Zscaler (ZS), a cybersecurity firm, is set to release its Q1 FY25 results on December 2. Wall Street analysts expect the company to report earnings of $0.63 per share for Q1 2025, down 6% year-over-year. On the contrary, analysts expect revenues to rise by 22% year-over-year, reaching $605.7 million for the quarter, according to TipRanks’ data.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Over the past year, Zscaler’s shares have gained about 3%, driven by the company’s steady execution in the competitive Secure Access Service Edge (SASE) market. Further, the increasing demand for cybersecurity solutions in a hybrid work environment has supported the modest growth in its stock price.

Interestingly, Zscaler has maintained a strong record of earnings surprises, surpassing estimates in each of the last nine quarters.

Analysts’ Opinions Ahead of Zscaler’s Q1 Earnings

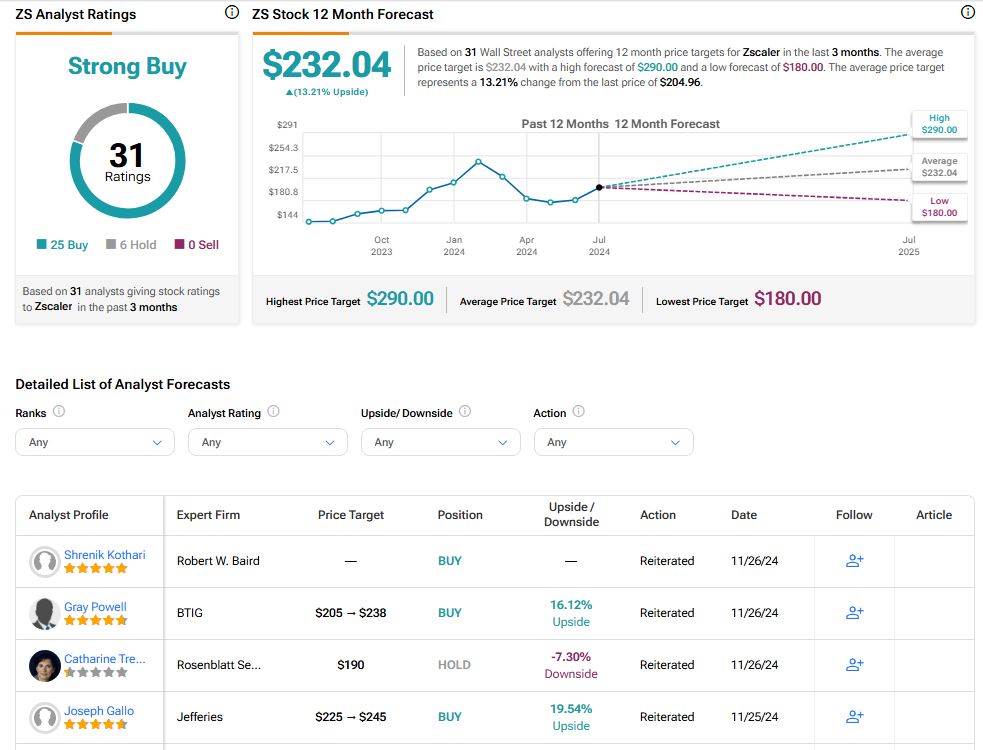

Ahead of Q1 results, Robert W. Baird analyst Shrenik Kothari has given Zscaler a Buy rating. Kothari believes the company is on track to meet its billing targets for the second half of FY25, supported by positive feedback from partners, non-cancelable contracts, growing product adoption, and strong growth prospects in the second half of the year.

Similarly, Jefferies analyst Joseph Gallo maintained a Buy rating and raised his price target on Zscaler from $225 to $245 per share. According to Gallo, survey results showed improved sentiment quarter-over-quarter, though other indicators pointed to slower growth compared to fiscal Q4. Despite this, Jefferies believes Zscaler can meet its conservative Q1 billings growth guidance of 10% year-over-year and expects mid-teen billings growth.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 21.1% move in either direction.

Is ZS Stock a Good Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on ZS stock based on 25 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. The average ZS price target of $232.04 per share implies 13.21% upside potential.