If legacy automaker Ford (F) was hoping that its new battery manufacturing plant in Kentucky would go in quietly and without a lot of labor hassles, those hopes were utterly dashed with a Reuters report. The United Auto Workers union has made a major advance therein. But investors are apparently preferring the devil they know, as Ford shares were up fractionally in Thursday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The report noted that Ford workers at the new plant in Kentucky have returned signed cards with the UAW in sufficient numbers for the UAW to have a majority therein. In fact, while the UAW did not mention exactly what percentage of workers therein were now union members, the UAW did say that it holds a “supermajority” therein. This is part of a larger push from the UAW, who invested $40 million into pulling in new, formerly non-union operations like Toyota and even Tesla (TSLA).

The battery plant in Kentucky, known as Blue Oval SK, is a partnership between South Korea’s SK On and Ford itself. It also represents something of a win for the UAW, which needs this foothold in new vehicle technology in the face of slowly declining membership numbers.

Ford and Trump

We have seen, in the last couple of weeks, plenty of coverage about what businesses are thinking about the new, or rather old, president making a comeback. Ford is no different on that front, as a report from the Detroit News detailed. But Ford seems to be staying the course, the one that it already set at least a few months prior.

For instance, its green ambitions are likely to stay back-burnered for the foreseeable future, especially with electric vehicle subsidies off the table, if only for now. But Ford—via CFO and vice chairman John Lawler—noted that its strength is in its current lineup, its gas, diesel, and hybrid systems. Which is true; Ford’s foray into electric vehicles has never been particularly large, so downplaying those cars for a while will likely cause little disturbance.

Is Ford Stock a Good Buy Right Now?

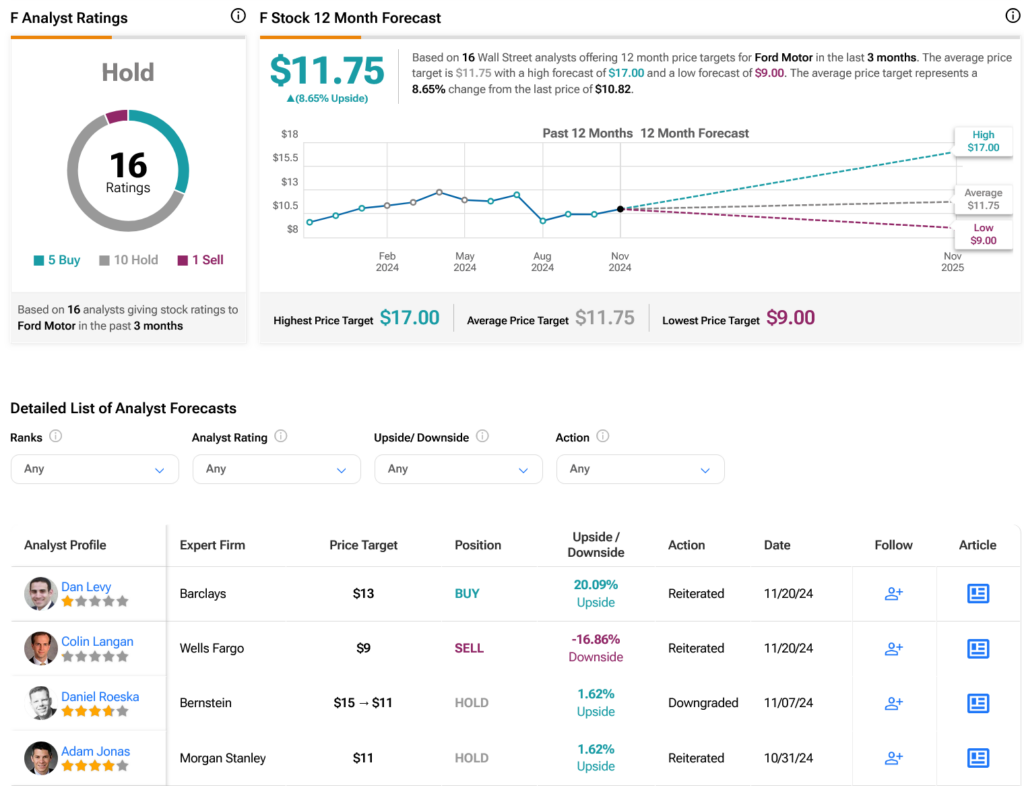

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on five Buys, 10 Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 12.88% rally in its share price over the past year, the average F price target of $11.75 per share implies 8.65% upside potential.