Affirm Holdings, Inc. (NASDAQ: AFRM) has raised its third-quarter and Fiscal 2022 guidance for key metrics on the back of strong performance in the quarter so far. The company offers a platform for digital and mobile-first commerce.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Despite the optimistic outlook, shares of Affirm tanked 15% on Monday and hit record lows of $20.02 during the day. Perhaps, this was a reaction to Bloomberg’s news released on Friday that Affirm delayed the sale of asset-backed securities on grounds of a significant investor backing out due to market volatility.

Updated Outlook

The company’s gross merchandise volume (GMV) in the third quarter and Fiscal 2022 is now expected to be more than $3.71 billion and $14.78 billion, respectively, up from $3.61 to $3.71 billion and $14.58 to $14.78 billion guided previously. GMV has also been benefitting from Affirm’s enterprise partnerships.

Furthermore, revenue less transaction costs is expected to exceed the prior outlook on the back of robust performance in both network revenue and transaction costs, including provision for credit losses. It is projected at $148 million and $600 million in the third quarter and Fiscal 2022, respectively. The previous guidance for the same was $138 million to $143 million in the third quarter and $585 to $595 million for Fiscal 2022.

Revenue in the third quarter and Fiscal 2022 is anticipated to be above $335 million and $1.31 billion, respectively. The company had earlier anticipated reporting revenue of $325 to $335 million in the third quarter and between $1.29 billion and $1.31 billion for Fiscal 2022. The consensus revenue estimates for the third quarter stands at $340 million.

Stock Rating

Following the news, Mizuho Securities analyst Dan Dolev maintained a Buy rating on Affirm and raised the price target to $79 from $77. The new price target implies 201.3% upside potential from current levels.

Based on 8 Buys, 5 Holds and 1 Sell, the stock has a Moderate Buy consensus rating. The average Affirm price target of $80.93 implies 208.7% upside potential from current levels.

News Sentiment

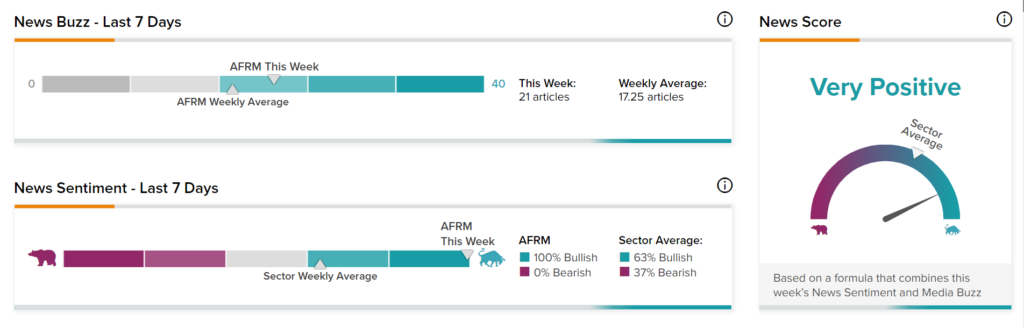

News Sentiment for Affirm is Very Positive based on 21 articles over the past seven days. All the articles have Bullish sentiment, compared to a sector average of 63%, and none have Bearish Sentiment, compared to a sector average of 37%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Curaleaf Opens New Dispensary in Florida; Street Says Buy

Citigroup Launches New Deposit Solution for Institutional Clients

Phoenix Generates Record Cash in 2021; Hikes Dividend