Shares of water and wastewater solutions provider Xylem (NYSE:XYL) are tanking in the pre-market session today after it announced a $7.5 billion acquisition of water treatment solutions and services provider Evoqua (NYSE:AQUA).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

With AQUA’s advanced treatment expertise, the combined entity could be well-positioned to address the modern market challenges. Further, AQUA is a leading name in the remediation of emerging contaminants and also caters to a range of industries including life sciences, microelectronics, power, and food and beverage with its digital offerings as well as water treatment systems.

Impressively, the move is expected to yield $140 million in cost synergies over the next three years. Under the terms, AQUA stockholders will receive 0.480 Xylem shares for each AQUA share held by them. This points to a $52.89 per share price and the acquisition is expected to close in the middle of this year.

Upon closing, Xylem investors will own 75% and AQUA investors will own the rest of the new combine. Finally, Patrick Decker, the President, and CEO of Xylem, will continue to be at the helm of the combined entity.

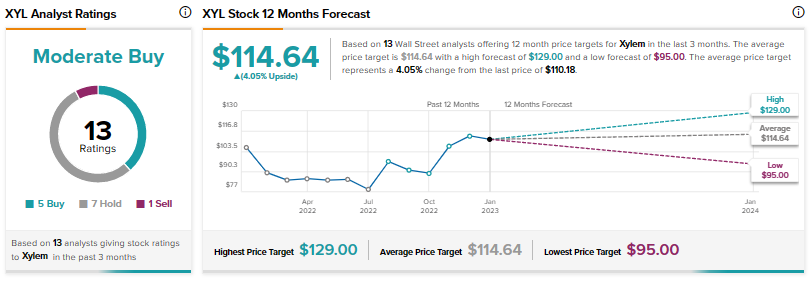

In the meantime, the Street has a Moderate Buy consensus rating on Xylem alongside an average price target of $114.64. Shares of the company have already gained nearly 35.7% over the past six months.

Join our Webinar to learn how TipRanks promotes Wall Street transparency

Read full Disclosure