Canadian mining company Barrick Gold Corporation (TSE:ABX) (NYSE:GOLD) is strongly progressing to meet its annual gold and copper production outlook. The company is widening its global exploration initiatives with a highly-efficient team. According to the TipRanks tool, bullish financial bloggers and retail investors also paint a positive outlook about the stock.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Now, let’s take a look at the factors that make this stock look appealing.

Key Growth Catalysts

Barrick Gold boasts a solid record of earnings beats. The mining company has successfully delivered an earnings surprise in all the trailing quarters in the last couple of years. If the trend persists, it can provide strong support to its share price performance in the coming quarters.

The company’s gold production, of 1.04 million ounces, rose sequentially in the second quarter of 2022. The upside was mainly on the back of impressive performances from Carlin and Turquoise Ridge in Nevada, Veladero in Argentina, and Bulyanhulu and North Mara in Tanzania. The company projects the momentum to accelerate in the second half of the year.

Furthermore, on the back of strength in Cortez, higher grades from Phoenix and Tongon, as well as better underground productivity at Hemlo, Barrick Gold estimates the strongest production levels in the fourth quarter of 2022. The mining company has provided a gold production outlook in the range of 4.2-4.6 million ounces for the full year of 2022.

ABX stock is making impressive progress with regard to the Pueblo Viejo expansion project in the Dominican Republic, along with an additional tailings storage facility. Further, the company has widened its exploration efforts from Nevada to include active projects in Canada.

Is Barrick Gold a Buy or Sell?

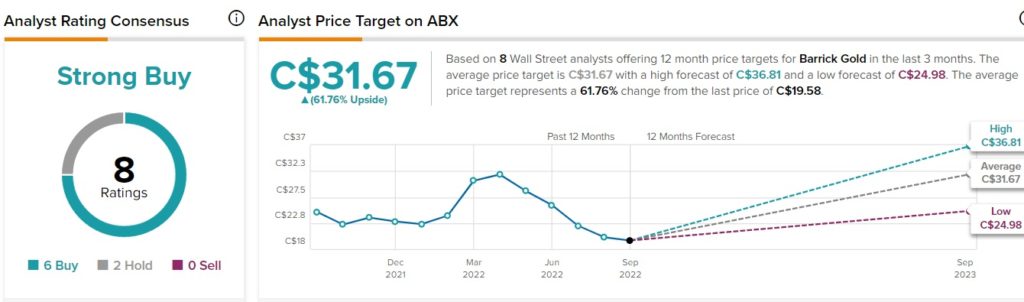

Barrick Gold stock looks like a great investment option to park your money in. Wall Street is optimistic about the prospects of ABX stock and has a Strong Buy consensus rating based on six Buys, and two Holds.

Further, financial bloggers are 95% bullish on ABX stock, compared to the sector average of 75%. As per TipRanks, retail investors, too, look bullish on the stock, as they increased their holdings in ABX stock by 1.7% in the last 30 days.

Final Thoughts

Barrick Gold stock has been disappointing investors with a 16.6% decline in its shares so far in 2022. However, on the back of a solid balance sheet, impressive Life of Mine plans, reliable cash flow, robust gold production levels, and strategies to expand its exploration footprint geographically, the company has got what it takes to rebound. Moreover, ABX stock’s average price target of C$31.67, implies a 61.8% upside potential from the current levels.

Read full Disclosure