Shares of container line shipping company ZIM Integrated Shipping Services (NYSE:ZIM) sunk nearly 12% today after its first-quarter numbers disappointed investors. Even a dividend announcement and an increased outlook are failing to buoy investor sentiment in the stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Favorable Winds for ZIM

During the quarter, ZIM’s revenue increased by nearly 14% year-over-year to $1.56 billion, surpassing expectations by $60 million. Its EPS of $0.75, on the other hand, missed the mark by $0.23. Still, this was an improvement compared to ZIM’s net loss per share of $0.50 in the year-ago period.

This improvement in ZIM’s performance was driven by a 10% increase in its carried volume and a 4% improvement in the average freight rate per TEU. The company’s total carried volume for the quarter stood at 846,000 TEUs. Importantly, the results point to favorable global freight rates as well as gains from ZIM’s focus on improving its cost structure. (TEU, or twenty-foot equivalent unit, is a measure of cargo capacity for container ships.)

The combination of these favorable trends and a positive bottom line prompted the company to announce a dividend of $0.23 per share. The ZIM dividend is payable on June 11 to investors of record on June 4.

ZIM’s Buoyant Outlook

Additionally, ZIM has hiked its financial outlook for the full year. It now anticipates adjusted EBITDA in the range of $1.15 billion to $1.55 billion, up from the prior estimate of $850 million to $1.45 billion. Moreover, the company expects the strong momentum in freight rates to continue due to robust demand and tight supply.

What Is the Stock Price Prediction for ZIM?

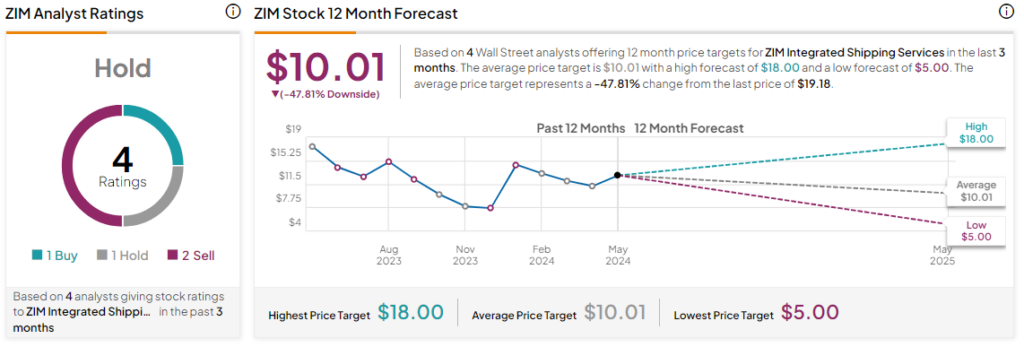

Today’s price decline comes after a nearly 176% jump in ZIM’s share price over the past six months. Overall, the Street has a Hold consensus rating on the stock, alongside an average ZIM price target of $10.01. However, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure