Bill Ackman heads the famed hedge fund, Pershing Square Capital Management L.P. The billionaire investor is currently in the limelight for his comments on the Russia-Ukraine war. His thoughts on a “negotiated settlement” did not go down well with the masses who accused him of being an “appeaser.”

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Pershing Square has about $7.46 billion in assets under management. Like several hedge funds that have underperformed owing to erratic market behavior, Pershing Square has also generated negative returns of 19.64% in the last 12 months. Nonetheless, since the filing of its latest 13F holdings on August 15, the fund’s returns have earned a positive 6.24%. The fund boasts of making $2.7 billion in profit this year alone by hedging against interest rate hikes. Let us look at the stocks that have been a favorite for Ackman.

The Howard Hughes Corporation (NYSE:HHC)

Texas-based Howard Hughes (HHC) is a real estate development and management company with a major focus on several master-planned communities (MPC). HHC’s high-growth real estate assets vis-à-vis a largely fixed-rate liability structure bode well for the company.

The hedge fund manager believes that HHC is well poised to earn long-term returns from “land price appreciation and rental income growth.”

HHC is the fifth largest holding of Pershing Square with 14.23% of the portfolio. The fund owns 13,620,164 shares of HHC with a current value of $950.69 million. Notably, on October 14, Pershing Square issued a tender offer to buy up to 6.34 million additional shares of Howard Hughes. The price range offered for the cash tender offer is between $60 and $52.25 with an expiry date of November 10.

Is HHC a Good Stock to Buy?

With three unanimous Buy ratings, Howard Hughes’ stock commands a Strong Buy consensus rating. On TipRanks, the average Howard Hughes price target of $87 implies 45.8% upside potential to current levels. Meanwhile, the stock has lost 41.6% so far this year.

Lowe’s Companies (NYSE:LOW)

American home improvement retailer Lowe’s (LOW) occupies the topmost position in Pershing Square’s portfolio (19.86%). The fund owns 10,207,306 shares of Lowe’s with a current value of $1.78 billion.

Despite the rising interest rates and a related downturn in the housing market, Ackman believes that Lowe’s “Pro” category offerings will continue to be in demand to complete the substantial projects undertaken during the pandemic. Notably, Ackman believes in LOW’s long-term earnings outlook, as it trades at relatively low valuations compared to its peers.

Is Lowe’s a Buy, Sell, or Hold?

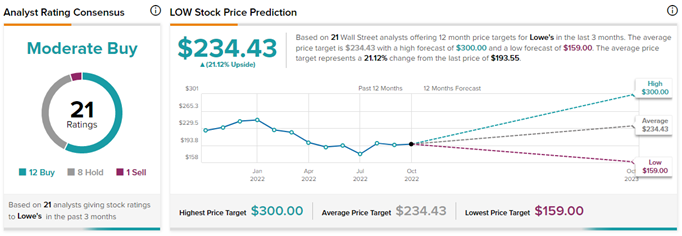

On TipRanks, Lowe’s stock has a Moderate Buy consensus rating. This is based on 12 Buys, eight Holds, and one Sell rating. The average Lowe’s Companies price forecast of $234.43 implies 21.1% upside potential to current levels. Meanwhile, the stock has lost 22.8% upside potential to current levels.

Ending Thoughts

Bill Ackman is known to have generated profitable returns for investors through his business acumen. An investor may choose to follow Ackman’s investment choices to make informed decisions. Notably, TipRanks accumulates the recommendations of several Top Experts, which can be considered while making investment choices to maximize returns.