Meta Platforms (META) has become my largest holding, and for good reason. Between its impressive revenue and earnings growth, ongoing advancements in artificial intelligence (AI), and a valuation that still feels far too cheap for what it offers, it’s hard for me to resist being bullish. And with the upcoming U.S. election cycle looking like a catalyst for even more growth, I feel the timing couldn’t be better to strengthen my position. Let’s take a look at some of the most prominent catalysts driving my bullish stance on the stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Unrivaled Growth Across Key Metrics

Meta’s growth has been outstanding, boosting my confidence in the bullish case of META stock in recent months. Every quarter, it continues to add more users across its platforms, defying the odds in what many would consider a saturated market. At the end of Q2, Meta celebrated 3.27 billion daily active users across its Family of Apps. That’s a 7% year-over-year rise, even after years of tireless growth. To put that in perspective, nearly half the planet uses a Meta platform daily.

Other notable highlights include WhatsApp’s explosive growth lately, with over 100 million monthly active users in the U.S. alone. Also, in Meta’s latest earnings call, Mark Zuckerberg addressed the misconception that Facebook is just an app for older people, clarifying that internal data—though not fully disclosed—shows strong engagement among young adults in the U.S. He also highlighted that Threads is approaching 200 million monthly active users, offering another positive sign.

Besides user growth, it’s also encouraging to see how well Meta monetizes them. The company saw a 10% jump in ad impressions and the average price per ad compared to last year. This is where Meta’s strength in AI really comes into play. With smarter ad targeting and better personalization, advertisers are seeing higher returns on their ad spend. The result? A 22% rise in revenue, reaching $39.07 billion in Q2.

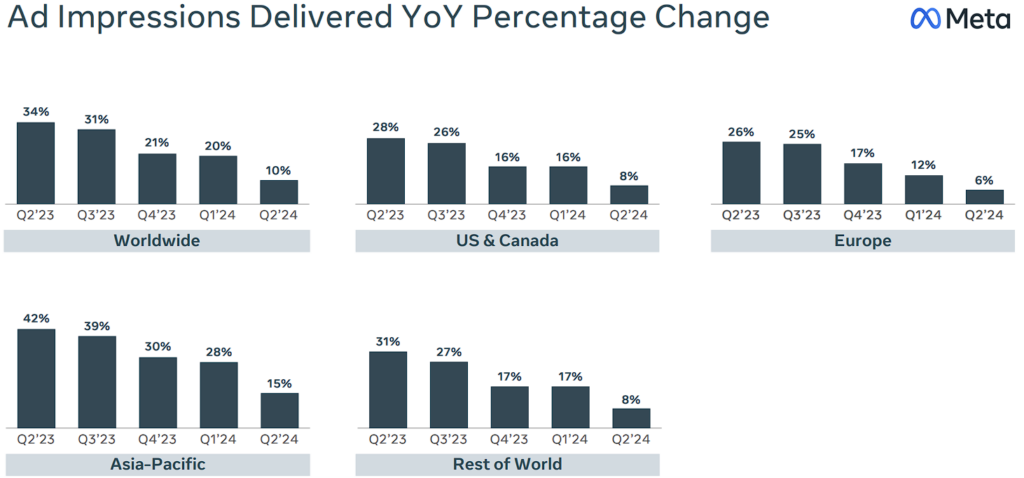

One important topic to note is the recent decline in the rate of ad impressions delivered. However, I believe this trend is quite normal. The 30%+ growth rates seen previously were an anomaly, driven by a surge in ad impressions following the post-pandemic rebound during 2020-2021. As long as Meta can maintain ad impressions growth in the high single digits to low double digits, coupled with higher ad pricing, strong revenue growth should remain well within reach.

Meta Benefits from AI and Monetization Synergies

Meta’s push into AI is transforming its entire business, which adds to my optimistic view. Let me elaborate a bit on how the company delivers ads to how it keeps users engaged. Unlike in the past, we’re not talking about AI in the abstract anymore; it’s already boosting Meta’s top and bottom lines. For example, Meta’s AI systems, like the Meta Lattice ad ranking architecture, drove a 22% higher return on ad spend for advertisers in using its Advantage+ shopping campaigns in Q2. That’s a game-changer for small and medium businesses and should keep attracting advertisers to jump on board, resulting in Meta continuing to rake in more ad dollars.

What’s also particularly interesting is how Meta utilizes AI to improve the user experience. Take Reels, for instance, where AI-driven recommendations have helped boost engagement and video consumption on Facebook and Instagram. And while engagement increases, so do the opportunities for ad placements, especially as the company blends short-form and long-form video content into a unified experience.

Looking forward, Meta’s AI ambitions are even greater. The company is already rolling out tools that allow advertisers to automate much of their creative process. Imagine a world where businesses only need to set a budget and a goal, and Meta’s AI takes care of the rest—from creating the ad to placing it in front of the perfect audience. This isn’t just theoretical; with over 1 million advertisers utilizing Meta’s AI-driven ad features in the past quarter, it’s clear that the market embraces these tools and that this is the future of advertising.

