SAP (DE:SAP) (SAP) shares were trading almost 5% lower at the time of writing this article after the Germany-based multinational software company reported mixed results for the second-quarter of FY2022. The top-line beat expectations, but the results disappointed on the profitability front.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SAP’s Mixed Q2 Results

The company reported GAAP earnings of €0.28 per share, which was much lower than the earnings of €1.15 per share reported in the prior-year period.

Positively, however, revenues jumped 13% year-over-year to $7.52 billion and exceeded consensus estimates of $7.34 billion. The increase in revenues reflected a surge in Cloud revenue, which increased 34% to $3.06 billion.

On the downside, International Financial Reporting Standards (IFRS) operating profit was down 32%, while non-IFRS operating profit was down 13% and down 16% at constant currencies, mainly due to the impact of the war situation in Ukraine.

SAP Updates Short-Term & Reiterates Mid-Term Outlook

SAP reaffirmed its revenue outlook for 2022 but lowered its operating profit guidance.

For FY2022, the company continues to forecast cloud revenues to be in the range of €11.55 to €11.85 billion, implying a growth rate of 23% to 26% at constant currencies. Cloud and software revenue combined are expected to be around €25 billion to €25.5 billion, up 23% to 26% at constant currencies.

Disappointingly, SAP now expects non-IFRS operating profit to decline in the range of 4% to 8% (€7.6 billion to €7.9 billion) in constant currencies, compared to the previous range of €7.8 billion to €8.25 billion.

For the mid-term period, SAP reiterated the previous outlook, including achieving double-digit growth in operating profit in 2023. Furthermore, management stated that they will update its mid-term targets in the upcoming quarters based on ongoing cloud momentum and recent favorable movement in currency.

SAP Increases Buybacks Worth $500 Million

Concurrent with the earnings call, the company announced a new share repurchase program of up to €500 million, expected to be executed between August 1 and December 31, 2022.

SAP CEO’s Comments

SAP CEO, Christian Klein, commented, “Our transition to the cloud is ahead of schedule and we have exceeded topline expectations, with cloud revenue becoming SAP’s largest revenue stream. Our pipeline is strong, and we are winning market share underpinned by the very strong 100% growth of S/4HANA current cloud backlog.”

Wall Street’s Take on SAP

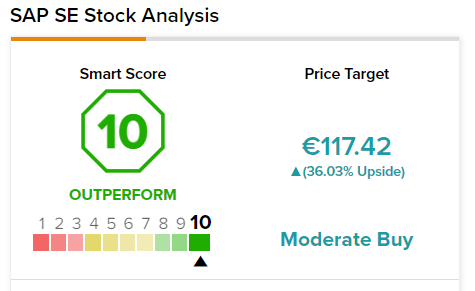

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 15 Buys and eight Holds. The average SAP price target of $117.42 implies 35.86% upside potential to current levels.

Perfect Score for SAP

SAP scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Concluding Thoughts

SAP shares have lost over 35% of their market capitalization over the past year, massively underperforming benchmark indices that are down almost 10% over the same period.

Positively, the cloud backlog surpassed $10 billion for the first time during the quarter. Though management is confident on achieving “sustained growth and profitability expansion” by leveraging on its growth investments made over the past year, investors will perhaps wait until they see signs of an upward swing in profitability.