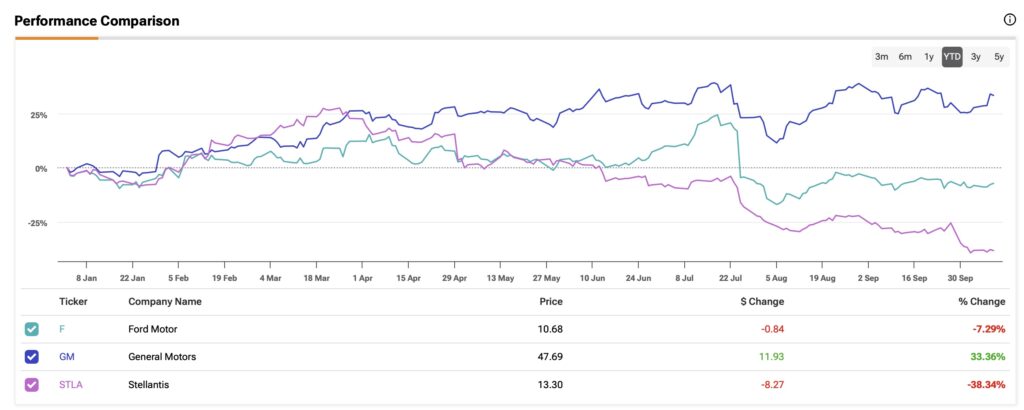

In this article, I will use the TipRanks Stock Comparison Tool to analyze traditional automakers, including Ford (F), General Motors (GM), and Stellantis (STLA). A closer look suggests a neutral stance on Ford, while a bullish outlook for both GM and Stellantis. However, if I had to choose one, I believe investing in General Motors is the best option compared to the other two, which I will discuss next.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Ford

I have a neutral view on Ford, the legacy U.S. automaker that has undergone significant restructuring to enhance profitability and resilience amid industry volatility. However, the company’s latest results have disappointed due to ongoing quality and warranty issues, a complex transition to electric vehicles, and a general lack of investor confidence.

Ford reported a significant EPS miss for Q2, coming in at 47 cents when analysts expected 68 cents. This marks the third consecutive quarter of sharp year-over-year declines, primarily driven by warranty costs. Additionally, Ford Blue, the segment focused on internal combustion engine (ICE) vehicles, reported an adjusted EBIT of $1.2 billion, down 48% from the previous year.

It should be noted that warranty costs have plagued Ford for years, affecting its reputation for quality and reliability. In 2023, the company had 5.9 million vehicles recalled, the highest of any U.S. automaker. These financial losses, coupled with rising warranty claims, suggest a troubling lack of quality in Ford’s combustion vehicles.

Ford Tackles Warranty Issues, Reinstates Dividends

I refrain from taking a bearish stance on Ford because there are positive developments. Promisingly, CEO Jim Farley indicated that warranty issues are expected to be resolved soon, with plans to invest in advanced technologies and improve testing protocols to significantly reduce these problems by 2025.

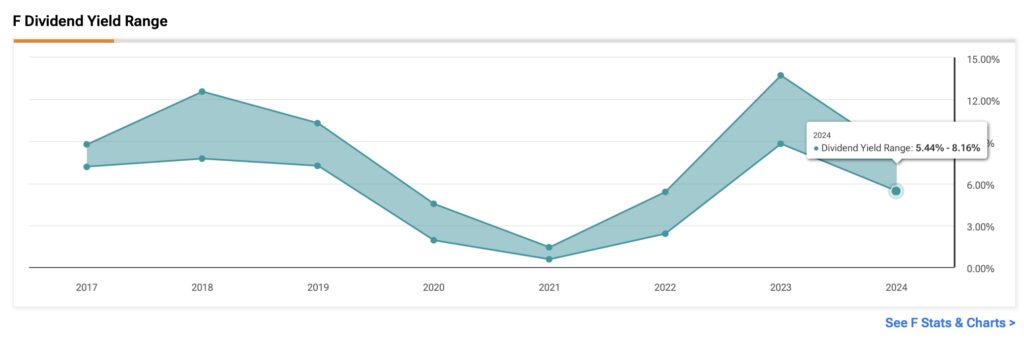

Also, after suspending its dividend during the pandemic, Ford reinstated it in 2021, signaling confidence in its financial health and sustainable cash flow. This makes Ford attractive to income-oriented investors, with a dividend yield of 7.43% and a payout ratio of 47.5%. Valuations also favor Ford, trading at a forward P/E ratio of 5.6x, about 30% below its five-year average.

