Amid tumultuous seas, ZIM Integrated Shipping Services (ZIM) has more than weathered a volatile global shipping environment, reaching a 52-week high and seeing its stock value soaring by an extraordinary 127% over the past year. The surge is primarily attributed to ZIM’s strategic initiatives and operational efficiencies, which have boosted its financial health and reinvigorated dividends.

Furthermore, ZIM’s dedicated drive towards fleet renewal and the augmentation of its freight rates have significantly fueled performance. The company’s commitment to sustainable advancement, mainly through its LNG-powered vessels, aligns with current industry trends and paves the way for a secure future in an ever-evolving industry landscape. With its robust financial positioning, ZIM stock appears to be an income-oriented value investment in a compelling growth story.

ZIM Expects to Continue Improving

ZIM Integrated Shipping Services is a global provider of container shipping and related services, offering door-to-door and port-to-port transportation for various customers. The company operates an extensive network in international markets with a fleet of 150 vessels, including 134 container vessels and 16 vehicle transport vessels.

As mentioned before, the company has handled the growing pressure on global shipping companies, such as geopolitical tensions in the Middle East, which caused vessels to be rerouted, supply Chain Pressures, and rising shipping freight rates.

In recent developments, ZIM has initiated a new long-term operational cooperation with the Mediterranean Shipping Company (MSC) focused on the Asia – U.S. East Coast and Asia – U.S. Gulf trades. This cooperation is expected to substantially enhance ZIM’s port coverage and service quality. Set to launch in February 2025, the initiative is awaiting regulatory approval.

Furthermore, the company’s strategic decision to increase its spot market exposure in transpacific trade has led to substantial growth. Rising rates and favorable demand trends are expected to continue improving the financial outlook for the second half of 2024, likely driving financial results (and the stock) to higher levels.

ZIM’s Recent Financial Results & Outlook

For Q2 2024, ZIM Integrated Shipping surpassed analysts’ estimates and reported revenue of $1.93 billion, exceeding predictions of $1.74 billion. The carried volume for the quarter increased 11% year-over-year, reaching 952 thousand TEUs at an average freight rate per TEU of $1,674, a 40% increase over Q2 2023. The record-breaking quarter was marked by a net income of $373 million, a dramatic increase compared to the net loss reported for the previous year’s Q2. The company’s adjusted EBITDA was $766 million, a 179% year-over-year increase. Earnings per share (EPS) of $3.08 were significantly higher than the consensus projections of $1.92.

Despite a rise in net debt to $3.25 billion, ZIM reduced its net leverage ratio from 2.2x in December 2023 to 2.0x in June 2024. The company’s solid financial performance allowed it to declare a dividend of $112 million or $0.93 per share.

Following its successful second-quarter results, ZIM’s management has updated its full-year guidance for 2024, forecasting an adjusted EBITDA increase from $2.6 billion to $3.0 billion, from previous estimates of $1.15 billion to $1.55 billion.

What Is the Price Target for ZIM Stock?

The stock has reflected the highs and lows of the post-pandemic era, climbing over 755% immediately after the global economy reopened, only to decline 85% through last fall, rebounding 154% year-to-date. It trades at the high end of its 52-week price range of $6.32 – $23.82 and shows ongoing positive price momentum by trading above its 20-day (19.95) and 50-day (18.61) moving averages.

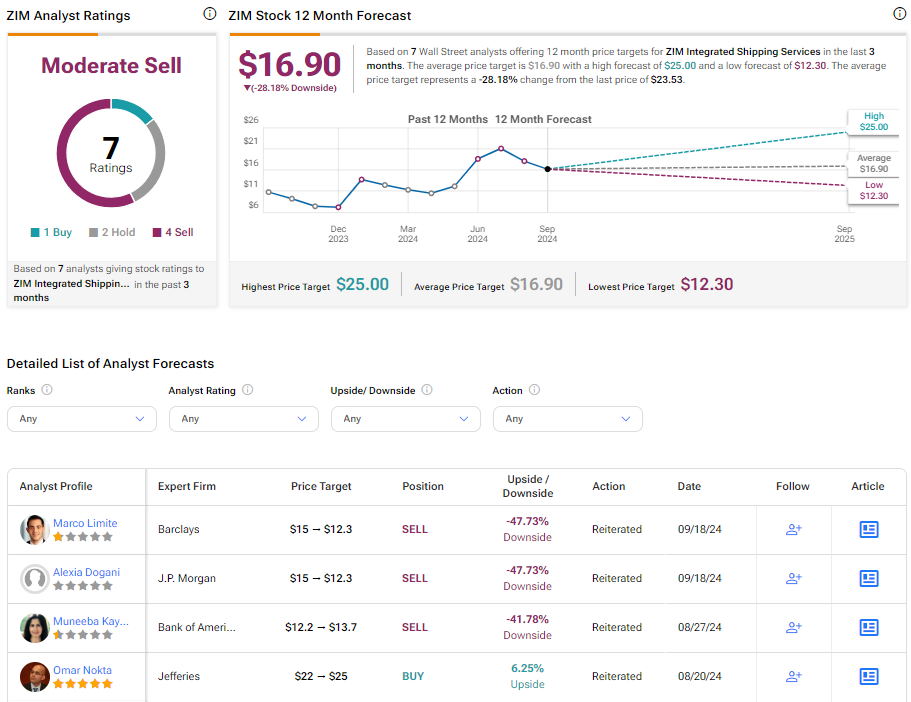

The company’s P/S ratio of 0.48x reflects a significant discount to the Marine Shipping industry’s average of 1.93x, which suggests not all market participants are sold on ZIM’s growth potential. Analysts covering the company have mainly taken a cautious stance on the stock. For instance, BofA analyst Muneeba Kayani recently reiterated a sell rating on the shares, though she raised the price target to $13.70 in the process. She notes the company’s increased EBITDA estimate for 2024 but articulated concerns regarding the sustainability of the current demand uptick and its ability to maintain its dividend payout in 2025.

ZIM Integrated Shipping Services is rated a Moderate Sell based on the recommendations and price targets recently issued by four analysts. The average price target for ZIM stock is $16.90, representing a potential -28.18% change from current levels.

ZIM in Summary

ZIM has showcased impressive resilience, primarily attributed to strategic initiatives and operational efficiency enhancements, which elevated its financial standing and led to renewed dividends. Recent collaborations with the Mediterranean Shipping Company and increased spot market exposure in transpacific trade contribute to ZIM’s expectations for further growth. While market participants have taken a cautious stance, ZIM’s financial outcomes and robust positioning, supported by a discount share price, suggest a solid investment opportunity.