Semiconductor giant Nvidia (NVDA) has been one of the hottest (and most polarizing) stocks of 2024. Now, it’s the largest holding of technology investor Brad Gerstner, founder of hedge fund Altimeter Capital. Gerstner is bullish on the semiconductor stock based on its current valuation, as well as the growth potential and capital expenditures for generative artificial intelligence (AI). I agree with Gerstner’s views and am also bullish on Nvidia.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

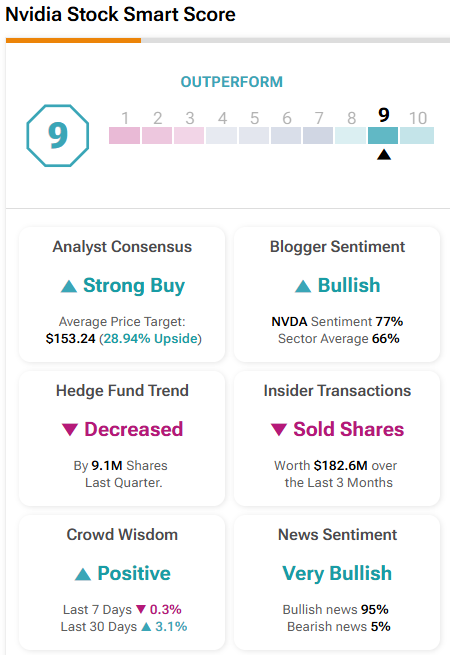

Nvidia stock has an Outperform-equivalent TipRanks Smart Score of 9 out of 10, and sell-side analysts collectively view the stock as having potential upside of 30% over the next 12 months.

Who Is Brad Gerstner?

Gerstner is a high-profile technology investor and the CEO of Altimeter Capital, which invests in both publicly traded and private companies. The hedge fund boasts more than $10 billion in assets under management, according to its most recent regulatory filings.

Gerstner is well-known for successful early investments in tech companies such as Snowflake (SNOW), Zillow (Z), and Grab (GRAB). He is also known for writing an open letter to Meta Platforms (META) CEO Mark Zuckerberg when that company’s stock was declining during the bear market of 2022, recommending that the company cut costs and reduce spending on Metaverse projects.

Now, Gerstner has set his sights on Nvidia. In a recent interview on CNBC, he revealed that he bought the dip on Nvidia when the stock slid recently and that it is Altimeter’s top holding. So, what does the veteran investor like about the stock?

Views on Nvidia

Gerstner is bullish on Nvidia, in large part because of its valuation. While the stock has begun to rebound, it is currently down 16% from its 52-week high as investors have rotated out of AI-related stocks amidst concerns that the sector is overheated and overhyped. After a summer selloff, shares of Nvidia are considerably cheaper. Nvidia currently trades at 29.3 times forward earnings estimates, which is admittedly higher than the S&P 500’s (SPX) valuation of 23.6 times earnings.

While the valuation isn’t cheap, it isn’t at unsustainable nosebleed levels, especially given the earnings and sales growth at the company. Gerstner says that Nvidia’s valuation is reasonable for what he calls “the most important company in computing today.” Gerstner also isn’t worried that customers will pullback spending on AI if they don’t see tangible returns on their investment. He points out that spending on AI makes companies more productive and efficient, positing that every $1 companies such as Amazon (AMZN) and Meta spend on AI, the return on investment is $5.

Additionally, Nvidia’s products can help data analytics companies, such as privately held Databricks, drive down the cost of processing by 95%. Gerstner also points out that there is more to Nvidia than the microchips and processors it makes that run AI applications and models. The company also makes chips and semiconductors for cloud computing data centers, video game consoles, and other industries. Gerstner forecasts that companies will invest about $1 trillion in AI over the next four years.

Is NVDA Stock a Buy, According to Analysts?

Turning to Wall Street, NVDA earns a Strong Buy consensus rating based on 39 Buys, three Holds, and zero Sell ratings assigned in the past three months. In addition, the average NVDA stock price target of $153.24 implies 28.7% upside from current levels.

Read analyst ratings on NVDA stock

Conclusion: Nvidia Is a Top Pick

Gerstner is bullish on NVDA stock, and so am I. After the recent selloff, the shares are considerably cheaper than they were just a few months ago, creating an attractive entry point for investors. As Gerstner says, companies are earning $5 for every $1 invested in AI, making Nvidia’s semiconductors worth the expense. Gerstner has a reputation for being an astute investor, and following his lead with Nvidia while shares are off their highs could prove to be a lucrative opportunity for long-term investors.