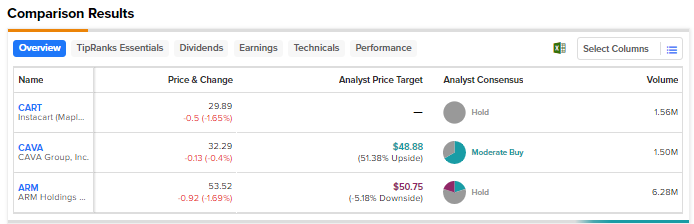

The initial public offering (IPO) market finally witnessed some activity this year following a slump of over one and half years due to elevated interest rates and macro uncertainty. While the IPOs of Arm Holdings (NASDAQ:ARM), Instacart (NASDAQ:CART), and Klaviyo (NYSE:KVYO) were cheered by investors on the first day of trading, these stocks have retreated since then. Other notable IPOs in 2023 include Cava Group (NYSE:CAVA), Oddity Tech (NASDAQ:ODD), Johnson & Johnson’s consumer healthcare unit Kenvue (NYSE:KVUE), and Intel (NASDAQ:INTC)-backed Mobileye (NASDAQ:MBLY). Using TipRanks’ Stock Comparison Tool, we placed Instacart, Cava, and Arm against each other to find the IPO stock that is favored by Wall Street.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Instacart (NASDAQ:CART)

Grocery delivery company Instacart, legally called Maplebear Inc., made its stock market debut on September 19 at an IPO price of $30 per share. The stock closed 12% higher on the first trading day but shed its gains in the subsequent days.

Instacart enjoyed solid demand during the pandemic when online shopping reached peak levels. However, growth rates decelerated following the reopening of the economy. In the second quarter of 2023, the company’s revenue grew 15% to $716 million, compared to the 40% growth witnessed in the prior-year quarter. Meanwhile, the company is aggressively cutting costs to improve its profitability.

Is Instacart Stock a Buy, Sell, or Hold?

On September 25, Wolfe Research analyst Deepak Mathivanan initiated coverage of Instacart with a Hold rating and a fair value range of $24 to $42. While the analyst likes the company’s competitive position in online grocery and attractive profit margins, he prefers to be on the sidelines due to the rising competition in the grocery delivery space and lack of conviction on the re-acceleration of growth.

Mathivanan contended that Instacart’s growth has decelerated steadily over the past few quarters. He anticipates the company’s gross transaction value (GTV) to remain near the mid-single-digit range over the medium term. He thinks that CART stock should trade at a discount to rivals Uber (UBER) and DoorDash (DASH) that are growing at a faster pace, but at a premium to Lyft (LYFT).

Wall Street’s Hold consensus rating on CART stock is based on three Hold ratings. As the stock recently made its debut, analysts have not yet assigned a definite price target. Shares have declined about 11% from the closing stock price on the first trading day.

CAVA Group (NYSE:CAVA)

Shares of Mediterranean restaurant chain Cava closed at $43.78 on June 15, marking a remarkable jump from its IPO price of $22 per share. However, the stock pared its gains and has declined more than 24% over the past three months.

Last month, Cava reported upbeat second-quarter results. The company’s overall revenue (including Zoes Kitchen) increased 27% to nearly $173 million, driven by new restaurant openings and same-store sales growth of 18.2%. The company opened 16 net new restaurants in Q2 2023, ending the quarter with 279 locations.

The quarter also gained from over a 10% jump in traffic and higher menu prices. Further, the company swung to earnings per share (EPS) of $0.21 from a loss per share of $6.23 in the prior-year quarter.

Cava aims to open 65 to 70 locations this year and projects full-year same-store sales growth in the range of 13% to 15%.

What is the Future of Cava Stock?

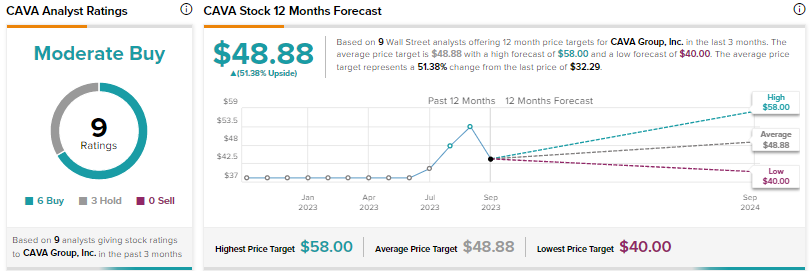

Following the Q2 print, William Blair analyst Sharon Zackfia reiterated a Buy rating on CAVA stock without a price target on August 16. The analyst attributed the company’s Q2 2023 performance to a resilient customer base and increased awareness due to the IPO, with favorable trends observed across vintages, geographies, and store formats.

Zackfia expects Cava to generate over $2.5 billion in revenue and about $400 million of adjusted EBITDA by 2032, supported by the company’s goal to operate nearly 1,000 locations.

With six Buys and three Holds, Cava stock earns a Moderate Buy consensus rating. At $48.88, the average price target implies 51% upside.

ARM Holdings (NASDAQ:ARM)

Arm Holdings made a solid debut with a 25% spike in shares on the first trading day. However, concerns over valuation and intense competition have weighed on investor sentiment.

The Softbank (SFTBY)-backed British company does not manufacture chips but licenses its designs to chipmakers, generating most of its revenue from royalties and licensing fees. The company’s architecture is the foundation for several smartphones.

However, the company’s top line is currently under pressure due to sluggish smartphone sales and macro pressures. Revenue declined by 2% year-over-year to $675 million in Q2 2023. Looking ahead, the company is optimistic about growth prospects in areas like cloud computing, automotive, Internet-of-Things (IoT), and AI-induced opportunities. That said, the company is expected to face intense competition in high-performance computing from chip giants Nvidia (NVDA), Advanced Micro Devices (AMD), and Intel.

Is Arm Holdings Stock a Buy Now?

On September 25, Bernstein analyst Sara Russo initiated coverage on ARM stock with a Sell rating and a price target of $46. The analyst said that the expectations for the company’s revenue growth are too optimistic, given that the mobile end market is maturing.

Meanwhile, Redburn Atlantic analyst Timm Schulze-Melander initiated coverage on ARM stock with a Hold rating price target of $50 on September 19. The analyst said that it would require a higher conviction about the company’s earnings accelerating over the next few years from a “weak” base in Fiscal 2023 for him to turn bullish on the stock.

The analyst added that the company’s guidance for a “rapid pivot” in royalty rates would be a notable departure from its historical trends. While new opportunities, like Compute Subsystems and v9 ISA royalty rates, offer attractive growth potential in the future, the analyst contends that these new avenues will take time to drive royalty revenue growth.

Wall Street’s Hold consensus rating on Arm Holding stock is based on one Buy, three Holds, and one Sell. The average price target of $50.75 implies a possible downside of 5% from current levels.

Conclusion

While several IPO stocks surged on their first trading day this year, they shed their gains soon as macro uncertainty continues to impact investor sentiment. Wall Street is cautiously optimistic about Cava stock but remains on the sidelines when it comes to Instacart and Arm Holdings. Analysts see solid upside potential in Cava stock from current levels.