Amid higher inflation, rising interest rates, and recession predictions, investors can face complex dynamics when trying to identify the best stocks to buy for the long-term.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TipRanks’ tools help investors navigate market intricacies to pick shares likely to perform well in their portfolios. Taking into account a variety of data-driven insights, the TipRanks Smart Score tool profiles stocks on a one-to-10 scale to show their potential to underperform or outperform the market.

The interpretation is that a higher smart score suggests that a stock is more likely to deliver a better performance than market averages. Stocks with a TipRanks “Perfect 10” score have historically outperformed the broader market. The tool can help investors carry out important due diligence within uncertain market environments. These two ASX stocks recently achieved the “Perfect 10” score.

Pro Medicus Limited (ASX:PME)

Established in 1983, Richmond-headquartered Pro Medicus is a global provider of medical imaging software and services. Its customers include hospitals, healthcare groups, and diagnostic centres. The global medical image analysis software market is forecast to grow to US$5.49 billion by 2030 from US$2.9 billion in 2021, according to Grand View Research.

Pro Medicus’ Fiscal 2022 profit jumped 44% to AU$44.4 million. The company has raised its annual per share dividend amount consistently over the past four years. Pro Medicus has a disciplined dividend program, as its 28.5% payout ratio indicates, the company retains much of its profit to invest in its future growth. The company recently secured several new revenue contracts.

Although Pro Medicus shares have dipped about 3% over the past week, they are up about 20% over the past six months. According to TipRanks’ analyst rating consensus, Pro Medicus stock is a Hold. The average Pro Medicus share price forecast of AU$56.58 implies over 4% upside potential.

Moreover, the TipRanks Company Insider Trading Activity tool shows that Insider Confidence Signal is currently Positive on Pro Medicus shares. In the past three months, Pro Medicus corporate insiders have purchased AU$9,100 worth of shares in the company.

Harvey Norman Holdings (ASX:HVN)

New South Wales-headquartered Harvey Norman is a multinational retailer that sells a broad array of products. Harvey Norman is leaning on its strong balance sheet to support its expansion drive, with plans to open stores in several overseas markets.

The retailer’s chairman, Gerry Harvey, recently revealed that shoppers were still making big-ticket purchases despite inflation pushing up the cost of living.

Harvey Norman is profitable and pays dividends. The retailer’s 24.8% payout ratio shows a conservative dividend program that spares much of the profit for reinvesting in the business.

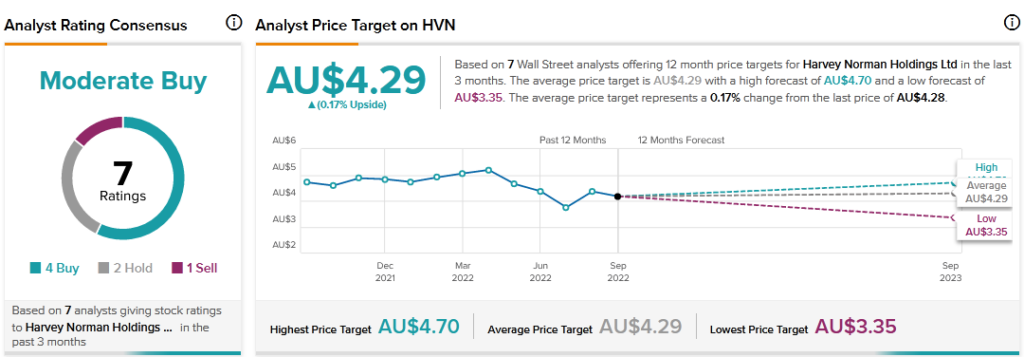

Although Harvey Norman shares have dropped about 12% year-to-date, analysts remain bullish on the stock. According to TipRanks’ analyst rating consensus, Harvey Norman stock is a Moderate Buy. The average Harvey Norman share price target of AU$4.29 implies the stock is fully valued at current levels.

Harvey Norman stock is gaining favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 100% Bullish on HVN, compared to a sector average of 65%.

Final thoughts

Pro Medicus and Harvey Norman have promising business prospects. Although there share price predictions currently show only modest upside potential, Pro Medicus and Harvey Norman are a good source of dividend for those investing for income.