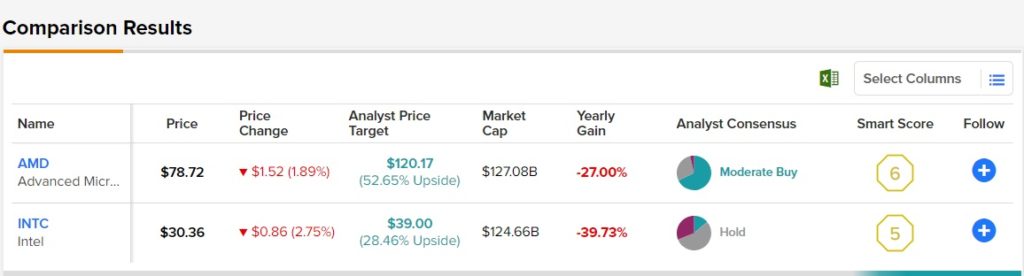

Advanced Micro Devices, Inc. (NASDAQ:AMD) and Intel Corporation (NASDAQ:INTC) are the two formidable names in the semiconductor industry. Using TipRanks’ Stock Comparison Tool, we placed these two semiconductor stocks against each other to discover which offers higher upside potential.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Making significant strides with its strong portfolio offerings in the highly lucrative server market, AMD, which boasts a market cap of $127.08 billion, recently surpassed Intel’s market cap, which is currently at $124.66 billion. Further, AMD is rapidly expanding its market share in the client and server central processing unit space, giving Intel fierce competition.

Positive Prospects in the Semiconductor Space

The latest Semiconductor Industry Association report sheds some insight into the sector. There was a 7.3% year-over-year rise to $49.0 billion in global semiconductor industry sales in July 2022. Geographically, semiconductor sales in the United States recorded the highest year-over-year rise of 20.9% compared to other regions. Further, the global semiconductor market is projected to surge by 13.9% over the prior year to $633 billion in 2022, according to the World Semiconductor Trade Statistics (WSTS).

The demand for semiconductor chips should continue to grow in several end-markets, thanks to the increasing popularity of hybrid work models and the growing dominance of artificial intelligence (AI).

Advanced Micro Devices (NASDAQ:AMD)

AMD delivered impressive second-quarter results on the back of persistent strength across all of the company’s business segments. Increasing sales of the data center and embedded products have been largely enhancing the top-line results.

The semiconductor company has shown its confidence in other markets by reiterating its 2022 revenue guidance amid the weakening personal computer (PC) market.

AMD has been seeing significant demand for its Ryzen and EPYC server processors. Boosting the Ryzen processor portfolio, the chip maker recently announced the launch of Ryzen 7000 Series desktop processors, powered by the new Zen 4 architecture, which will be available from September.

Is AMD a Good Stock to Buy?

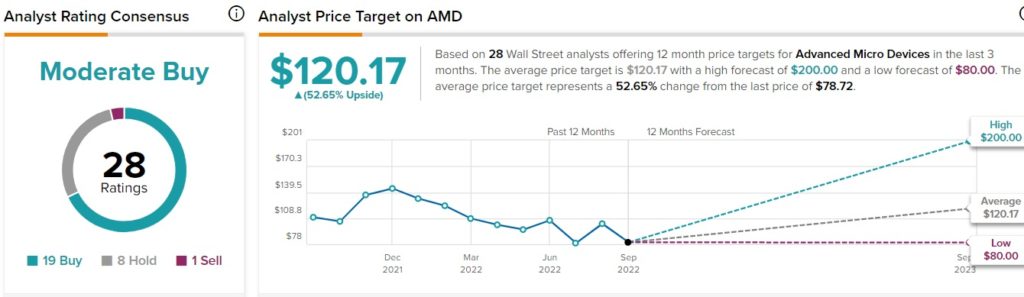

As of now, AMD stock seems to be a decent option to invest in. Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 19 Buys, eight Holds, and one Sell. Further, Wells Fargo analyst Aaron Rakers recently reiterated a Buy rating on the AMD stock. His price target of $130 for the AMD stock, represents 65.1% upside potential from current levels.

Similarly, financial bloggers opinions are 89% Bullish on AMD, above the sector average of 64%. TipRanks data shows that hedge funds are also bullish about the company, as they bought 1.3 million shares of AMD stock in the last quarter.

Intel Corporation (NASDAQ:INTC)

Intel Corporation, on the other hand, posted disappointing earnings results for the second quarter, with both revenue and earnings declining from the year-ago period. The company has been grappling with higher costs, supply-chain disturbances, and cut-throat rivalry in the semiconductor space.

While AMD is busy expanding its market share, Intel has been struggling to launch its latest chips in the high-potential server market. Citing the sluggish PC market as a concern, Intel Corporation (INTC) also slashed its full-year guidance.

Meanwhile, Intel recently signed a $30 billion deal with Canada-based Brookfield Asset Management. Also, this one of the oldest technology companies is expected to enjoy additional benefits than its rival AMD, from the recently passed Chips and Science Act.

Is Intel a Buy, Sell or Hold?

Analysts have mixed feelings about the Intel stock. According to TipRanks, Street is neutral about INTC’s stock, which carries a Hold consensus rating based on four Buys, 16 Holds, and nine Sells. Further, hedge funds look apprehensive about INTC stock, as they have sold 1.4 million shares of INTC stock in the last quarter.

Intel stock’s average price target of $39, signals a 28.5% upside potential from current levels. Shares of INTC stock have lost 41.5% so far in 2022.

Meanwhile, financial bloggers and retail investors look bullish about the INTC stock. Financial bloggers‘ opinions are 77% Bullish on INTC stock, above the sector average of 64%. Moreover, retail investors have increased their holdings in the INTC stock by 1.4% in the last 30 days.

Why is AMD Better than Intel?

Don’t settle for mediocrity when you can have the best. AMD stock is better than Intel stock in several ways. The company been strategically using its opportunities to expand its market share. The company’s new generations of chips are significantly used in PCs and servers, along with rising dominance in the data-center central-processing-unit market. Also, AMD’s Pensando and Xilinx acquisitions buoy optimism.

Further, the 47.6% decline in shares of AMD stock highlights a good long-term opportunity to buy the dip. Notably, Advanced Micro Device stock’s average price target of $120.17 signals 52.7% upside potential from current levels.

Read full Disclosure