Alphabet (GOOGL) stock is up today despite an announcement that a leader from the Google News division is stepping down. Shailesh Prakash has been with Google since 2002, serving as Vice President of Product and Engineering for Google News. Today, however, the Wall Street Journal reports that he will be stepping down from his position as relationships between the tech giant and many news outlets remain strained.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Will this development impact Alphabet stock in the coming months as Donald Trump’s ascension to the White House spurs demand for news coverage? The short answer is probably not. But let’s take a closer look at Prakash’s resignation and assess what it is likely to mean for Google.

What’s Happening with Alphabet Stock?

While trading has been a little volatile today, Alphabet closed out the day in the green. The week, in general, has been a good period for most Big Tech stocks, as Trump’s recent election victory is seen as a bullish indicator for the sector. Alphabet stock is up 3% for the past five days despite some slight dips that have never persisted.

Google has not issued any statement on Prakash’s resignation nor indicated any plans for Google News as it moves forward at a pivotal time. News outlets across the U.S. and beyond are dependent on Google for website traffic and in some cases, paid subscribers that drive their revenue. And as the Journal notes, Prakash’s role is central to the relationships that news publishers have with Google.

As such, news media stocks will likely be more impacted by Prakash’s replacement than Google itself. As a leading tech company with exposure to many facets of the tech sector, Alphabet is well-positioned to continue growing into 2025 and beyond. But if the person appointed to take his place makes major changes, it could disrupt most media stocks.

Wall Street Is Highly Bullish on GOOGL Stock

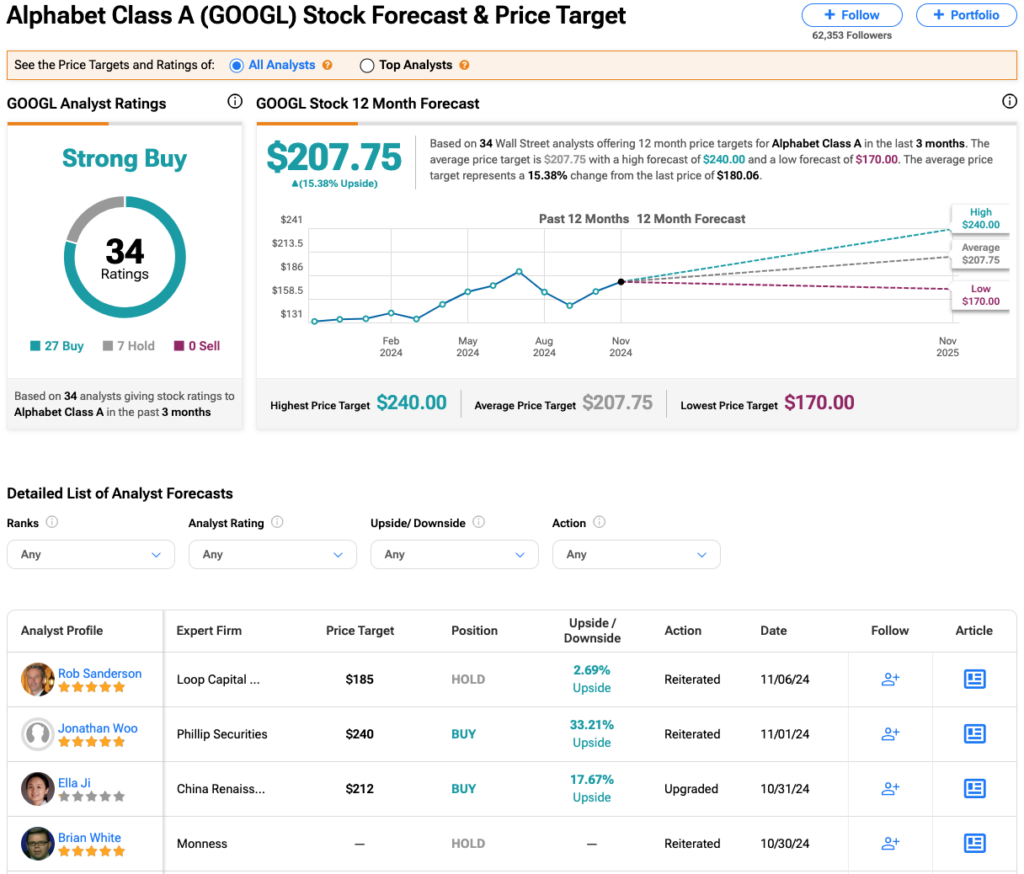

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 27 Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 37% rally in its share price over the past year, the average GOOGL price target of $207.75 per share implies 15.4% upside potential.