Shopify, Inc. (NYSE: SHOP) (TSE: SHOP) announced a 10-for-1 stock split in April in order to make its stock accessible to more retail investors. The split was completed on Wednesday.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the completion of the stock split, shares of the Canadian cloud-based commerce behemoth declined 5.64% at Wednesday’s close. Several macro headwinds seem to keep investors cautious.

Wall Street’s Take

Following the completion of the stock split, Stifel Nicolaus analyst Scott Devitt reiterated a Buy rating and a price target of $65 on the stock. This indicates 96.67% upside potential from Wednesday’s closing price of $33.05 per share.

Devitt updated his model to reflect the company’s stock split and believes that “Shopify is the best-positioned platform to benefit from the ongoing digital transformation given its breadth of merchant solutions, subscription plans designed to scale alongside merchants’ growth, technology infrastructure, expertise, and worldwide brand recognition.”

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 15 Buys, 12 Holds, and two Sells. The average Shopify price target of $63.58 implies 92.38% upside potential. Shares have lost 97.74% over the past year.

Besides, TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Shopify is currently Positive, as the cumulative change in holdings across all 36 hedge funds that were active in the last quarter was an increase of 134,700 shares.

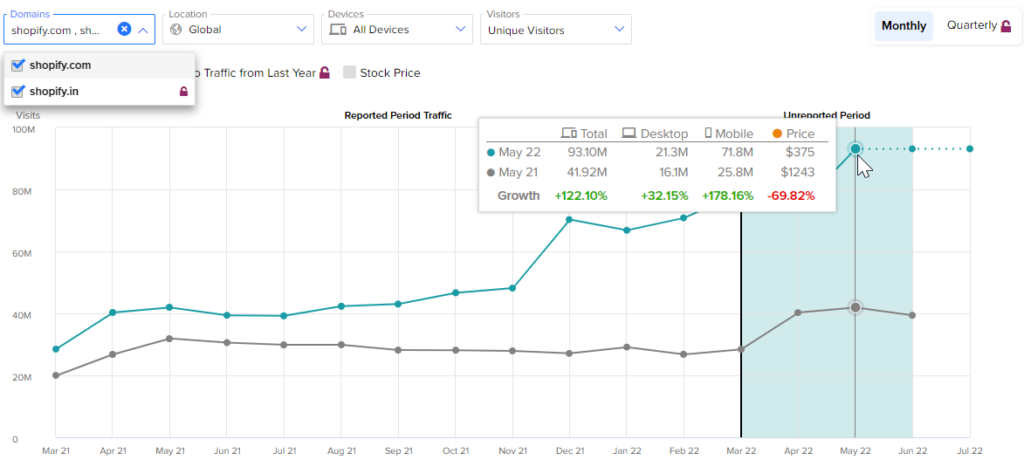

Monthly Website Visits

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), offers insight into Shopify’s performance.

According to the tool, Shopify websites recorded a whopping 83.54% and 122.1% increase in total visits in April and May, respectively, on a year-over-year basis. Also, year-to-date website growth, compared to year-to-date website growth in the previous year, came in at 134.11%.

This, in turn, indicates that the company might report strong revenues in the fiscal second quarter.

Concluding Remarks

Investors appear to be wary about the stock in the near term due to macro headwinds. However, decent analyst ratings and hedge funds’ buying actions point to long-term optimism.

Additionally, vigilance on website trends as shown by TipRanks’ Website Traffic Tool could be helpful.

Read full Disclosure