Chicken wings aren’t just a big hit among consumers; they’ve also helped investors generate substantial gains, as Wingstop (WING) stock is up by more than 350% over the past five years. However, I believe the rally can continue due to the company’s strong earnings, meaningful same-store sales, and its ability to gain market share. I am bullish on the stock even as it approaches all-time highs because the long-term growth opportunity remains compelling.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

How WING’s Same-Store Sales Compare with Other Fast Food Giants

Wingstop’s impressive same-store sales (SSS) growth is one of the main reasons I’m bullish on the stock. The restaurant chain reported 28.7% year-over-year SSS growth in the fiscal second quarter of 2024.

This growth rate is much higher than for your typical restaurant chain, and we’ll use three growth-oriented restaurant stocks to demonstrate this concept. Investors gushed when Chipotle (CMG) reported an 11.1% year-over-year increase in comparable restaurant sales in the second quarter. Meanwhile, Cava (CAVA) and Sweetgreen (SG) reported year-over-year SSS growth of 14.4% and 9%, respectively.

Many growth investors who analyze restaurant stocks are looking at Chipotle, Cava, and Sweetgreen. All three of those stocks have outperformed the S&P 500 year-to-date. Chipotle is a fan favorite due to its long-term outperformance, while Cava and Sweetgreen have more than tripled year-to-date. Wingstop shares haven’t even doubled year-to-date, and yet its SSS growth has comfortably exceeded the numbers recently posted by these three restaurant competitors.

Profit Margins Are Already in a Good Place

Same restaurant sales growth isn’t the only advantage Wingstop has over Cava, Chipotle, and Sweetgreen. The wing maker also has higher profit margins, revenue growth, and net income growth. Rising profit margins make me bullish on the stock.

Wingstop closed out the second fiscal quarter with a 17.7% net profit margin. Chipotle is the closest, with a 15.3% net profit margin in the most recent quarter. However, Cava’s 8.5% net profit margin is much lower, and Sweetgreen still isn’t profitable.

WING’s P/E ratio is high at 109x (forward non-GAAP), but profit margins are high and growing. Revenue increased by 45.3% year-over-year, while net income jumped by 69.9% year-over-year in the second fiscal quarter. That led net profit margins to a 16.9% year-over-year growth rate. If Wingstop maintains this growth rate, its net profit margins should exceed 20% next year. That’s not far-fetched, as Wingstop closed out the previous quarter with a 19.7% net profit margin. High revenue growth combined with soaring profits suggests an attractive long-term opportunity.

Wingstop Has Meaningful Restaurant Growth

Sterling domestic and franchise restaurant growth presents more fuel for a bullish stance. Wingstop’s ability to maintain high same restaurant sales growth suggests a vibrant business model that can be scaled. Leadership is certainly pursuing this, as the number of system-wide restaurants is up by 15% year-over-year.

The restaurant chain’s success has attracted many entrepreneurs who wish to run their own franchises. Wingstop closed out the quarter with 1,988 domestic franchise restaurants and 312 international franchise restaurants. Those totals represent year-over-year growth rates of 13.7% and 23.8%, respectively.

Wingstop’s international expansion is encouraging, as it represents a largely untapped market opportunity. When domestic growth inevitably slows down, Wingstop can tap into international markets to keep growth rates elevated. However, it doesn’t seem like growth is slowing down anytime soon. Wingstop also has successful company-owned domestic restaurants that have achieved 14.1% year-over-year SSS growth.

Is Wingstop Stock a Buy?

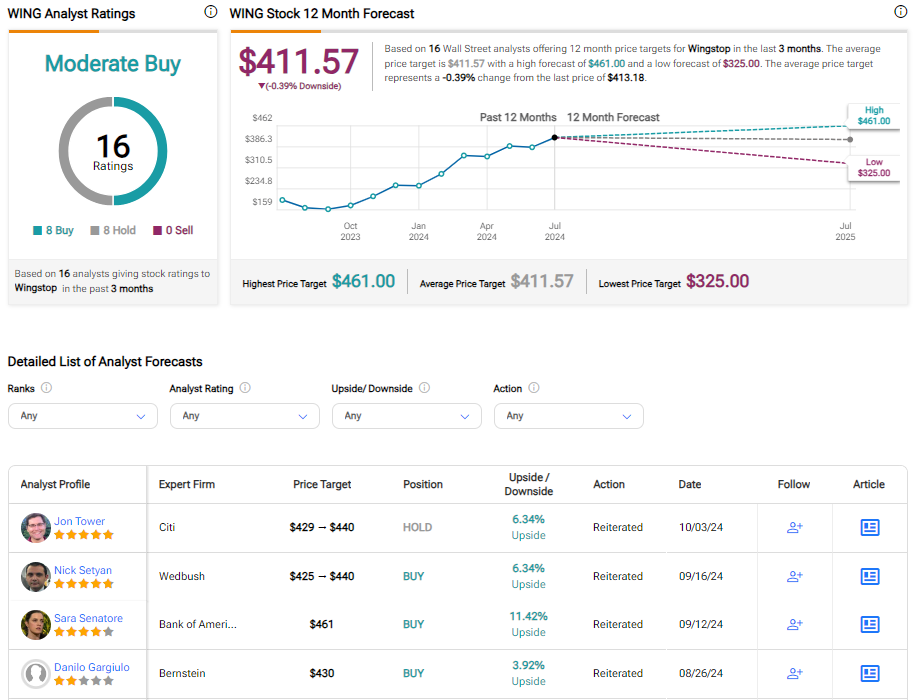

Wingstop is currently rated a Moderate Buy based on ratings from 16 analysts. The stock has received eight Buy ratings and eight Hold ratings in the past 3 months. No analyst has rated the stock as a Sell during this period. The recent rally caught some analysts by surprise, as the average WING price target of $411.57 is marginally below the stock’s recent trading price.

However, recent price targets have been more optimistic. Two recent price targets imply a 6% upside. The analyst who has afforded the highest price target of $461 per share believes that WING stock can advance an additional 11% from its current price.

The Bottom Line on Wingstop Stock

Restaurant stocks have been attracting growth investors. Chipotle has been one of the most successful restaurant stocks this millennium, and investors are always looking for the next CMG. Cava often receives that title, and Sweetgreen stock has also received plenty of attention after more than tripling in value this year.

However, Wingstop has the best growth rates and profit margins of the group. The company’s 28.7% year-over-year same restaurant sales growth significantly surpasses the rates posted by others. Elevated revenue growth rates and a sprawling presence of more than 2,000 restaurants lead me to believe that Wingstop can continue to outperform the stock market.

Wingstop has a solid business model by any measure. After comparing WING stock to other restaurant stocks, I believe that the rally can continue. The share price ascent to all-time highs is warranted, and Wingstop stock remains attractive for investors who can afford to hold onto their shares for the next decade. I’m bullish on WING.