Shares of Vapotherm (VAPO) hit an all-time low on Thursday after the stock fell a massive 39% on the company’s announcement to withdraw its earlier guidance for full-year 2022 due to reduced COVID-19 cases. The stock declined a further 6.3% at the time of writing.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The medical technology company engages in the development and commercialization of medical devices for patients suffering from respiratory distress. Shares of VAPO have tanked 61.9% so far this year.

Vapotherm had based its guidance on assumptions of two COVID-19 surges in 2022. However, as no such scenario is likely to occur again, the company’s top line will be impacted deeply by lower demand for breathing instruments. Thus, it withdrew its guidance for annual revenue, gross margin, operating expense, and adjusted EBITDA.

Vapotherm now expects preliminary revenue for the first quarter to be in the range of $20.5 million to $21.5 million, down from $32.3 million reported in the same quarter last year. The guidance still remains below the consensus estimate of $24.1 million.

Stock Rating

Following the news, Piper Sandler analyst Jason Bednar downgraded Vapotherm’s rating to Sell from Buy and lowered the price target to $8 from $23. The new price target implies 1.4% upside potential from current levels.

Bednar is of the opinion that Q1 guidance reflects the demand for capital and consumables to have lowered considerably post Vapotherm’s guidance update in February. Also, he is concerned about a breached revenue covenant included in its recently secured debt facility.

Consensus among analysts is a Moderate Buy based on two Buys and one Sell. Vapotherm’s average price target stands at $22 and implies upside potential of 210.3% to current levels.

News Sentiment

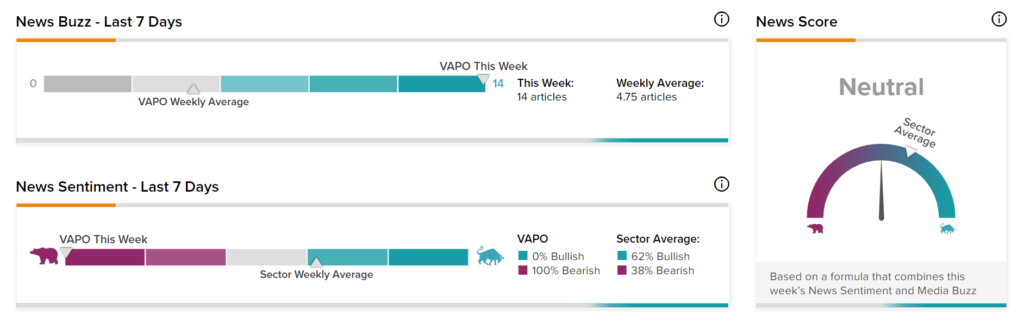

News Sentiment for Vapotherm is Neutral based on 14 articles over the past seven days. All the articles have a Bearish sentiment, compared to a sector average of 38%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Moderna Eyes Low-Income Countries for Sustained Growth

Why Did CDK Global Jump 11.3% on Thursday?

Upbeat Q4 Performance Cheers Up Constellation Brands