Legendary investor Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) continues to ramp up its stake in oil and gas giant Occidental Petroleum (NYSE: OXY). As per TipRanks Insider Trading Tool, in an SEC filing, Berkshire disclosed its purchase of over 1.94 million additional shares of Occidental in multiple transactions between July 14 and July 16. These transactions were made at prices ranging from $56.1425 to $59.6733, for an aggregate price of $112.1 million. While the Oracle of Omaha is clearly betting on the oil major, Wall Street analysts seem to be cautiously optimistic on Occidental stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Occidental shares have more than doubled this year, fueled by soaring oil prices and Berkshire’s growing stake.

Buffett Moves Close to a 20% Stake in Occidental

With the most recently reported transaction, Berkshire now owns a 19.4% stake in Occidental. Berkshire seems to be heading toward a 20% stake in the company, following which it can include a proportionate share of Occidental’s earnings in its financial results.

It’s worth noting that Berkshire also owns $10 billion of Occidental’s preferred stock, as well as warrants to purchase 83.9 million shares of common stock at $59.624 per share.

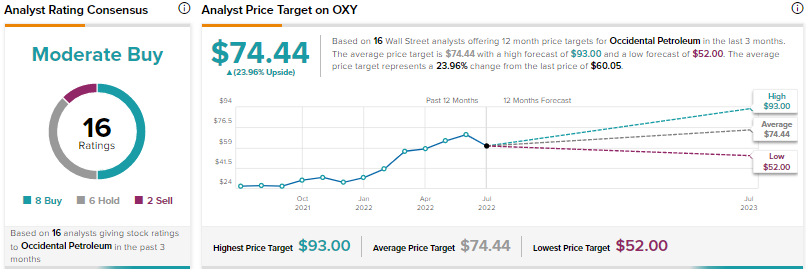

Wall Street has a Moderate Buy Consensus

Last week, Goldman Sachs analyst Neil Mehta downgraded Occidental stock to a Hold from Buy, with a price target of $70. Mehta remains optimistic about Occidental’s free cash flow outlook, which can ensure further balance sheet improvement and higher capital returns.

That said, the analyst now expects “less differentiated free cash flow to current enterprise value following the outperformance relative to peers.”

Mehta feels that Occidental’s effort in repaying nearly $10 billion of its net debts since the end of 2020, is largely reflected in its share price. However, the analyst added that any further larger-than-expected debt reduction could continue to drive the stock higher. Currently, Mehta prefers ConocoPhillips (COP), given the stock’s relative underperformance so far this year.

Meanwhile, last month, Truist Financial analyst Neal Dingmann increased his price target for Occidental stock from $88 to a Street high of $93 and reiterated a Buy rating. Dingmann believes that there is a “good chance” that Buffett could purchase the remaining stake in Occidental, once the company achieves an investment grade rating.

Overall, the Street is cautiously optimistic on Occidental, with a Moderate Buy consensus rating based on eight Buys, six Holds, and two Sells. The average Occidental Petroleum price target of $74.44 implies 23.96% upside potential from current levels.

Conclusion

Buffett’s interest in Occidental and higher energy prices have driven a phenomenal rise in the stock this year. However, concerns about the impact of an impending recession on oil and gas demand could hurt the stock in the days ahead. Wall Street analysts seem to be divided on Occidental stock, with the consensus rating indicating a cautiously bullish view.

Meanwhile, as per TipRanks Smart Score System, Occidental earns a “Perfect 10”, indicating that the stock is likely to outperform the broader market.