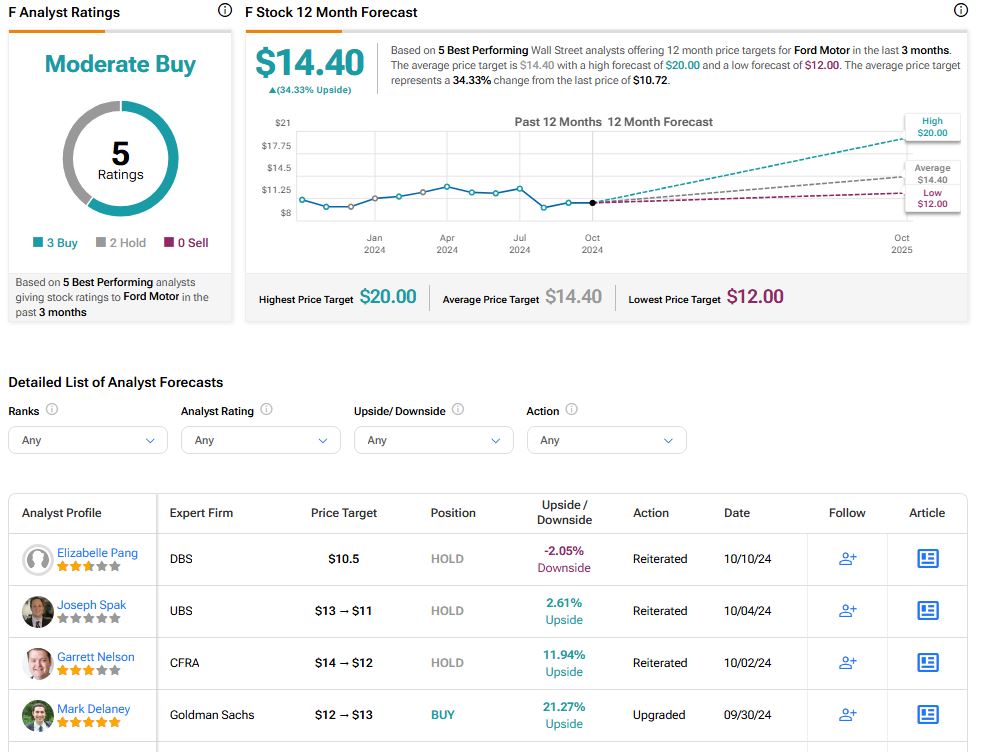

At TipRanks, Wall Street consensus rates Ford as a Moderate Buy. The average price target is $14.40, suggesting a potential upside of 34.33%.

General Motors

I have an optimistic outlook on General Motors, one of the largest automakers and a leader in vehicle electrification, thanks to its strong sales growth and aggressive push toward electric vehicles. As a result, GM has outperformed nearly all of its competitors this year.

In Q2, GM reported strong results, particularly in its internal combustion engine (ICE) trucks and SUVs, marking its eighth consecutive quarter of beating EPS estimates with $3.06 per share—a 60.2% year-over-year increase. The company achieved $4.4 billion in adjusted EBIT, up 37% from last year, prompting a $500 million increase in full-year guidance to between $13 billion and $15 billion.

GM Outperforms, Buys Back Shares, and Boosts Valuation

Much of the bullish investment thesis for General Motors hinges on its commitment to scaling Electric Vehicle (EV) initiatives. While GM previously pledged to electrify 50% of its fleet by 2030 and 100% by 2035, management now indicates that these goals will be guided by consumer demand.

Moreover, I believe one reason GM stock has outperformed its peers is that the company grew revenues by nearly 5% year-over-year, compared to the industry average of 2%. Additionally, GM’s EBIT increased by 4.2%, while the industry average was just 1.8%. In contrast, peers like Ford and Stellantis reported EBIT declines of 55% and 27%, respectively.

