AI is today’s ‘shiny new thing,’ the technological advance that will forever change the world we live in. Imagine the advent of metal smelting, or the invention of the electric telegraph – AI is making a similar impact on our lives, an impact that is amplified by our reliance on technology of all sorts, especially digital technology.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The key virtue of AI is its potential to supercharge productivity. Programmers can already put AI to work on a wide range of automated tasks, and businesses are using AI to get more output from less input. Artificial intelligence is taking some of the workload off of human intelligence, letting us focus on the matters that we deem truly important.

AI is also creating numerous opportunities in the stock markets, as the companies involved in the development and expansion of AI tech are reaping the benefits of increased profits and increased investment activity. These AI stocks are shaping the financial future, and Wall Street’s analysts are taking notice.

Two companies – Advanced Micro Devices (NASDAQ:AMD) and Super Micro Computer (NASDAQ:SMCI), each a well-known name in AI technology – have picked up plenty of recent interest as they get ready to release financial and earnings results. We’ve opened up the TipRanks database to get the bigger picture on both of them, and to find out which one the analysts have tagged as the superior AI stock to buy ahead of the earnings releases. Let’s dive in.

Advanced Micro Devices (AMD)

We’ll start with AMD, one of the semiconductor industry’s leading innovators. While not quite in the same league as market leader Nvidia, AMD’s $265 billion market cap still makes the firm the world’s sixth-largest chip maker, and the company is acting on a plan to expand its market share in the lucrative – that is, large and growing – market for AI-capable semiconductor chips.

AMD has recently introduced a number of new products, including leading-edge PC processors and AI-capable accelerators. The Ryzen AI PRO 300 series is a set of AI-capable mobile processors designed for the PC market to bring AI performance to business applications; the Instinct MI325X accelerators headline a run of new accelerator chips purpose-created for the generative AI and data center markets; and the EPYC CPUs are 5th generation processors developed for AI, cloud, and enterprise uses. The common denominator here is a full-court press into the cutting edge of the AI market, a company strategy to increase market share by offering indispensable quality.

AMD is not offering these chip lines in a vacuum. The company is building on its successful MI300 accelerator series and already has strong relationships with such major AI names as Meta, Oracle, and Microsoft. The AI chip market is expanding rapidly and is expected to reach as high as $92 billion in total global revenue by the end of next year. AMD wants to make sure that it can take a larger piece of that pie than it has now.

The chip maker is slated to release its earnings numbers today, October 29, after the markets close. The Street is expecting to see approximately $6.7 billion at the top line, paired with a 92-cent EPS, in the 3Q24 release. For comparison, the company generated $5.84 billion in revenue and realized 69 cents per share in Q2, beating the forecasts by $113.8 million and 1 cent, respectively.

For Stifel analyst Ruben Roy, the earnings outlook on AMD is reasonable, and investors should find plenty of reason to expect that AMD will continue to grow going forward.

“We expect September quarter revenue in line to be modestly above the $6.7bn (+15.5% y/y, +14.8% q/q) guidance midpoint driven by continued momentum in the Data Center segment, which we are modeling up 20% q/q. Similarly, we expect December quarter outlook to be positively biased with another raise to full-year MI300 revenue expectations. We continue to believe AMD is positioned to benefit from various medium-term growth drivers including (i) AI-infrastructure investment, (ii) continued x86 CPU share gains, and (iii) an AI-driven PC refresh cycle, which we expect to accelerate in 2025,” Roy opined.

To this end, the analyst puts a Buy rating on AMD shares, and his $200 price target implies a 22% gain for the months ahead. (To watch Roy’s track record, click here)

