The stock market surged on Wednesday following Trump’s Presidential Election win, yet Rivian (NASDAQ:RIVN) was absent among the winners. The EV maker’s stock fell 8%, joining a broader decline among EV stocks (with Tesla as the exception) as concerns grew over potential EV-unfriendly policies from the incoming Trump administration.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

This latest drop adds to Rivian’s miserable year, with the stock down 57% in 2024.

With the company set to report Q3 earnings today (Thursday) after the close, could this be a chance to reverse the downward trend? Guggenheim analyst Ronald Jewsikow has a balanced take on what’s in store for the readout.

“Our cash burn forecast worsens in the near-term as losses widen, and we would note consensus 3Q FCF forecasts look unrealistically optimistic,” Jewsikow opined. “While we are below consensus revenues/FCF, we do see margins outperforming on the cost reduction benefits of the Gen 2 platform, despite lower than anticipated volume leverage vs. our prior forecasts.”

Looking further ahead, the analyst takes a positive stance regarding the “altering potential of both the VW JV and the R2 launch in 2026.”

The VW JV closing and any positive update around it, in particular, could be near-term catalysts. In fact, in contrast to investor sentiment late in Q3, Jewsikow thinks the market has “started to coalesce around the RIVN/VW JV closing.” Jewsikow continues to think the deal will close by year-end (VW recently suggested it would close in December, though he doesn’t expect a significant update in the 3Q call) and sees it as a “positive catalyst” for the company. The next major positive developments for the Rivian/VW joint venture are likely to come from expanding the JV’s scope, such as adding new customers or products, and/or providing details on potential cost savings for Rivian.

One direct Q3 earnings issue that investors will be focusing on revolves around gross margins. There’s a notion that the path to achieving breakeven gross margins by the end of 2024 is not primarily due to higher volumes. Instead, it is driven by significantly improved costs on the Gen 2 R1 models, “synthetic leverage” from consolidating production lines, and notably lower battery costs achieved through better pricing and the rollout of LFP models.

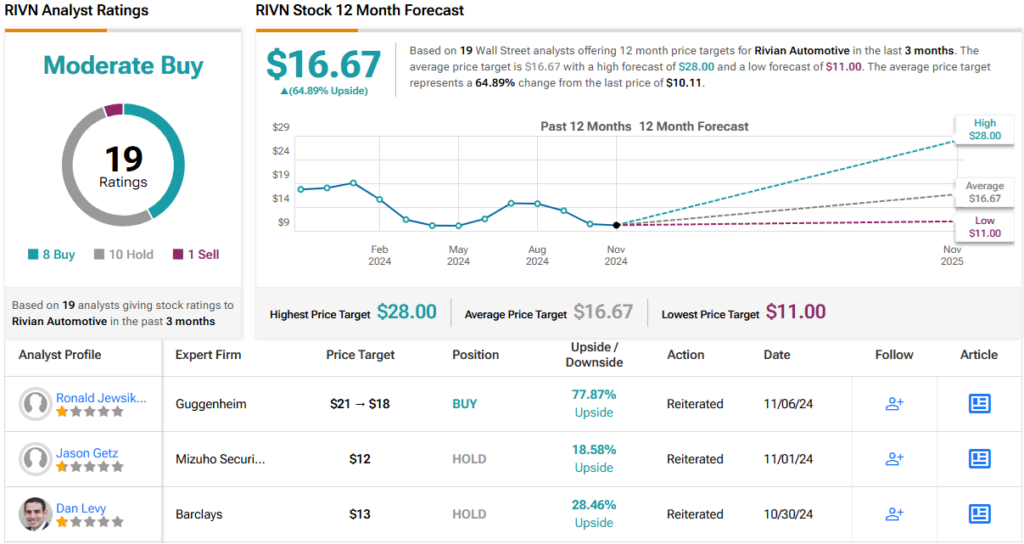

With these factors in mind, Jewsikow rates RIVN shares a Buy, though he has trimmed his price target from $21 to $18, factoring in “modestly lower mid-term demand forecasts.” Nevertheless, the target suggests a ~78% upside from current levels. (To see Jewsikow’s track record, click here)

That target still sits above the Street’s average, which lands at $16.67 and factors in a 12-month gain of ~65%. On the rating front, based on 8 Buys, 10 Holds and 1 Sell, the stock claims a Moderate Buy consensus rating. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.