Shares of Cisco Systems (NASDAQ: CSCO) declined 12.8% in Wednesday’s extended trading session and a further 13.6% in the pre-market trading session on Thursday after the company reported mixed results for the third quarter and lowered its outlook for the Fiscal Year 2022.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Cisco offers a broad range of technologies across networking, security, collaboration, applications and the cloud. Its shares have tanked 22.5% so far this year.

Results in Detail

Cisco reported adjusted earnings of $0.87 per share, up 5% year-over-year. Further, the figure surpassed the consensus estimate of $0.86 per share.

Revenues of $12.8 billion missed analysts’ expectations of $13.3 billion and remained flat year-over-year. Annualized Recurring Revenue (ARR) stood at $22.4 billion, up 11% year-over-year.

Segment-wise, product revenues were up 3% year-over-year to $9.4 billion, while service revenues declined 8% to $3.4 billion.

Markedly, product revenue performance was driven by growth in Secure, Agile Networks (up 4%), Internet for the Future (up 6%), End-to-End Security (up 7%), and Optimized Application Experiences (up 8%). However, Collaboration revenue was down 7%.

Adjusted gross margin was 65.3% in the quarter, down 700 basis points year-over-year. Remaining Performance Obligations (RPO) came in at $30.2 billion, up 7%.

The CEO of Cisco, Chuck Robbins, said, “We continued to see solid demand for our technologies and our business transformation is progressing well. While Covid lockdowns in China and the war in Ukraine impacted our revenue in the quarter, the fundamental drivers across our business are strong and we remain confident in the long term.”

Guidance

For the fourth quarter, revenues are expected to decline 1%-5.5% year-over-year. Adjusted EPS is projected in the range of $0.76 to $0.84 against analysts’ expectations of $0.87 per share.

Further, Cisco has lowered its guidance for the Fiscal Year 2022. Revenues are now projected to rise 2-3%, compared with the prior guidance of 5.5%-6.5% year-over-year growth. Adjusted EPS for the year is anticipated between $3.29 and $3.37, down from $3.41 and $3.46 per share expected earlier. The consensus estimate for the same is pegged at $3.44 per share.

Wall Street’s Take

The Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on six Buys, four Holds and one Sell. Cisco’s average price forecast of $62.10 implies 28.4% upside potential to current levels.

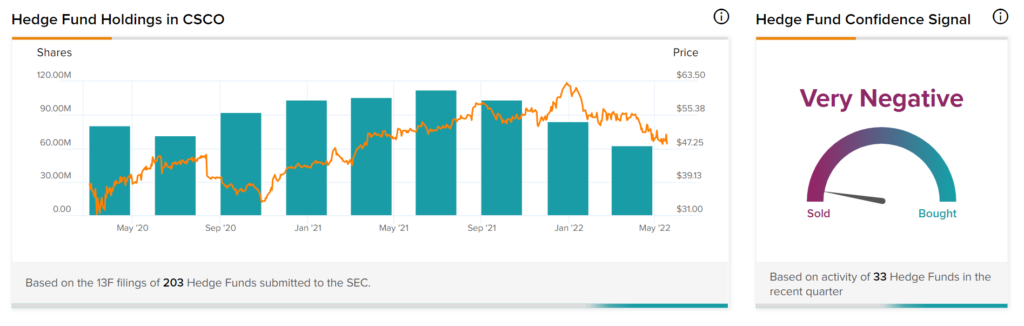

Hedge Funds’ Activity

TipRanks’ Hedge Fund Trading Activity tool shows that the confidence of hedge funds in Cisco is currently Very Negative, as the cumulative change in holdings across all 33 hedge funds that were active in the last quarter was a decrease of 21.7 million shares.

Conclusion

The expectation of lower revenues due to the ongoing Ukraine-Russia conflict remains a key drag for Cisco. Also, negative sentiments of hedge funds and investors at TipRanks are concerning.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

TipRanks’ Hedge Fund Tool Hinted at Dalio’s Move to Part Ways with Tesla

Why Are Top Insiders Selling Meta Stock?

Home Depot Hits Home Run with Solid Q1 Results