Magellan Financial Group Ltd (AU:MFG) shares plunged by as much as 10% today, after the company announced a large drop in the amount of funds under management (FUM).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Magellan provides funds management services to institutional and retail investors. Its total FUM dipped to AU$50.9 billion at the end of September, from AU$57.6 billion at the end of August. The largest fund outflows were experienced in the institutional clients division.

Magellan was among the ASX financial stocks that rose sharply after the Reserve Bank of Australia delivered a softer than feared interest rate increase. The other ASX shares plunging alongside Magellan today were De Grey Mining Ltd (ASX:DEG) and Kelsian Group Limited (ASX:KLS).

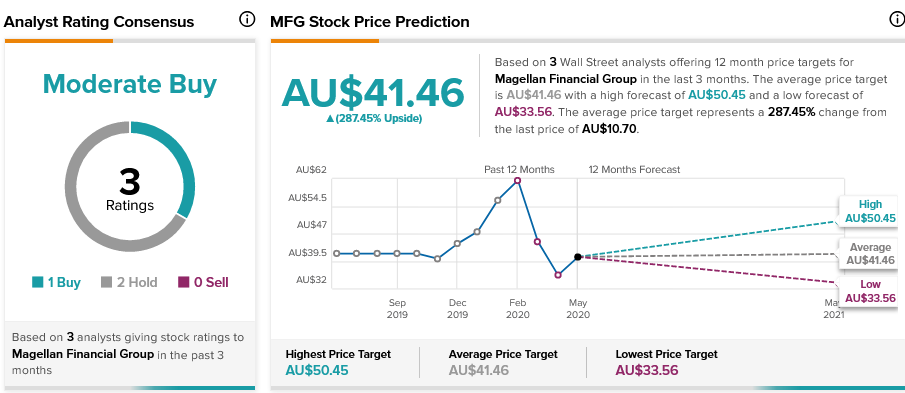

Magellan share price prediction

Magellan shares have dropped more than 40% since the beginning of the year. According to TipRanks’ analyst rating consensus, Magellan stock is a Moderate Buy. The stock’s average price prediction of AU$41.46 suggests nearly 290% upside potential.

Closing remarks

While the drop in Magellan’s funds under management saw the share price plunge, analysts remain mostly bullish on the company, according to TipRanks’ insights.