Boeing’s (BA) second-quarter earnings report is due on July 27, and judging by the stock’s recent price movement, investors could be in for a surprise.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

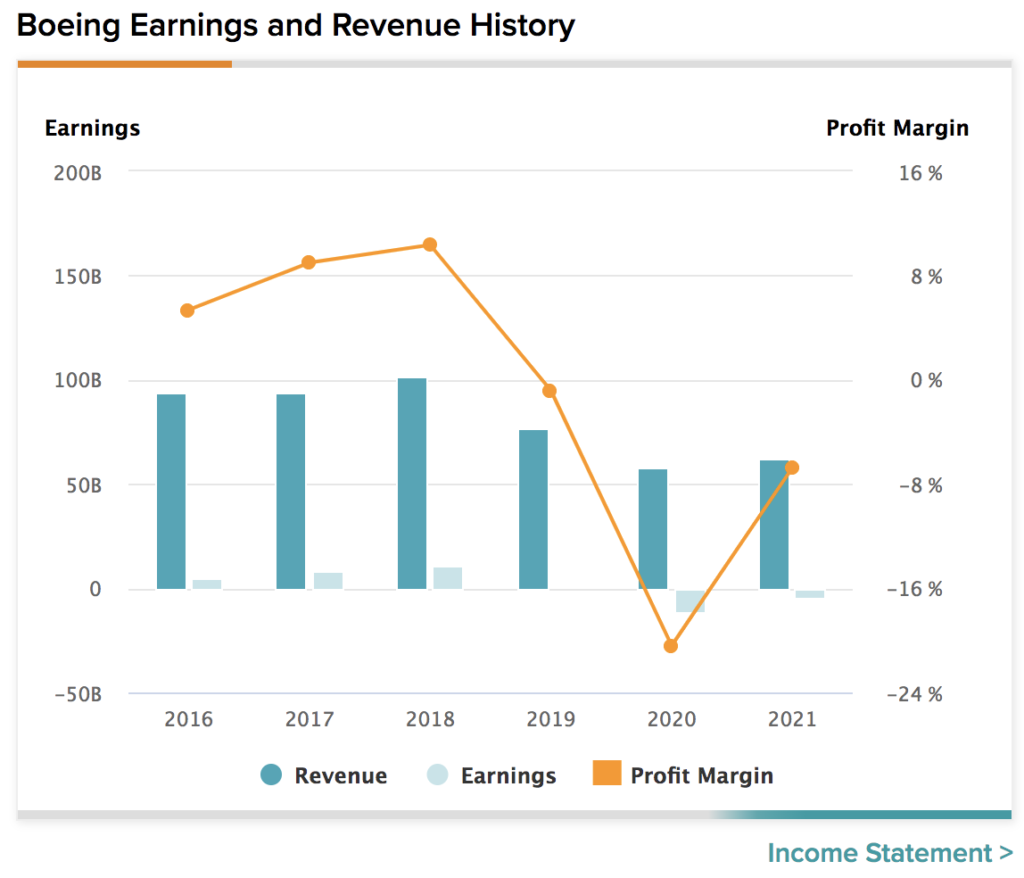

The aerospace manufacturer has struggled during the past few years due to a variety of systemic headwinds. However, Boeing has likely hit an inflection point, and thus I’m bullish on the stock.

Stock Price Stickiness

Global asset management firm AllianceBernstein classifies Boeing as a “price-sticky” stock. According to Ann Larson, who’s the bank’s Head of Quantitative Analysis, Boeing’s 45% retail investor ownership means that it could trade with excess volatility whenever its earnings season is near.

Adding substance to Larson’s observation is Boeing’s high-beta classification, paired with the current market environment. The stock’s beta coefficient of 1.37 means that it’s more volatile than the broader stock universe, which throws gasoline to the fire, considering we’re in a precarious economic environment. Therefore, Boeing could be one of the market’s most volatile assets; the question remains whether its return distribution will exhibit positive or negative skewness.

Recent Earnings Track Record

TipRanks’ earnings tracker conveys that Boeing’s been one of the big earnings laggers over the past two years. In its past eight quarters, Boeing missed its earnings-per-share target six times and its revenue target five times.