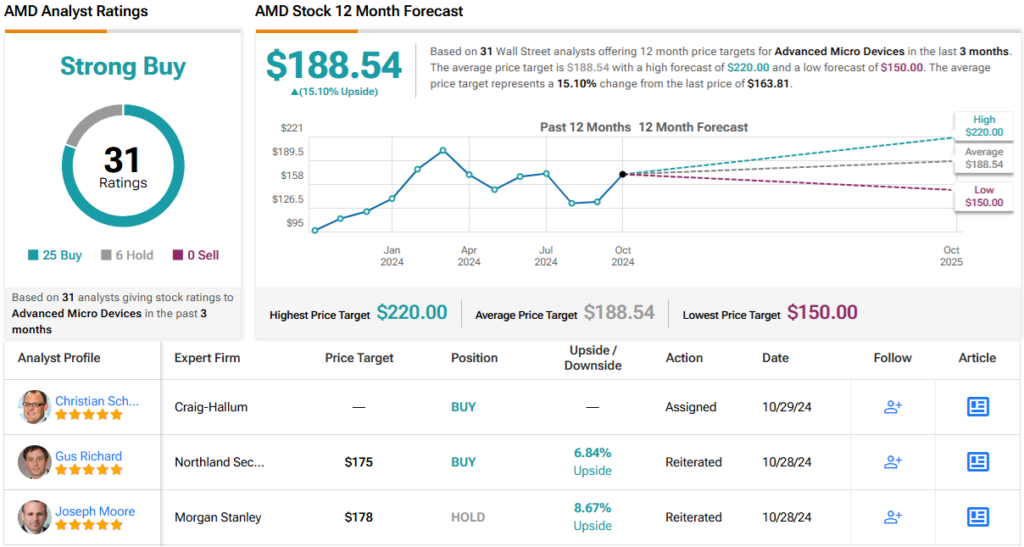

This outlook is in line with the bullish take on the Street. AMD shares have a Strong Buy consensus rating, based on 31 recent analyst reviews that include 25 Buys to 6 Holds. The shares are priced at $163.87, and the $188.54 average price target suggests an upside of almost 15% on the one-year horizon. (See AMD stock forecast)

Super Micro Computer

The next stock under review is SMCI, a leader in high-end, AI-capable computer hardware. The company designs, develops, and manufactures advanced computer systems essential for running AI applications. This includes enterprise-scale server stacks, high-performance computers, and solid-state memory systems, forming the backbone of hardware infrastructure crucial for AI. Additionally, these systems support a range of advanced data center applications, such as cloud computing, edge computing, and even 5G networking.

Super Micro Computer has been in the business of building top-end computer systems since 1993, and in that time the company has become the industry’s ‘one stop shop’ for custom-made high-end computing needs. Super Micro’s chief claim is that it can design and build its products – server stacks and HPCs – to any specification, no matter how unique or demanding. The company has in-house design and build capabilities, and fills orders with a combination of custom-made devices and off-the-shelf parts – and can fill those orders at any scale across a wide range of applications.

The company backs up this guarantee of meeting orders with a solid manufacturing footprint, over 6 million total square feet of manufacturing floor space and global operations spread across 100-plus countries. Super Micro can maintain a high production output, completing as many as 5,000 AI systems, HPCs, and liquid cooling racks every month. The company is currently shipping more than 100,000 GPUs per quarter.

While Super Micro has benefited greatly from the AI boom of the last couple of years, we should note that its stock peaked in March of this year and has fallen off since. Some of the recent headwinds that have buffeted the stock have come from government regulators – the Justice Department is investigating potential accounting violations, and the investigation caused the company to fall out of compliance with NASDAQ rules regarding regulatory filings. Despite these bureaucratic and legal matters, however, Super Micro was able to execute a planned 10-to-1 stock split this past October 1.

On the financial side, Super Micro’s performance has been solid. Revenue surged from $7.2 billion in fiscal 2023 to $14.94 billion in fiscal 2024. For fiscal 1Q25, analysts expect revenues to reach $6.46 billion, indicating continued strong growth momentum.

While the company is an established name in the AI world, and has a solid niche, Barclays analyst George Wang sees it facing a number of near- and mid-term challenges.

“Our more cautious view [is] mainly due to a lack of visibility on forward AI server GM trends, ongoing customer erosion (i.e., market share loss), weaker competitive positioning in GB200 era (declining market share) with higher working capital requirement, and room for improvement in terms of internal controls and corporate governance. We would like to see more transparency in financial disclosure in terms of quarterly order intake and backlog. While we continue to be positive on the long-term prospects related to AI, we believe the current risk/reward is balanced for SMCI,” Wang explained.

Following this stance, Wang assigned an Equal Weight (i.e. Neutral) rating on SMCI shares, with a $42 price target suggesting a one-year share depreciation of 14.5%. (To watch Wang’s track record, click here)

Wang’s caution is shared by many analysts: of 12 covering SMCI, 3 rate it a Buy, while 9 issue a Hold. Nonetheless, the stock’s consensus price target of $64.49 suggests a possible 31% upside from its current trading level. That upside, however, doesn’t justify the risk in the eyes of the analysts. (See SMCI stock forecast)

With the data in, it seems clear that Wall Street’s analysts prefer AMD over Super Micro Computer as the superior AI stock to buy ahead of the companies’ upcoming earnings releases.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.