Popular electric vehicle (EV) maker NIO (NYSE:NIO) has the potential to turn around its dismal performance on the stock exchanges so far in 2022. The company is aiming to ramp up production in the second half of 2022 along with the delivery of several newly launched models. According to TipRanks’ data, Wall Street analysts and financial bloggers are also upbeat about NIO’s ability to deliver robust performance with support from its growing product portfolio.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

NIO Looks Unstoppable

NIO managed to deliver encouraging financial results for the second quarter of 2022 as the top-line figure surpassed Street estimates. The company’s impressive performance has come despite it grappling with multiple challenges like cost volatility, supply-chain disturbances, and production delays due to China’s zero-COVID policy.

The China-based EV maker has impressed with strong delivery numbers for August. It witnessed an 81.6% year-over-year rise to 10,677 vehicles.

Encouragingly, NIO has been receiving a solid response to its newly launched mid-large five-seater smart electric SUV, the ES7. NIO reportedly delivered 398 ES7s to users in the last month. Notably, NIO is also aiming to begin the mass production and delivery of the ET5 in late September.

China’s recent pledge to extend support to its EV industry should bode well for the stock. Also, NIO’s regulatory hurdles regarding delisting have eased to some extent following a preliminary audit agreement between the United States and China.

Is NIO Stock a Buy, Sell or Hold?

Considering the EV maker’s efforts to ramp up production and delivery numbers in the coming quarters, NIO stock seems like a lucrative investment option. According to TipRanks, the Street is optimistic about NIO stock and has a Strong Buy consensus rating based on 9 Buys.

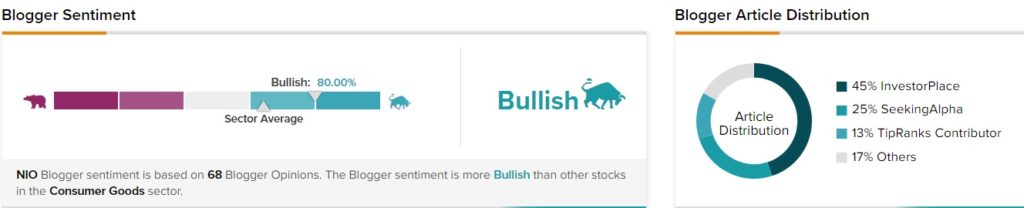

Similarly, TipRanks data shows that financial bloggers are 80% Bullish on NIO stock , compared to the sector average of 64%. The news sentiment is also Positive for the stock.

However, shares of the stock have declined 39.8% so far in 2022 amid tough macroeconomic challenges.

Conclusion: NIO’s Prospects Appear Bright

NIO has shown optimism about its capabilities to ramp up production with encouraging guidance for the third quarter of 2022. It expects to deliver vehicles between 31,000 and 33,000 in Q3, rising about 26.8–35% from the prior year. Further, NIO’s average price forecast of $31.84 implies a 58% upside potential to current levels.

Read full Disclosure