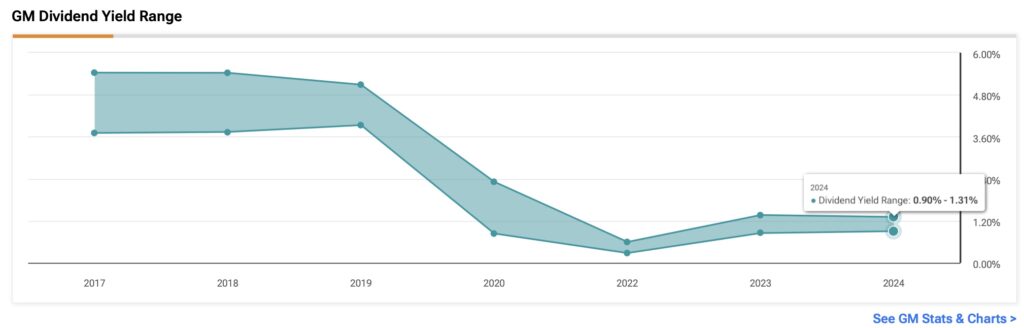

GM’s dividend yield is just under 1%, much less attractive than Ford’s. However, the company has repurchased about $11.5 billion worth of shares over the past twelve months, resulting in a buyback yield of around 21.6%, compared to 1.3% for Ford. Additionally, GM trades at a forward P/E ratio of 4.8x, nearly 40% below its historical average, despite a roughly 55% stock appreciation over the past year.

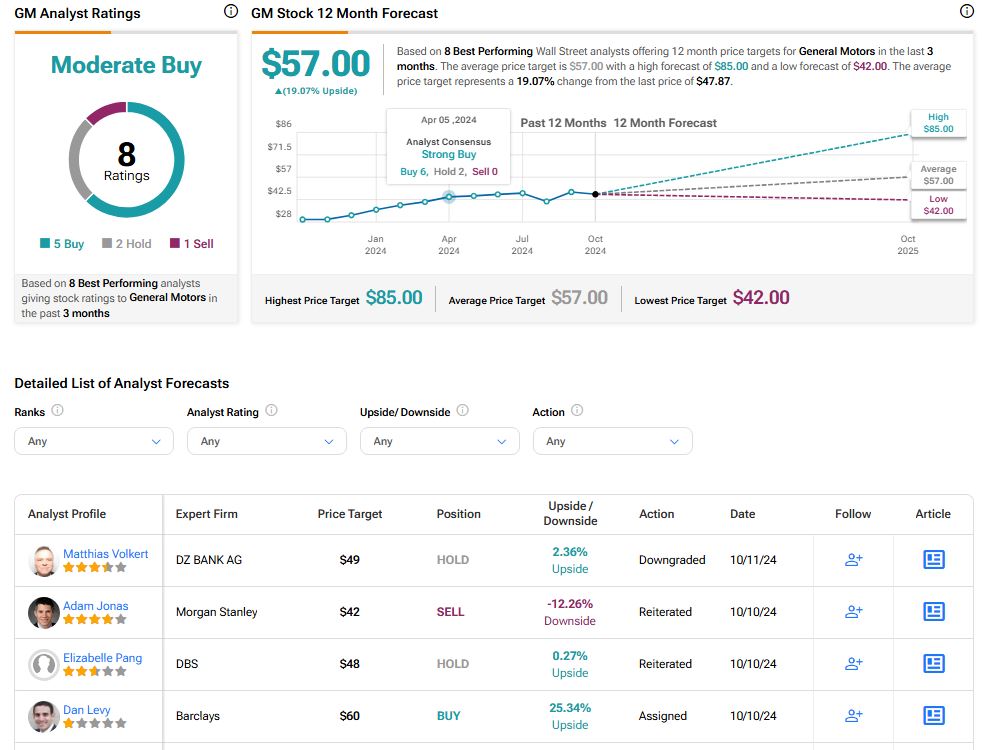

At TipRanks, the Wall Street consensus rates GM as a Moderate Buy, with an average price target of $57, suggesting an upside of 19.07%.

Stellantis

I hold a cautiously bullish view of Stellantis, which, despite poor performance this year, is undergoing a transitional period in its product cycle. Formed in 2021 from the merger of Fiat Chrysler Automobiles (FCA) and Peugeot Groupe, Stellantis has a diverse portfolio of 14 iconic brands.

Recent results have disappointed the market. After a record year in 2023 with net revenue, net profit, and free cash flow all at new highs, the company reported yearly declines of 14% in revenue and 38% in net profit for H1 2024.

Concerns about Stellantis’ investment thesis stem from its transitional phase. The company plans to invest $50 billion over the next decade in battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), averaging $8.3 billion annually. However, Stellantis has been consistently reporting cash operations exceeding $20 billion, providing positive free cash flow for dividends and buybacks.

Stellantis Shows Capital Efficiency

Despite its recent disappointing results, several factors make me optimistic that the current bearishness surrounding Stellantis could present a good entry point for investors.

First, the company demonstrates strong capital efficiency with a return on total capital of 9.7%, well above the industry average of 6.1%, Ford’s 1.1%, and GM’s 3.7%. This efficiency, driven by streamlined operations and a focus on high-margin vehicles, bodes well for its transition to fleet electrification.

