Grab Holdings (GRAB) is based in Singapore and was established in 2012. The company operates a number of related mobility and delivery services, but is also using its brand name to extend into other business areas. While Grab looks set to grow faster than Uber (UBER) and Lyft (LYFT), valuation needs to be a consideration here. For example, Grab has about half the revenues that Lyft reports, but trades at a ~3x higher market cap. Its valuation metrics are also above those of industry leader Uber.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I identify mostly as a value and special-situations investor, so don’t hold a lot of high-growth names in my portfolio. With that said, I rate GRAB stock as a Buy for risk-tolerant investors.

My Grab Experience

A little over a year ago I had my maiden opportunity to visit Singapore, as a tourist. Let me first say that it’s a fascinating country, much different than any other place I’ve been to in South-East Asia. Singapore shares a number of similarities with the United States, actually. Recent statistics suggest that these are the #5 and #6 ranked countries in GDP per capita, with Singapore the higher rank. Both are import-driven nations, although Singapore’s dependency on foreign countries for all sorts of goods is more notable. The Singapore Dollar was also pegged to the U.S. Dollar for a period of time, although that ended in 1985.

When travelling internationally, I’m often struck by how inefficient (and sometimes unregulated) things are in foreign countries. That wasn’t the case with Singapore; this is an efficient business-minded country, and a global finance and trade hub. My experience with Grab also measured up. The company’s services seem to run like a well-oiled machine, and my confidence in using my Grab app accelerated quickly.

Singapore is the perfect headquarters for Grab Holdings, since the rate of car ownership is only about 15 vehicles per 100 people (depending on source), versus more than 80 vehicles per 100 people in the United States. All these Singaporean business people need to get to work somehow, and that’s often via Grab.

Like most car-hailing services, Grab also has a delivery business for meals, groceries and packages. The company has also expanded into the financial services and leisure bookings businesses. It’s important to note that GRAB operates in several South-East Asian countries beyond its home base, including Thailand, Malaysia, Vietnam and Indonesia.

How Has Grab Stock Performed?

Grab revenues have soared about 6-fold in the past 4 years, with a CAGR rate of nearly 50% over that period. The company has regularly been posting large losses, and prior to mid-2022 quarterly operating losses were even exceeding sales! Losses have slowly but surely been declining, and the company posted $0.01 in diluted EPS in its recent Q3 2024.

The march towards profitability helped the investibility of GRAB stock, and shares have risen about 50% in the past 12 months.

However, the company’s progress has trailed the expectations of original investors. GRAB stock, which went public as a SPAC through a reverse merger, was trading at above $15/share in its early days on the NASDAQ. Despite the company’s tremendous growth, GRAB stock is down by more than two-thirds in the past ~4 years.

Assessing GRAB’s Valuation and Growth Potential

Taking a look at GRAB’s valuation, given its very fresh profitability, measuring the stock on the basis of P/E (~90x forward) is of little value. The EV/EBITDA looks a lot more affordable, but that’s actually largely due to GRAB’s net cash balance in excess of $5 billion. This is the first thing that investors might overlook in assessing GRAB’s investibility. The ~$18 billion market cap may look awfully expensive against ~$2.8 billion in revenues. But, once accounting for net cash, the ~6x sales multiple shrinks to about 4.4x. As a comparison, UBER’s EV/S is about 3.3x.

GRAB is posting much higher gross margins than UBER, at ~42% over the past four quarters as opposed to ~33%. This is one of the reasons for the company’s premium valuation, as there is a lot more operating leverage to benefit from as sales rise.

Indeed, sales are rising, although no longer at the ~50% annualized pace. That growth has slowed to about 22% over the past year, and analysts expect an average revenue growth of 22% over the next 3 years as well. As long as the company can continue to demonstrate operational leverage, earnings could grow at a ~50% rate. On the basis of consensus EPS estimates three years out, GRAB’s current share price represents a P/E of under 15x, after adjusting for cash.

On the topic of cash, its worth mentioning that GRAB has delivered ~$600 million in OCF over just the past 2 quarters, against capex of only about $37 million. So this is a company flush with cash, whose balance is set to grow. Stock Based Compensation of about $75 million per quarter over the past year is a deterrent, of course, and shareholder dilution is almost an unnecessary evil when it comes to GRAB. With that said, the company did embark on their first share buyback program in 2024.

Unpacking Grab’s Balance Sheet Asterisk

The fact that Grab Holdings has delved into the financial services business (accepting deposits and issuing loans) muddies its cashflow and balance sheet picture. When analyzing a banking institution, it’s dubious to convert Market Value to Enterprise Value by adjusting for net cash, which largely represents customer deposits. We’re not quite at that point with Grab Holdings, but indeed customer deposits reached $1.1 billion (against $0.5 billion in loans) as of September 30, 2024. The company’s operating cashflow statement may increasingly reflect incoming deposits and outgoing loans, which don’t represent the cash earnings from Grab’s core operations.

The complexity in Grab’s financial statements introduces a challenge for investment analysts, and may already be leading to some confusion and hesitation. I’m all onboard with Grab’s decision to use its credibility to expand into financial services, although as that segment grows, so will the opaqueness of its operating results. Spinning-off the financial business at some point could enhance transparency, and potentially lead to better market valuations.

Is Grab a Good Stock to Buy?

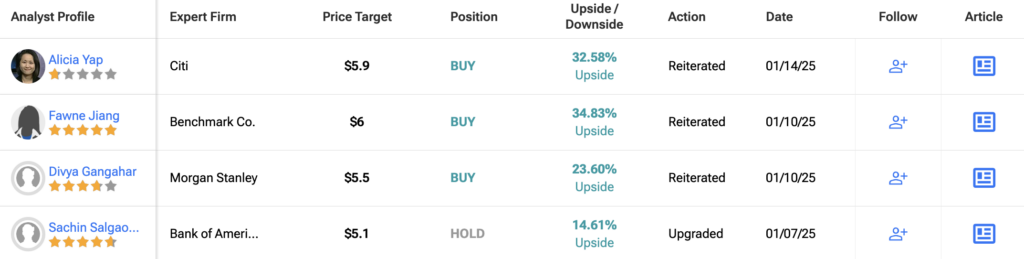

Analysts remain cautiously optimistic about GRAB stock, with a Moderate Buy consensus rating based on 11 Buys and four Holds. Over the past year, GRAB has increased by more than 50%, and the average GRAB price target of $5.69 implies an upside potential of 27.9% from current levels.

Key Takeaway

Grab Holdings is a Singapore-based mobility and delivery company, and Uber is an investor. There have been some rumors about Uber acquiring Grab, but my investment view on the stock is as an independent public company.

Grab delivers a highly dependable service in its operating markets in South-East Asia, from my personal experience. The Singapore market is particularly attractive for the business, as very few citizens own vehicles, and the local metro isn’t the most impressive.

The company is posting strong growth, despite it slowing in recent years. Profitability has been reached in the recent quarter, and 2025 should mark full-year profitability for the first time. GRAB stock looks expensive on many traditional metrics, but that’s partially due to the fact the company is cash rich, with more than $5 billion net cash against its market cap of $18 billion.

I like the story here, and can tolerate the higher valuation than I normally find appealing. As the company expands its financial services business, analyzing GRAB will increase in complexity. I’m hoping for added transparency and detail from management as that occurs. On the basis of a ~15x adjusted P/E valuation on expected 2027 results, I rate GRAB a Buy.