Education

About Us

Working with TipRanks

Follow Us

IXJ Holdings Information

Holdings Count

116Total Assets

4.18BTop 10 Percentage

45.45%Asset Class

EquityCategory

SectorRegion

Global116 Holdings as of Feb 20, 2026

Sector Breakdown

Healthcare

98.63%General

1.37%Countries Breakdown

United States

69.61%Switzerland

10.32%United Kingdom

6.21%Japan

4.15%France

2.43%Denmark

2.25%Germany

1.67%Belgium

1.11%Australia

1.06%Hong Kong

0.33%Korea

0.32%Netherlands

0.30%Brazil

0.11%Sweden

0.06%Spain

0.05%Breakdown By Smart Score

The weighted average smart score of the IXJ ETF is 7

10

5.23%9

15.95%8

22.98%7

23.18%6

18.15%5

8.29%4

2.98%3

2.13%2

1.10%1

0.00%IXJ ETF News

PremiumCompany Announcements

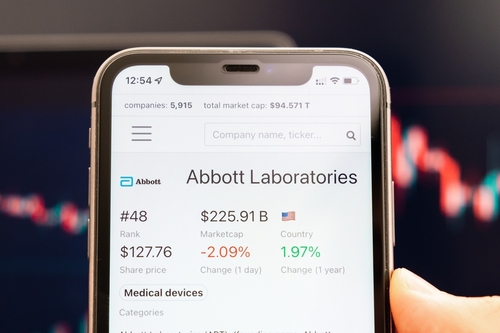

Abbott Laboratories Streamlines Governance With Smaller Board

See More IXJ News

IXJ ETF FAQ

What are ETF IXJ’s top 3 holdings?

IXJ’s top 3 holdings are LLY, JNJ, ABBV.

What is ETF IXJ’s holdings count?

ETF IXJ’s is holdings 116 different assets.

What are the total assets of ETF IXJ?

ETF IXJ’s total assets are 4.18B.