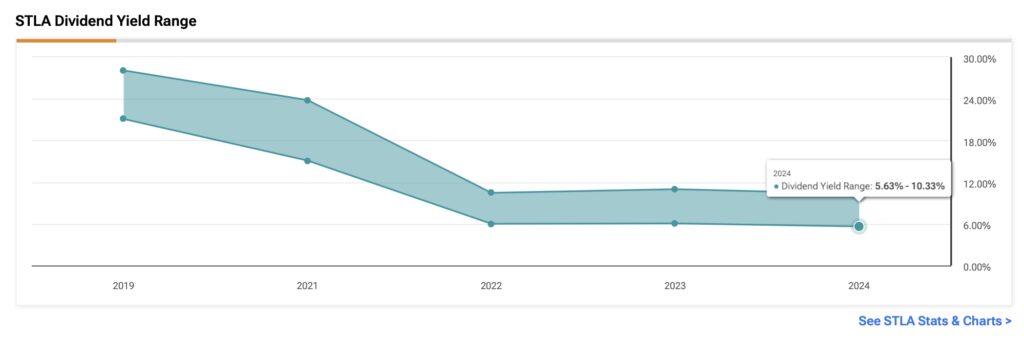

Additionally, Stellantis offers a dividend yield of 10.4% with a payout ratio of 41.5%. However, the company plans to reduce this to a 25-30% payout ratio for 2025, likely leading to a decline in the yield. On a positive note, Stellantis’ valuation is attractive, trading at a forward P/E ratio of 4.1x, which is lower than those of Ford and GM.

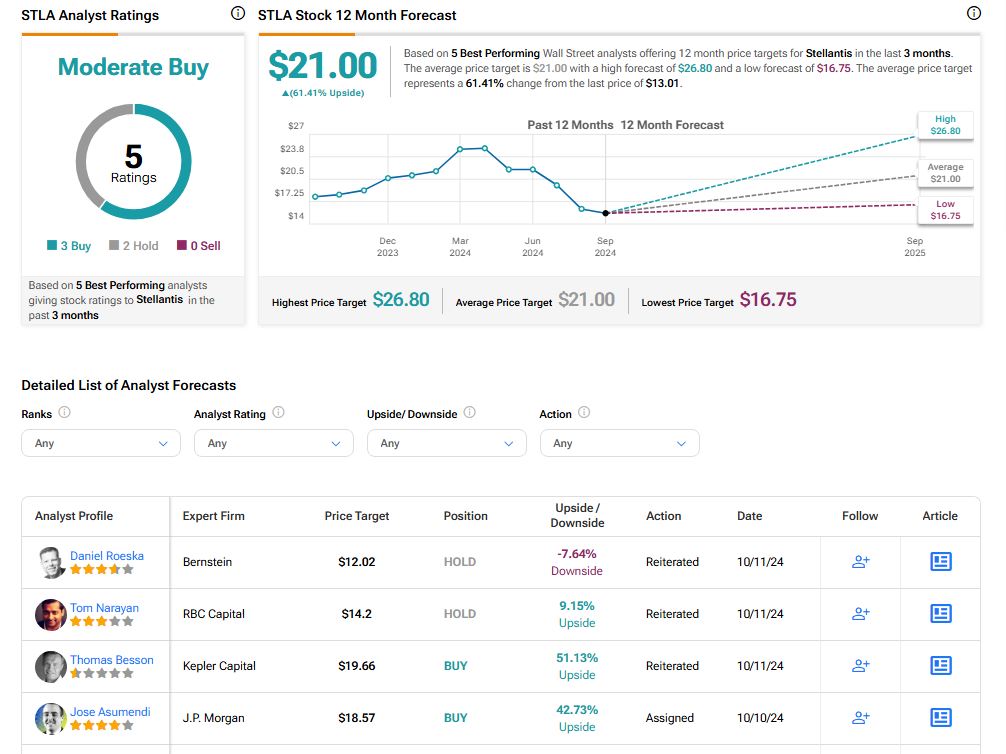

According to TipRanks, the Wall Street consensus rates STLA as a Moderate Buy. The average price target is $21, suggesting an upside of 61.41%.

Conclusion

I believe GM’s current momentum inspires more confidence than that of Ford and Stellantis. Despite offering a modest dividend yield, GM delivers compelling returns to shareholders through buybacks and still trades at an attractive valuation. Furthermore, GM has significantly outperformed its peers, demonstrating robust earnings results that have led to improved annual guidance.