ZIM Integrated Shipping Services (ZIM) has made quite an impression this morning, with its stock soaring 16.21% in pre-market trading following a stellar second-quarter report. The shipping company’s latest earnings release highlights a significant turnaround from last year’s struggles.

ZIM Reports Impressive Q2 Financials and Record Volume

For the second quarter of 2024, ZIM reported a robust $1.93 billion in revenues, surpassing analyst expectations of $1.78 billion and marking a substantial increase from $1.31 billion in the same period last year. This significant revenue growth is driven by higher freight rates and increased carried volume.

Additionally, the company turned around its financial performance with a net income of $373 million, reversing a net loss of $213 million from Q2 2023. The diluted earnings per share of $3.08 notably exceeded the analyst consensus estimate of $1.92 and is a dramatic improvement from last year’s loss of $1.79 per share.

Eli Glickman, ZIM’s President & CEO, expressed his satisfaction with the results, saying, “We are pleased with our strong second-quarter performance, highlighted by outstanding strategic execution that led to record high carried volume.” ZIM achieved an 11% increase in carried volume, reaching 952 thousand TEUs, and saw the average freight rate per TEU climb to $1,674, a 40% year-over-year jump.

ZIM Upgrades 2024 Guidance

Looking ahead, ZIM has revised its full-year 2024 guidance upwards. The company now anticipates Adjusted EBITDA between $2.6 billion and $3.0 billion, up from previous estimates. Glickman is optimistic about the latter half of the year, stating, “We expect our results in the second half of 2024 to be better than in the first half.”

ZIM Rewards Shareholders with Dividend

ZIM is also focused on rewarding its shareholders. The company declared a dividend of $0.93 per share, totaling $112 million, which represents 30% of the second quarter’s net income. This dividend is set to be paid on September 5, 2024, reflecting ZIM’s commitment to returning value to its investors.

Is ZIM a Good Stock to Buy?

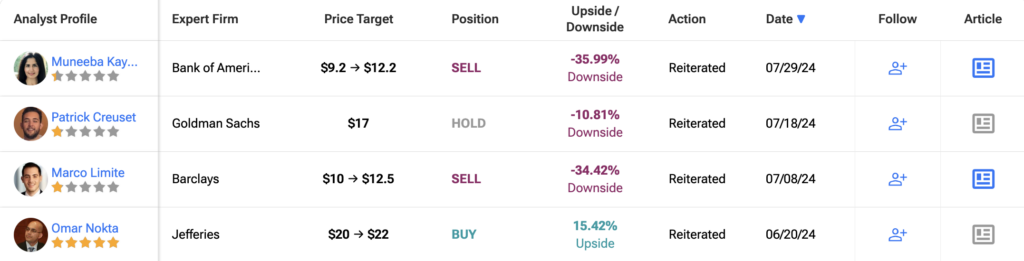

Analysts remain bearish about ZIM stock, with a consensus Moderate Sell rating based on one Buy and three Sells. Over the past year, ZIM has increased by more than 50%, and the average ZIM price target of $14.18 implies a downside potential of 25.60% from current levels. These analyst ratings are likely to change following ZIM’s results today.