Value meals are drawing a lot of attention back to the fast food sector, and Yum! Brands (NYSE:YUM) mainstay Taco Bell is joining the fray. Sadly, this didn’t help much for Yum stock, as shares slipped fractionally in Thursday afternoon’s trading.

The new value meal is known as the Luxe Cravings Box, though what makes a Taco Bell meal “luxe” is, at best, unclear. The meal, priced at $7, features a chalupa supreme, a beefy five-layer burrito, double taco chips, and cheese sauce, along with a medium drink. That’s actually not bad, and Taco Bell is making waves because the $7 charged represents a 55% savings over ordering each item separately.

That doesn’t exactly make things better, but it does highlight the depth of the deal being offered. They’re far from the only ones making a value menu happen, but the question is, will anyone care, or has everyone gotten used to cooking at home at this point?

Something Must Be Done

Yum! Brands has already been staring down the barrel of calamity. Share prices are sliding as menu prices rise, and the 200-day moving average line is being threatened. Moreover, Yum! Brands in China has pulled its account with Mindshare, a public relations relationship going back to 1998 and worth about $400 million. Instead, it’s going with Publicis Media, a move made after GroupM was reportedly found taking bribes.

There’s no doubt that Yum! Brands will need all the high-end marketing firepower it can get, especially as prices rise to the point where people are throwing up their hands and going out to nice restaurants, which are only slightly more expensive at this point.

Is YUM a Good Stock to Buy?

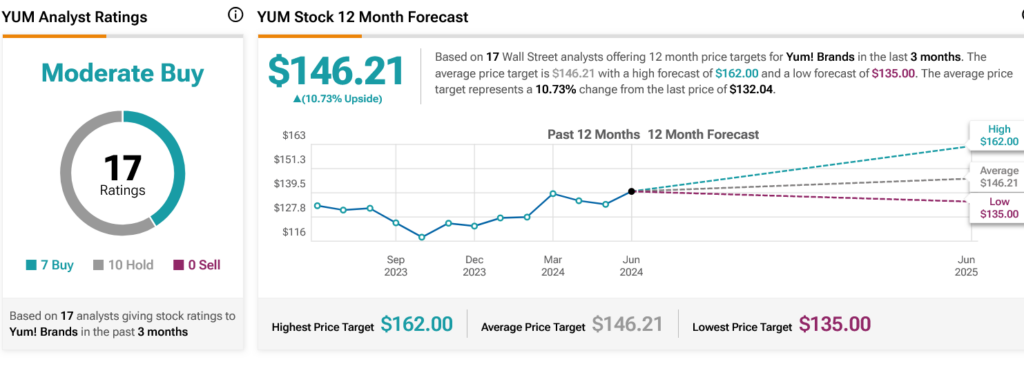

Turning to Wall Street, analysts have a Moderate Buy consensus rating on YUM stock based on seven Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 0.46% loss in its share price over the past year, the average YUM price target of $146.21 per share implies 10.73% upside potential.