Shares of healthcare companies including UnitedHealth Group (NYSE:UNH), CVS (NYSE:CVS), and Humana (NYSE:HUM) dropped in pre-market trading after the Centers for Medicare and Medicaid Services announced an increase in the reimbursement rate by 3.7% on average for Medicare Advantage plans in 2025. This reimbursement rate was below investors’ expectations.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This reimbursement rate affects health insurers like UnitedHealth, CVS, and Humana, who are providers of Medicare Advantage health plans.

Medicare Advantage represents a healthcare option provided by private companies approved by Medicare, that must follow rules set by the Medicare program. Excluding some items, the reimbursement rate implies a drop of 0.16%, according to a Reuters report. The report cited Evercore analysts stating that this reimbursement rate was a setback for businesses engaged in the Medicare Advantage sector and could potentially pressure the profit margins for these companies.

Is IXJ a Good Investment?

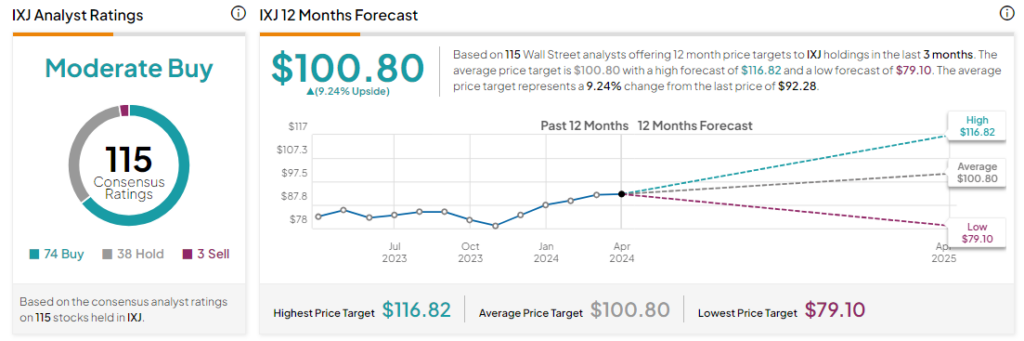

Analysts remain cautiously optimistic about the iShares Global Healthcare ETF (IXJ) with a Moderate Buy consensus rating based on 74 Buys, 38 Holds, and three Sells. Over the past year, IXJ has gained by more than 10% and the average IXJ price target of $100.80 implies an upside potential of 9.2% at current levels.