Although the cybersecurity company delivered better-than-expected second-quarter results, Zscaler (NASDAQ:ZS) declined in pre-market trading. The company reported an adjusted income of $0.76 per share compared to $0.37 per share in the same period last year. This was above consensus estimates of $0.58 per share.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company’s revenues surged by 35% year-over-year to $525 million and exceeded consensus estimates of $507.6 million. In addition, its calculated billings grew 27% year-over-year to $627.6 million. The firm defines calculated billings as total revenue plus the change in deferred revenue in a period.

Looking ahead to the upcoming quarter, Zscaler has projected revenue to be between $534 million and $536 million, with adjusted earnings in the range of $0.64 to $0.65 per share. Analysts were expecting revenues of $531 million and earnings of $0.58 per share. For FY24, the company has forecasted adjusted earnings to land between $2.73 and $2.77 per share on revenues of $2.11 billion to $2.122 billion. Analysts were expecting adjusted earnings of $2.49 per share on revenues of $2.1 billion.

Is ZS Stock a Good Buy?

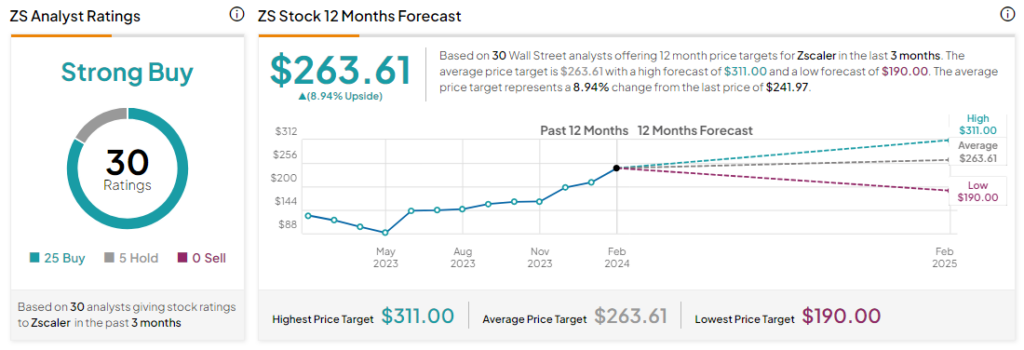

Analysts remain bullish about ZS stock with a Strong Buy consensus rating based on 25 Buys and five Holds. Over the past year, ZS stock has surged by more than 85%, and the average ZS price target of $263.61 implies an upside potential of 8.9% at current levels. However, it’s worth noting that estimates will likely change following today’s earnings report.