Shares of Albertsons Companies (NYSE:ACI) are trading 39% below their all-time high before factoring for dividend payments, which have helped shareholders endure the fall in price. However, the grocery company is coming off of a solid one-year performance, and coupled with bullish news about a potential acquisition and healthy financial results (with the company benefiting from food inflation), the stock is poised to rise and is worthy of consideration for long-term investors. Therefore, I’m bullish on ACI stock.

A Boring, Steady Company

Albertsons may not have the glitz and glamour of Big Tech companies such as Tesla (NASDAQ:TSLA) or Apple (NASDAQ:AAPL), but it operates in the often-overlooked consumer staples sector, which has proven time and time again that its inelastic demand is what makes it a focal point of many investors’ portfolios. That’s because needs always supersede wants, and like shelter and clothing, food is a necessity in life.

It’s also a necessity that’s steadily been costing consumers more money. Since the arrival of the pandemic, food inflation, as measured by the Consumer Price Index (CPI), has been hurting household budgets while helping companies’ financial statements. Costs for food at home have risen to the tune of a 3.4% year-over-year increase in 2020, a 3.9% year-over-year increase in 2021, a staggering 9.9% increase in 2022, and 5.8% (estimated) in 2023.

This isn’t a case of what goes up must come down, either. Costs for food at home hardly ever subside. In fact, going back to 1968, they have only fallen 10 out of 660 months. In other words, the U.S. has experienced food cost increases in 98.5% of the months since the Lyndon Baines Johnson administration.

Because supermarket chains are able to embrace cost pass-through to offset increases to their own cost basis, many of these publicly-traded companies have seen their stocks appreciate accordingly since the arrival of COVID-19. Albertsons is one of them. Since its June 2020 IPO in the midst of the pandemic, shares of ACI rose 140%+ to their all-time high of $37.99 by March 2022.

Solid Financials and an Upcoming Dividend

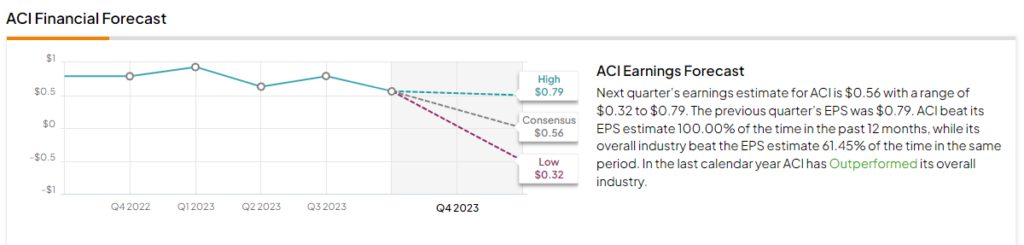

Since its all-time high, ACI has pulled back, shedding 39% at the time of writing. This is despite the stock beating its earnings per share (EPS) estimates every quarter dating back to at least Q3 2021. By comparison, its overall industry was only able to beat EPS estimates 61.45% of the time over the past 12 months.

On January 9, 2024, Albertsons reported EPS of $0.79, easily beating the consensus estimate of $0.65. Additionally, its $18.56 billion in revenue for Q3 represents a year-over-year increase of 2.2%.

Beyond its track record of earnings beats, there are plenty of other reasons to like ACI, including its dividend. For income investors drawn to stocks in safety-rated sectors like consumer staples, Albertsons’ dividend yield of 2.1%, or 12 cents per share at current prices, represents a 14.8% payout ratio — the percentage of net income that is dedicated to a company’s dividend program.

The stocks’ next ex-dividend date is January 25, 2024, so investors who get in before then will qualify for ACI’s first distribution of the new year.

The company’s sales forecast is built upon a firmly established foundation of outperformance. The grocer was forecast to have brought in $18.36 billion in the final quarter of 2023, with a range of $18.1 billion to $18.52 billion. In Fiscal Q3 2023, Albertsons’ sales were $18.29 billion, and the supermarket chain beat sales estimates 75% of the time over the past 12 months compared to the overall industry, which beat estimates just 58.1% of the time over the same period.

Additionally, Albertsons was able to increase its net income from -$144.2 million in February 2021 to $361.4 million as of November 2023. Additionally, the negative net income reported in February 2021 was the only quarter the company posted a net loss since August 2018. Over the past five years, Albertsons has had a median quarterly net income of $303.15 million.

Potential Acquisition Presents an Opportunity

The Federal Trade Commission (FTC) is close to ruling on a prospective merger between Albertsons and Kroger (NYSE:KR), with America’s third-largest supermarket chain acquiring Albertsons for $24.6 billion. There are ongoing regulatory approval concerns over the merger of two enormous companies operating in the same industry, which could present antitrust issues.

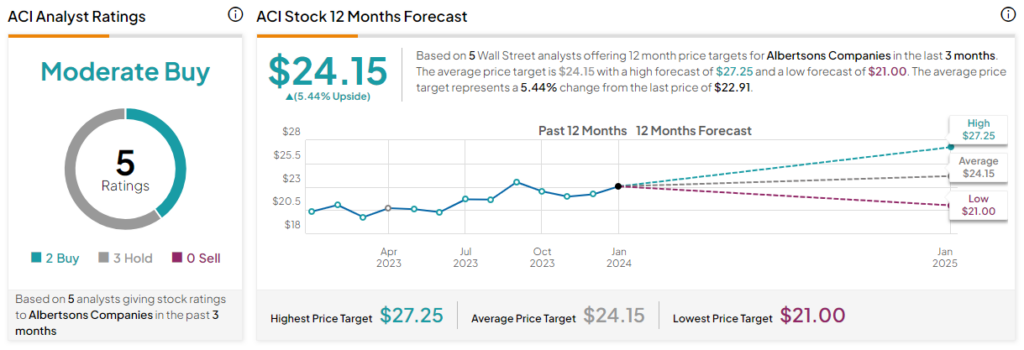

However, if the acquisition is approved by the FTC, which is expected, the deal could go through as soon as early this year. In that case, ACI’s stock is being valued at $34.10 per share by Kroger. After paying a special cash dividend of $6.85 to shareholders in October 2023, the adjusted per share cash purchase price is expected to be $27.25, representing potential upside of more than 18% from the current ACI share price.

Beyond its namesake grocery stores, the Albertsons-Kroger merger would involve Safeway, Acme, Vons, Tom Thumb, Kings, Carrs, and 15 other Albertsons’ subsidiary brands combined with Kroger and its affiliate organizations Ralphs, Dillons, Harris Teeter, City Market, Fred Meyer, and 15 other subsidiary brands. The combined market capitalization of Albertsons Companies ($13.2 billion) and Kroger ($33 billion) would create a $46.2 billion company operating in a high-demand sector that’s seeing outsized profits thanks to ongoing food inflation.

Is ACI Stock a Buy, According to Analysts?

Currently trading around $23, the average ACI stock price target of $24.15 represents 5.4% upside potential. Meanwhile, shareholders get to enjoy a healthy 2.1% dividend. Overall, the stock earns a Moderate Buy consensus rating based on two Buys and three Holds assigned in the past three months.

ACI is also a Buy based on TipRanks’ technical sentiment tool, as you can see below.

The Takeaway

Despite seeing its shares slip 39% from their all-time high, ACI looks primed for a recovery. Fueled by steady consumer demand and ongoing food inflation, and factoring in the news of a likely acquisition by Kroger, ACI stock may have already put in a bottom. Further, the company’s financial statements and bullish technical analysis indicators suggest continued earnings beats and bullish price action over the next 12 months. On top of this, bulls are supported by a Moderate Buy consensus rating from analysts.