Advanced Micro Devices, also known as AMD (AMD), is a seasoned player in the semiconductor industry. Its market cap is $276 billion, and its total revenue was $23.28 billion in the trailing twelve months. Yet, this company is often considered a small-bit actor in the glamorous Nvidia (NVDA) show.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

However, AMD’s hunger for a bigger role in the new era of AI and data centers has driven the company to make substantial advancements in this field and create more holistic products. So much so, that it claims its new EPYC processors and Instinct accelerators offer superior performance to Nvidia’s GPUs. Our writer at Tipranks, James Fox, has written extensively about AMD and why he’s bullish about AMD stock, which you can read more about here.

For now, let’s take a quick look at 2 new positive developments and AMD’s one primary goal:

- Full-Stack Offering: AMD has decided not to waste time and has invested heavily in its “full-stack” AI solutions, including hardware and software. This holistic approach is expected to enhance its competitiveness in the AI market, primarily against Nvidia.

- Acquisition of ZT Systems: AMD’s purchase of ZT Systems represents a major coup for the company. ZT is an experienced firm that designs and delivers large-scale AI infrastructure. This acquisition aims to improve system-level integration, speed up the delivery of AI solutions to the market, and expand AMD’s foothold in the hyperscale market. The AI accelerator market and data centers are expected to reach $400 billion by 2027.

- Growth in AI Market Share: Currently, AMD occupies 5% of the GPU market, and if we include the CPU segment, it reaches an 11% market share. It pales next to Nvidia’s 88% of the GPU market, while NVDA doesn’t have much stake in the CPU market. Despite having a smaller market share than Nvidia, AMD is making strides in the AI sector, meaning prospects for a bigger market share are not out of reach. As mentioned before, acquiring ZT Systems is expected to help the company get a larger share of this expanding market.

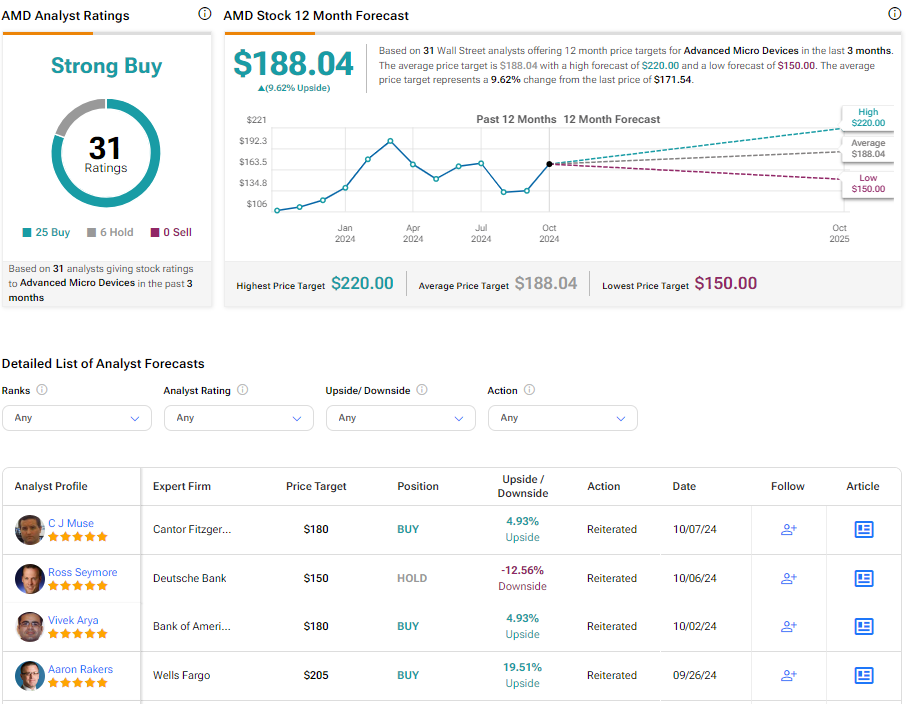

Wall Street Is Bullish on AMD

Looking at Wall Street, we find a bullish sentiment among analysts covering AMD stock: 25 Buys, six Holds, and zero Sells. The average price target for AMD stock is $188.04, signaling a 9.98% upside.

Takeaway

While AMD is a veteran in the semiconductor industry, it still holds just a small portion of the market share. Now, AMD is determent to change the market’s landscape and grab a bigger slice of the market in this new era of AI solutions and data centers that need better-performing GPUs. The acquisition of ZT Systems was done with this exact intention. AMD’s prospects look very bright, and though Nvidia is in a position of its own, it doesn’t mean that AMD can’t grow significantly.