Not so long ago, theater owners expressed concern about the potential sale of entertainment giant Warner Bros. Discovery (WBD), believing that this could be bad news for them due to a potential reduction in content. Theater owners have since reconsidered the landscape, and discovered an even bigger potential minefield ahead. It turns out one potential buyer for Warner is the “worst-case scenario.” Investors were unfazed, as Warner stock fell just slightly in the closing minutes of Thursday’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It turns out that for theater owners, the worst case scenario is Netflix (NFLX) coming out on top. Basically, the idea here is that, if Netflix were to buy Warner, a lot of that content would not find its way into theaters at all, but rather, onto the streaming platform instead. This would not merely reduce the amount of content coming to theaters, rather, it would basically shut down an entire studio’s worth.

Granted, Netflix has shown some signs of thawing in this direction. We have already heard about how Netflix is losing talent, like Zach Cregger, due to its hesitation to take on the theatrical market. We also know that Netflix does have some theatrical releases, generally the ones it wants to put up for awards consideration as some theatrical run time is required to qualify. So Netflix winning here may not be the disaster theaters might think, but then, it certainly could be.

Stepping Up the Sports

Meanwhile, in a point we have not had much chance to consider lately, Warner is carrying on its pattern of looking to unusual niche sports to draw attention to its live sports line. With winter coming on, that turns some enthusiasts’ hearts to thoughts of luge, and Warner will be taking on coverage of the International Luge Federation’s 2025-2026 season.

Several linear Warner channels will get in on the action, with local coverage and commentary set to show up throughout the luge season. And of course, streaming coverage will also take a hand in the events, as both Eurosport.com and TNTSports.co.uk will have a presence. Given those two account for about 28 million viewers a month, it could really give luge a boost.

Is WBD Stock a Good Buy?

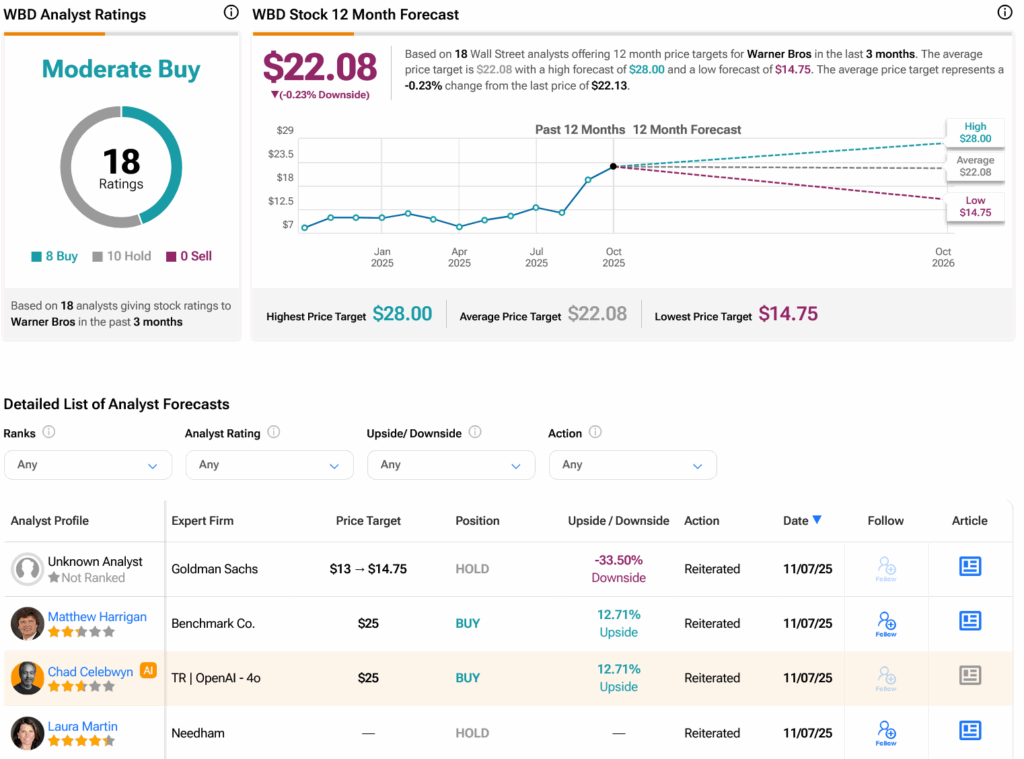

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on eight Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 125.05% rally in its share price over the past year, the average WBD price target of $22.08 per share implies 0.23% downside risk.