So far, 2022 has seen fewer mergers in certain industries, such as healthcare, due to high valuations and skepticism surrounding antitrust investigations.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Big drugmakers are recording revenue losses on the verge of patents expiring and, as a result, proceeding toward merger deals to strengthen their pipeline and portfolios.

Merck (NYSE: MRK) is one such healthcare company that contemplates valuable deals to focus on sectors like cancer, vaccines, and animal health. According to a recent Wall Street Journal report, Merck is in discussions to purchase cancer-focused biotech firm Seagen Inc. (SGEN), which has a market capitalization of $30.46 billion. The move is expected to enhance the pharmaceutical company’s cancer-drug portfolio.

Following the report, shares of Merck remained stable, while Seagen stock jumped 12.72% at Friday’s close.

According to the source, if the deal is not completed on regulatory issues, both companies are expected to ink a marketing agreement.

Before contemplating the Seagen deal, Merck completed the acquisition of Acceleron Pharma Inc. last November for $11.5 billion. Meanwhile, the company shrugged off some slower-growth assets such as women’s health products and cholesterol treatments and formed a new publicly traded company.

Background

In accordance with their existing relationship, Merck and Seagen will develop and commercialize a breast-cancer treatment. According to the agreement, Seagen will get an upfront payment of $600 million, and Merck will purchase five million shares for $1 billion. Interestingly, the experimental treatment will be tested with Keytruda, Merck’s key product.

Wall Street’s Take

Earlier this month, following Merck’s oncology-focused investor event at ASCO, Mizuho (MFG) Securities analyst Mara Goldstein maintained a Buy rating on Merck and a price target of $100 (18.19% upside potential).

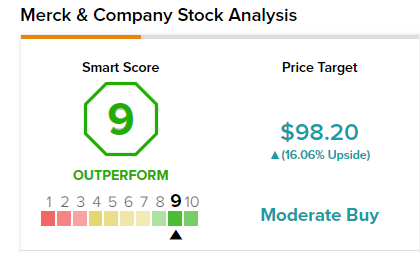

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on seven Buys and three Holds. The average Merck price target stands at $98.20 and implies upside potential of 16.06% to current levels. Shares have gained 14.21% over the past year.

Smart Score Rating

Merck scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

The Bottom Line

Amid uncertain markets and growing investor fears, the recent performance of Merck’s stock price and decent analyst ratings raise optimism. The Seagen deal, if completed, should boost Merck’s product pipeline to a great extent.

Read full Disclosure