New Hope Corporation (ASX:NHC) shares rose as much as 9.3% to hit a new 52-week high of AU$5.97 in afternoon trading. The stock soared after the coal mining company released strong earnings results for Fiscal 2022 and announced a special dividend.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New Hope’s earnings in detail

Revenue increased 143% to AU$2.56 billion. Net profit after tax soared more than 1,100% to a record AU$983 million. The strong results were supported by high coal prices. New Hope sold its coal at an average price of AU$282 a tonne, representing an increase of 178% from the previous year. Coal prices have benefited from tight supply and strong demand for the commodity.

As a result of strong coal prices, New Hope was able to deliver solid earnings despite selling fewer tonnes of coal in Fiscal 2022 compared to the prior year. The company expects the high coal prices to persist for the next 12 months.

New Hope’s special dividend share repurchase plan

Following the record annual profit, New Hope boosted its final dividend to AU$0.31 per share from AU$0.07 per share a year ago. Additionally, the company plans to pay a special dividend of AU$0.25 per share. New Hope ranks among the best ASX shares for dividends. It offers a dividend yield of 4.74%, compared to the sector average of about 2%. New Hope has also maintained a modest pay out ratio of about 13% to ensure dividend stability.

In the future, New Hope may use its excess cash to fund share repurchases. Moreover, the company plans to deploy its surplus capital toward expansion of its operations and acquisitions.

New Hope share price forecast

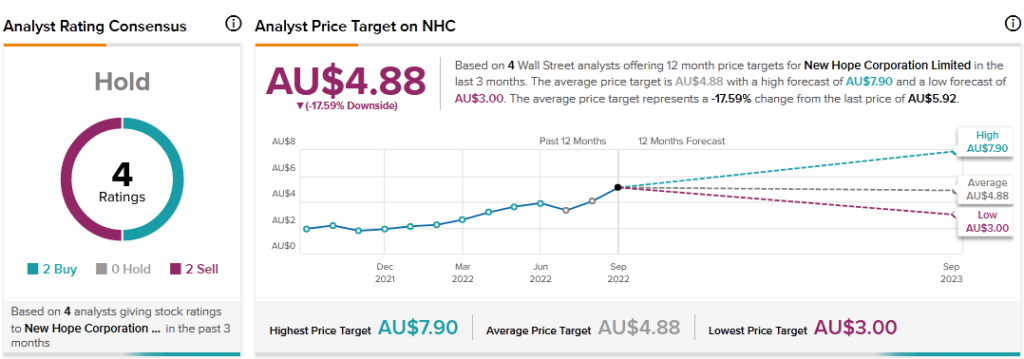

New Hope’s shares have soared more than 160% since the beginning of 2022. According to TipRanks’ analyst rating consensus, New Hope stock is a Hold. As the stock has already exceeded expectations, the current average New Hope share price target of AU$4.88 implies 18% downside potential.

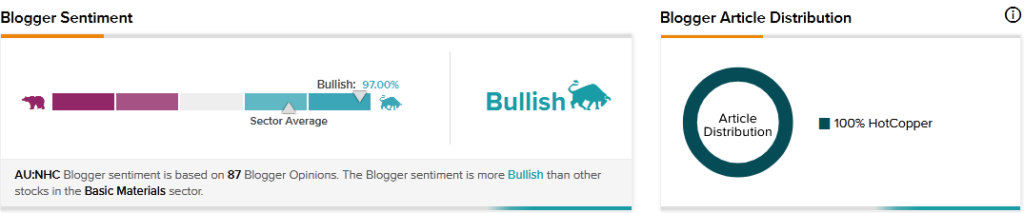

New Hope stock continues to see positive mentions on financial blogs. TipRanks data shows that financial blogger opinions are 97% Bullish on NHC, compared to a sector average of 74%.

Final thoughts

New Hope’s forecast for continued high coal prices points to strong profit ahead, which could enhance dividend stability. The company’s plan for share repurchases in the future also offer a positive.