Children’s Place (NASDAQ: PLCE) reported weaker-than-expected Q1 results, significantly missing both earnings and revenue estimates due to inflationary pressures, unseasonably cold weather, and the waning effect of last year’s government stimulus.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company did not provide FY2022 earnings per share (EPS) guidance based on the uncertainty in the current environment.

Despite the Q1 miss and lack of EPS guidance, shares of the U.S.-based pure-play children’s specialty apparel retailer gained by over 10% on May 19 to close at $47.74.

Investors welcomed the company’s stance on reiterated double-digit operating margin and EPS for 2022 and beyond.

Q1 Miss

Adjusted earnings of $1.05 per share fell far short of analysts’ expectations of $1.46 per share. Furthermore, it was much lower than the reported earnings of $3.25 per share in the prior-year period.

Revenues declined 16.8% year-over-year to $362.4 million, lagging consensus estimates of $401.59 million.

Positively, however, the adjusted gross margin of 39.2% expanded 250 bps, compared to the adjusted gross margin of 36.7% in the pre-pandemic first quarter of 2019.

Muted Sales Outlook

Based on “persistently high levels of inflation and the lack of visibility into its impact on the balance of the year,” the company modified the sales guidance for FY2022 and did not provide EPS guidance.

The company now forecasts a mid-single-digit decline in sales for 2022.

Positively, however, the company remains confident in achieving double-digit operating margin and double-digit EPS for 2022 and beyond, reaping the benefits of its “structural reset” made over the last two years.

CEO’s Comments

PLCE CEO, Jane Elfers, commented, “Looking ahead, while the impact of last year’s stimulus will eventually wane and the weather will eventually change, we believe that the unprecedented levels of inflation, which are now projected to persist into 2023, will continue to have an outsized impact on the lower income consumer, particularly due to significantly higher gasoline and food prices.”

Wall Street’s Take

In response to the Q1 results, Citigroup analyst Paul Lejuez decreased the price target on Children’s Place to $48 (fairly valued at current levels) from $60 and reiterated a Hold rating.

Lejuez believes that the Q1 miss was due to unfavourable weather and that “management underestimated the benefit stimulus had on Q1 of last year.”

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on three Buys and two Holds. The average Children’s Place price target of $68.60 implies 55.49% upside potential to current levels.

Bloggers Weigh In

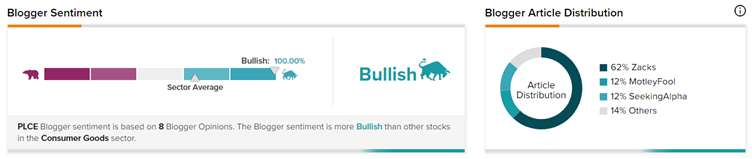

TipRanks data shows that financial blogger opinions are 100% Bullish on PLCE stock, compared to a sector average of 65%.

Concluding Thoughts

Though a host of factors led to the Q1 miss and the resulting cut in the FY2022 sales guidance, the company reinstated investors’ confidence by reiterating its goal to deliver double-digit operating margin as well as double-digit EPS for 2022 and beyond.

This is indeed commendable, especially in these uncertain times, where inflationary pressures don’t seem to be ending anytime soon.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Are Top Insiders Selling Meta Stock?

Why Did Sea Shares Jump 14%?

Home Depot Hits Home Run with Solid Q1 Results