39.4% in 2021 to $81.3 billion. Moreover, net income increased by similar margins.

Furthermore, given its rock-solid second-quarter results, it seems that top and bottom-line expansion won’t stop anytime soon. It has time to continue milking its two cash cows to generate strong numbers. On top of that, it has ramped up its merger and acquisitions (M&A) activity to create new growth drivers for the future.

PFE Stock Had a Remarkable Second Quarter

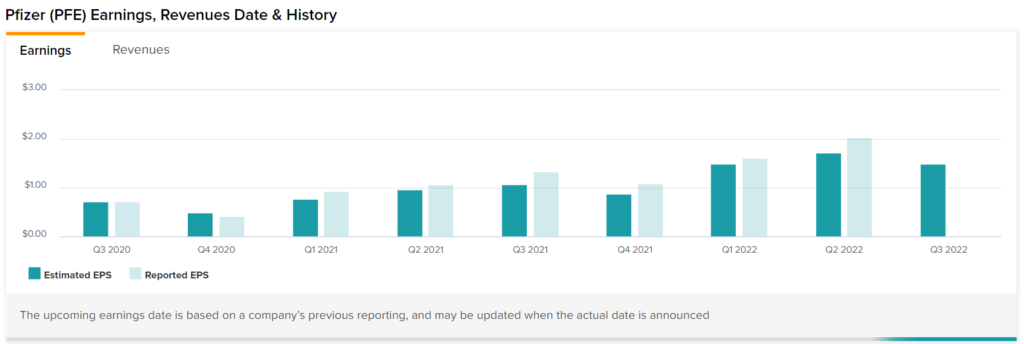

Pfizer posted $27.7 billion in sales during its second quarter, representing a 47% jump from the prior year. Naturally, Paxlovid and Comirnaty were the stars of the show. Paxlovid’s sales have risen nearly five-fold since the first quarter of this year. The company believes Paxlovid will likely generate even greater sales during the year’s second half. Additionally, Pfizer’s adjusted earnings per share came in at $2.04, a 92% improvement from the prior-year period.

Moreover, sales of the company’s blood thinner, Eliquis, shot up 23% from the prior-year period to over $1.7 billion. Furthermore, Prevnar, which is its pneumococcal vaccine, posted $1.4 billion in sales, up 18%. Its kidney cancer and heart disease drugs have also registered double-digit growth from the same period last year.

For Fiscal Year 2022, Pfizer expects its sales to fall between $98 billion to $102 billion with adjusted EPS of $6.25 to $6.45, up a tremendous 50% on a year-over-year basis.

Pfizer Stock is Looking to Diversify Its Income Stream

Perhaps the major concern for long-term investors of Pfizer is its future. A lot has been made of how the business could survive once its two primary growth drivers phase out in popularity. The firm’s management seems to be more proactive in its attempt to create more income streams by boosting its M&A activity.

The company’s free cash flow in 2021 came in at a tremendous $29.9 billion compared to $10.5 billion in 2019. Hence, it’s clear that the company has enough money to fund its shopping spree. It started off its spree with an early-stage biotech, Trillium Therapeutics, which develops drugs to fight hematological cancers.

Moreover, it also bought Arena Pharmaceuticals, which is developing a drug that has shown potency against ulcerative colitis. Also, it added a migraine therapy specialist called Biohaven to its portfolio for $11.6 billion.

What is the Target Price for PFE Stock?

Turning to Wall Street, PFE stock maintains a Moderate Buy consensus rating. Out of 12 total analyst ratings, four Buys, eight Holds, and zero Sells were assigned over the past three months. The average Pfizer price target is $61.75, implying 25.6% upside potential. Analyst price targets range from a low of $49 per share to a high of $105 per share.

Takeaway – PFE Stock is Too Cheap to Ignore

Pfizer has been an incredible investment over the past couple of years on the back of stellar top-line expansion. Comirnaty and Paxlovid have generated massive sales for the company and continue contributing immensely to total revenues. Additionally, PFE stock trades at just 2.7 times forward sales, compared to a five-year average of 3.86 times forward sales. Hence, I side with my colleague Joey Frenette to say that PFE stock is just too cheap to ignore.

Moreover, its management has a sense of urgency in creating more growth avenues for the business. Its M&A activity has increased at a healthy pace over the past few quarters, and we don’t expect that pace to drop anytime soon. It should be able to piggy-bank over the success of its two growth drivers and usher in the next era of growth.

Naturally, it won’t be an easy task, but the great thing is that its management feels the need to act proactively, which pays a lot of dividends down the road.

Furthermore, the company remains committed to rewarding its shareholders. Pfizer offers a dividend yield of 3.27% with a forward annual payout of $1.60 per share. Moreover, its payout ratio is at 26%, which means that it has room to increase dividends. Thus, if we combine this with its beaten-down valuation, it makes for a solid bet at this point. There may be some near-term weakness, but we feel strongly about PFE stock over the long run.