A range of COVID lockdowns, supply chain issues, and analyst utopia has contributed to overestimating Boeing’s earnings in recent times. Nevertheless, we live in a more transparent world than we did in the past two years, and thus it’s likely that Boeing’s second-quarter earnings-per-share estimate of -$0.13 could come to fruition.

Key Talking Points

Boeing’s order book seemingly keeps on growing as it has received numerous attractive requisitions of late, one of which is the Delta Air Lines (DAL) order. According to reports, Delta Air Lines has ordered 100 Boeing 737 Max jets, with an option of an additional 30. This deal bears significance as it is Delta’s first significant Boeing jet order in more than a decade, suggesting that Boeing’s new 737 concept is in popular demand.

Furthermore, Boeing’s appearance at the Farnborough airshow this week (18 to 25 July) could see it land a few welcome orders. Boeing’s under a lot of pressure, especially in the narrow-body segment, which is nearly 70% owned by Airbus (EADSF). However, Boeing’s recent decline could change, as its new 737 max planes possess improved fuel efficiency by 20% to 30%.

According to Josh Sullivan of Benchmark, Boeing’s “multi-year water torture of internal supply-side negative news from Boeing is at an inflection point.”

Accrual Accounting Practices

As mentioned before, Boeing missed out on an array of earnings targets in the past two years. Although many of Boeing’s earnings misses were due to sub-par performance — conservative accounting also played a role.

To elaborate, accrual-based accounting laws allow firms to recognize income and expenses in independent periods, which often overstate or alternatively understate earnings. Boeing’s Beneish M-Score of -4.27 implies that the company might’ve frontloaded a large number of its costs and lagged its income recognition. As such, to restore equilibrium, aggressive accounting practices could’ve taken place in the firm’s most recent quarter, which could see its July 27 earnings release surprise to the upside.

Valuation & Momentum

Boeing is an undervalued stock if measured on a relative basis. The stock’s price-to-sales is at a 27.06% discount to its 5-year average, suggesting that the market underscores the firm’s top line. In addition, the stock has formed a momentum trend by trading above its 10-and 50-day moving averages, meaning that Boeing is a popular name among investors yet again.

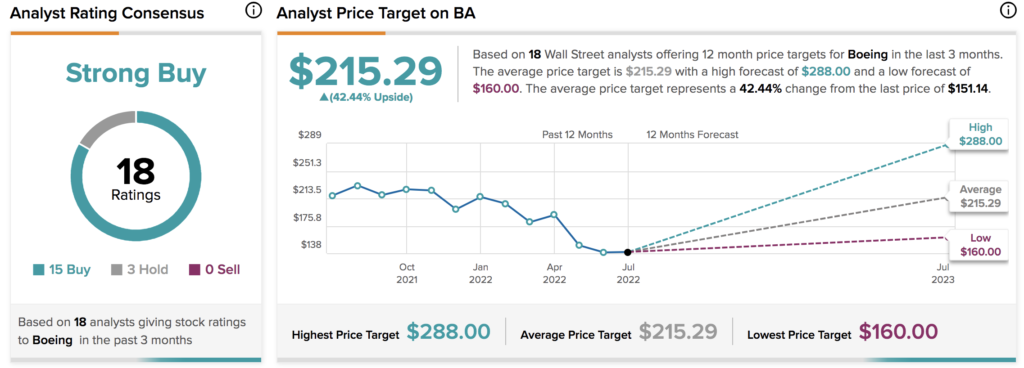

Wall Street’s Take on BA Stock

Turning to Wall Street, Boeing earns a Strong Buy consensus rating based on 15 Buys and three Holds. BA’s average price forecast of $215.29 implies 42.44% upside potential.

Boeing Could Take Off

Empirical evidence implies that Boeing could live up to expectations when it releases its second-quarter earnings report later this month. Furthermore, TipRanks’ data conveys Wall Street’s optimism regarding Boeing stock, which is warranted given that the asset is undervalued relative to its 5-year average.

Read Full Disclosure