Williams-Sonoma (WSM) had a very upbeat third quarter, which might come as a surprise to some given its primary stock in trade is high-end furniture. But CEO Laura Alber explained why its high-priced furniture sold well.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Basically, Alber noted, Williams-Sonoma is working the “you get what you pay for” strategy about as hard as it can. It makes a point of being “upfront about cost” with customers, trying to elicit the emotional response first to soften reactions to the price tag.

Alber also said that other retailers are using short-term promotions to draw in customers, but the problem with that play is that the customers wait for the next promotion to pull the trigger. Alber wants Williams-Sonoma to be synonymous with “pricing integrity,” which in turn should draw shoppers’ trust that they are getting the best price possible.

Analyst Concerns

Separately, while Williams-Sonoma is counting on product quality and pricing integrity, some analysts remain concerned. Williams-Sonoma’s recent all-time high did little to budge analyst opinion on the stock, with many holding back from going to full Buy recommendations.

Christopher Horvers with JPMorgan Chase (JPM) kept a Neutral rating, though nudged up the price target from $145 to $153. Horvers noted that the stock itself was “expensive,” and will pressure Williams-Sonoma to “drive sales.” Seth Basham at Wedbush kept his Neutral rating as well, though also hiked the price target from $135 to $175.

Is Williams-Sonoma a Good Stock to Buy?

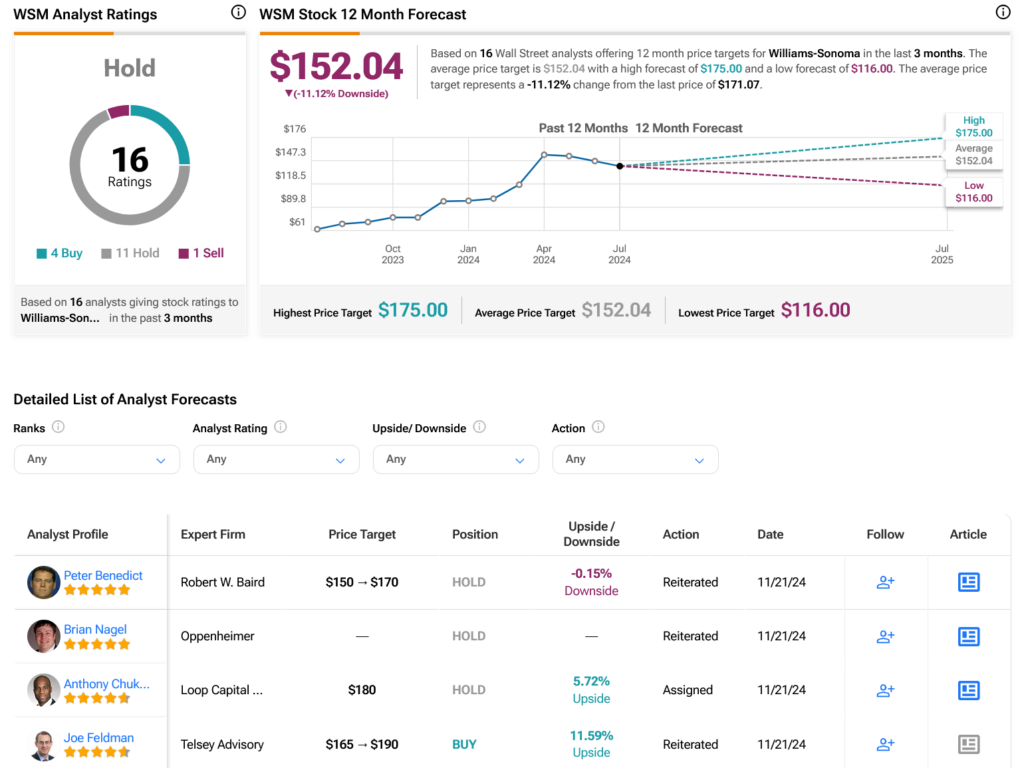

Turning to Wall Street, analysts have a Hold consensus rating on WSM stock based on four Buys, 11 Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 89.24% rally in its share price over the past year, the average WSM price target of $152.04 per share implies 11.12% downside risk.