Shares of Stitch Fix, Inc. (NASDAQ: SFIX) tumbled nearly 12% on June 9, in anticipation of third-quarter results. SFIX stock continued the downfall in the after-hours trading session, sinking over 16% after the company missed Wall Street expectations and also announced a job cut.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Stitch Fix is an online personal shopping and styling service platform offering services across the U.S. and the U.K. Its shares have lost almost 60% so far this year.

“We know we still have work to do,” CEO Elizabeth Spaulding noted. However, she remains encouraged by the increase in revenue per active client (RPAC) and activity within the expanded Stitch Fix ecosystem. “Our team is committed to executing our strategy with excellence while thoughtfully and deliberately making the necessary decisions and innovations to drive our business forward,” she added.

Q3FY22 Results in Detail

Stitch Fix reported a diluted loss of $0.72 per share, 14 cents worse than analysts’ expected loss of $0.58 per share. The loss was even wider compared to the prior year’s loss of $0.18 per share.

Similarly, net revenue fell 8% year-over-year to $492.94 million and failed to meet the analysts’ estimates by $0.77 million.

The drastic revenue fall was due to a decrease in active clients by 5% compared to the same period last year. Nonetheless, owing to the inflationary environment, its RPAC of $553 rose 15% year-over-year.

Looking ahead, Stitch Fix expects Q4 net revenue to fall between $485-$495 million, representing a decline of 13%-15% year-over-year.

Stitch Fix Leans on Job Cuts for Long-Term Profitability

After undertaking a detailed review of its operations, and based on the current business momentum and macroeconomic uncertainty, Stitch Fix has decided to reduce its workforce.

Accordingly, the company plans to cut off approximately 15% of salaried roles, mostly related to non-technology corporate roles and styling leadership roles.

Following this, the company expects cost savings between $40-$60 million in FY23. Furthermore, SFIX also expects to incur one-time restructuring and other charges to the tune of $15 million to $20 million in Q4FY22.

Price Target

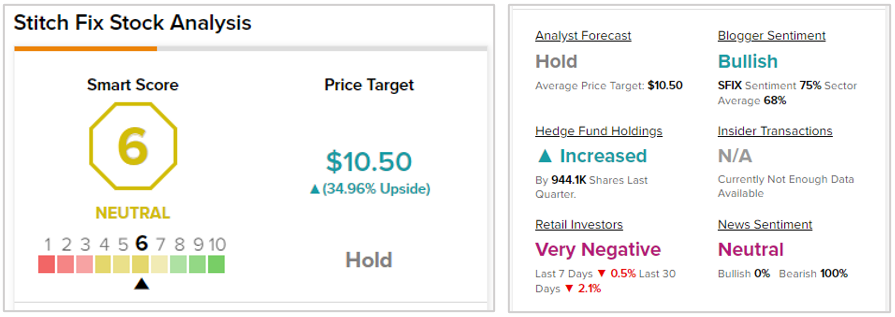

Based on two unanimous Hold ratings over the past three months, SFIX stock has a Hold consensus rating. The average Stitch Fix price target of $10.50 implies nearly 35% upside potential to current levels.

Stock Analysis

According to TipRanks’ Smart Score, Stitch Fix scores a six, indicating that the stock is likely to perform in line with market expectations. Bloggers are bullish on the stock, and hedge funds have increased their holdings of SFIX stock by 944,100 shares in the last quarter. However, retail investors have reduced their exposure to SFIX stock by 2.1% over the last 30 days.

Ending Note

Notably, Stitch Fix’s performance is dependent on increasing its client base. The reported quarter’s client base shows a decline, which signals that the company needs to ante up its ways to attract more clientele and improve profitability.

Read full Disclosure