Yum! Brands, Inc. (YUM) reported mixed Q2 results, with earnings beating expectations but revenue falling short. The fast food giant, home to KFC, Taco Bell, Pizza Hut, and The Habit Burger Grill, saw its shares dip 0.71% following the announcement.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

YUM’s Earnings Beat but Revenue Misses

Yum! Brands posted adjusted earnings per share of $1.35, surpassing the analyst estimate of $1.33. However, revenue came in at $1.76 billion, below the $1.81 billion consensus forecast. Despite the revenue miss, the company’s ability to beat earnings expectations showcases some financial resilience in a challenging environment.

Taco Bell Shines, Pizza Hut Struggles

Taco Bell was the star of the quarter, with system sales growing 7% and same-store sales increasing by 5%. CEO David Gibbs attributed this success to “unmatched, crave-worthy innovation” and the launch of the Cantina Chicken menu. On the other hand, Pizza Hut’s performance was flat, showing no growth in system sales.

“I’m incredibly pleased with how well our teams have managed through a challenging operating environment,” Gibbs said. He emphasized the strength of Taco Bell and KFC International, which together delivered a 5% system sales growth, driven by an 8% increase in unit growth.

YUM! Brands Expands Global Footprint

Yum! Brands opened 894 new units globally during the quarter, expanding its footprint and reinforcing its growth strategy. Digital sales remained robust, hitting nearly $8 billion and accounting for over 50% of total sales.

YUM Maintains Outlook Despite Challenges

Despite the revenue shortfall, Yum! Brands maintained its outlook, expecting at least 8% core operating profit growth for the full year. Gibbs expressed confidence in the company’s long-term strategy, noting, “Based on our first half results, we continue to expect to deliver at least 8% Core Operating Profit growth this year.”

Is YUM a Good Stock to Buy?

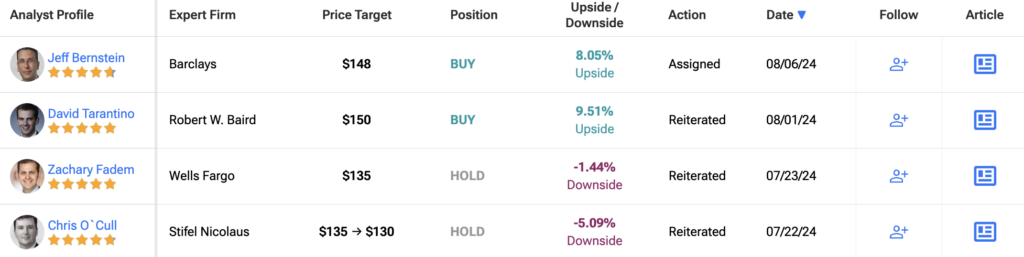

Analysts remain cautiously bullish about YUM stock, with a Moderate Buy consensus rating based on eight Buys and nine Holds. Over the past year, YUM has increased by 3%, and the average YUM price target of $146.13 implies an upside potential of 6.7% from current levels. These analyst ratings are likely to change following YUM’s results today.