The Election Cycle Could Boost Meta

Let’s not forget the upcoming U.S. election cycle—a massive yet often overlooked catalyst for Meta that has also bolstered my bullish view on the stock. According to eMarketer, political campaigns are expected to spend more than $12 billion on advertising during the 2024 election, and increasingly, that money is flowing into digital platforms. Meta, with its unrivaled reach and ability to target ads with laser precision, stands to be one of the biggest beneficiaries.

We’ve seen this play out before. Meta’s platforms have been a go-to for political campaigns targeting specific voter demographics during past election cycles. With over 3.27 billion people engaging with its platforms daily, it’s no surprise that Meta is primed to capture a large chunk of this ad spend. What’s different this time is that Meta’s AI tools, like Advantage+, make it even easier for campaigns to optimize ad placements and target the right voters. Thus, I wouldn’t be surprised to see an acceleration in revenue growth in Q3 and Q4.

Meta’s Cheap Valuation Offers Strong Risk/Reward

Now, I’ve felt confident making Meta my largest position due to its current valuation level, which I consider to be rather unwarranted given the company’s growth prospects. This sets up an appealing risk/reward opportunity. Now trading at a (P/E) ratio of around 25.2x based on this year’s expected EPS, I feel fairly confident the stock is quite undervalued against the market’s EPS growth estimates.

In particular, even when applying Wall Street’s estimates, which tend to be quite conservative, Meta’s EPS is expected to grow at a compound annual growth rate (CAGR) of nearly 18%. Considering such strong EPS growth estimates and Meta’s overall qualities, I believe the stock deserves a higher multiple. Investors are essentially getting a high-growth company for the price of a slow-growth staple stock, allowing for the possibility of a significant upside while ensuring a wide margin of safety.

Is META Stock a Buy, According to Analysts?

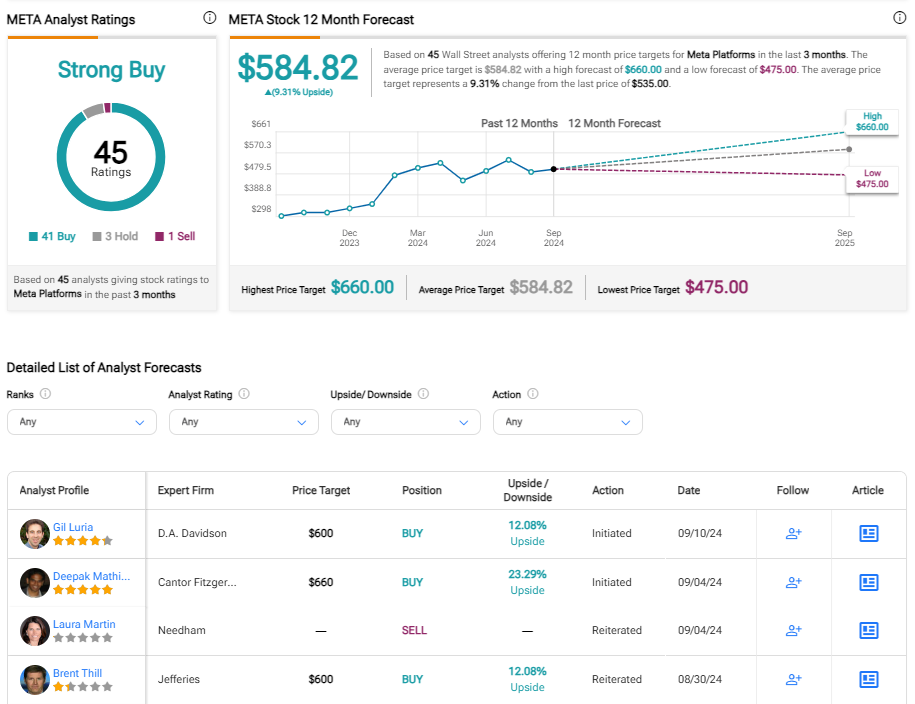

Wall Street’s outlook on Meta Platforms remains bullish, with an analyst consensus rating of Strong Buy. In the past three months, the stock has gathered 41 Buy, three Hold, and one Sell ratings. The average META price target of $584.82 implies a potential upside of 8.74% from current levels.

If you’re uncertain which analyst to follow for META stock, Brad Erickson of RBC Capital stands out as the most profitable over a one-year timeframe. His recommendations have delivered an average return of 70.92% per rating, with an impressive 79% success rate. Click the image below to learn more.

Key Takeaway

To sum up, Meta Platforms presents an exceptional growth opportunity with several drivers. The most notable ones that have caught my attention recently are its impressive user base expansion, AI-powered advertising capabilities, and the upcoming U.S. election cycle. With over 3.27 billion DAUs and AI-powered ad tools boosting both engagement and dollar flow, Meta’s growth potential is undeniable. Further, the upcoming election could accelerate this momentum, while the stock’s attractive valuation presents an attractive risk/reward balance. Therefore, I feel assured having Meta as my largest holding today.