Ride-hailing company Lyft (NASDAQ:LYFT) reported better-than-anticipated third-quarter earnings, thanks to the turnaround efforts and growth initiatives to lure back customers under the leadership of CEO David Risher, who took over as head of the company in April. However, shares fell nearly 2% in Wednesday’s extended trading session as the company’s Q3 bookings were lower than that of arch-rival Uber Technologies (NYSE:UBER).

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Lyft’s Q3 Metrics

Lyft’s revenue grew 10% to $1.16 billion, surpassing analysts’ expectations of $1.14 billion. Further, the company reported adjusted earnings per share (EPS) of $0.24, reflecting a significant improvement from a loss per share of $0.16 in the prior-year quarter. The company beat analysts’ adjusted EPS consensus of $0.15 per share.

Lyft gained from the back-to-school season and return-to-office, with rides growing 20% to 187 million. The company also benefited from continued momentum in travel, with airport trips rising by about 15% year-over-year.

Meanwhile, gross bookings increased 15% year-over-year to $3.55 billion, reflecting strong ride growth that was partially offset by lower prices as the company is trying to stay competitive. In comparison, rival Uber reported a 31% rise in the gross bookings of its Mobility business.

Looking ahead, the company expects Q4 bookings in the range of $3.6 billion to $3.7 billion. It expects Q4 revenue to grow by mid-single-digits quarter-over-quarter.

What is the Forecast for LYFT Stock?

Today, Goldman Sachs analyst Eric Sheridan reiterated a Buy rating on Lyft stock but slightly lowered the price target to $12 from $13. The analyst highlighted that Lyft’s Q3 revenue and adjusted EBITDA beat his expectations, as rideshare rides accelerated for the third consecutive quarter, with continued acceleration in October.

That said, Sheridan noted that the fourth quarter is expected to see “another step-down” in contribution margins due to higher third-party insurance costs. He views LYFT as a “show-me story,” given the relative market share dynamics in the U.S. ridesharing market, stability/improvements in contribution profit per ride, and a ramp to sustained GAAP profitability.

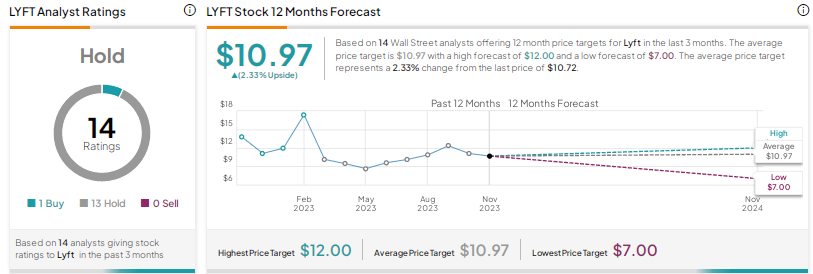

Overall, Wall Street is sidelined on Lyft stock, with a Hold consensus rating based on one Buy and 13 Holds. The average price target of $10.97 implies the stock could be range-bound at current levels. Note that the average price target could change due to analysts’ reactions to the Q3 results and outlook.