At its Financial Analyst Day, AMD (AMD) highlighted that spending on artificial intelligence isn’t slowing down. Indeed, CEO Dr. Lisa Su announced that the chipmaker now expects the total AI data center market to reach $1 trillion by 2030, which is up from its previous estimate of $500 billion. She emphasized that high-performance computing, especially when tied to AI, is now essential to everyday life. As a result, Dr. Su said that AMD is on track to earn “tens of billions” in revenue from data centers by 2027, thanks to upcoming products like the MI450 GPU and Helios rack-scale systems.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

She added that the company is aiming for a double-digit share of the AI data center market, with that segment expected to grow at an 80% annual rate over the next three to five years. AMD also sees its overall revenue growing at a rate of at least 35% annually during that same time. While Nvidia (NVDA) currently dominates this space with over 90% market share, Su believes that AMD is gaining ground quickly with its growing product lineup.

Interestingly, Su noted that the pace of change in AI is faster than anything she’s seen before, and companies with strong financials are investing heavily in AI infrastructure to stay competitive. Over the past 12 to 18 months, AMD has secured $45 billion in custom design wins across industries like aerospace, defense, communications, and data centers. AMD’s Instinct GPUs are now used by seven of the world’s top 10 AI companies, and its data center CPUs make up 40% of its revenue. Su also shared that AMD has moved from launching new products every two years to doing so annually.

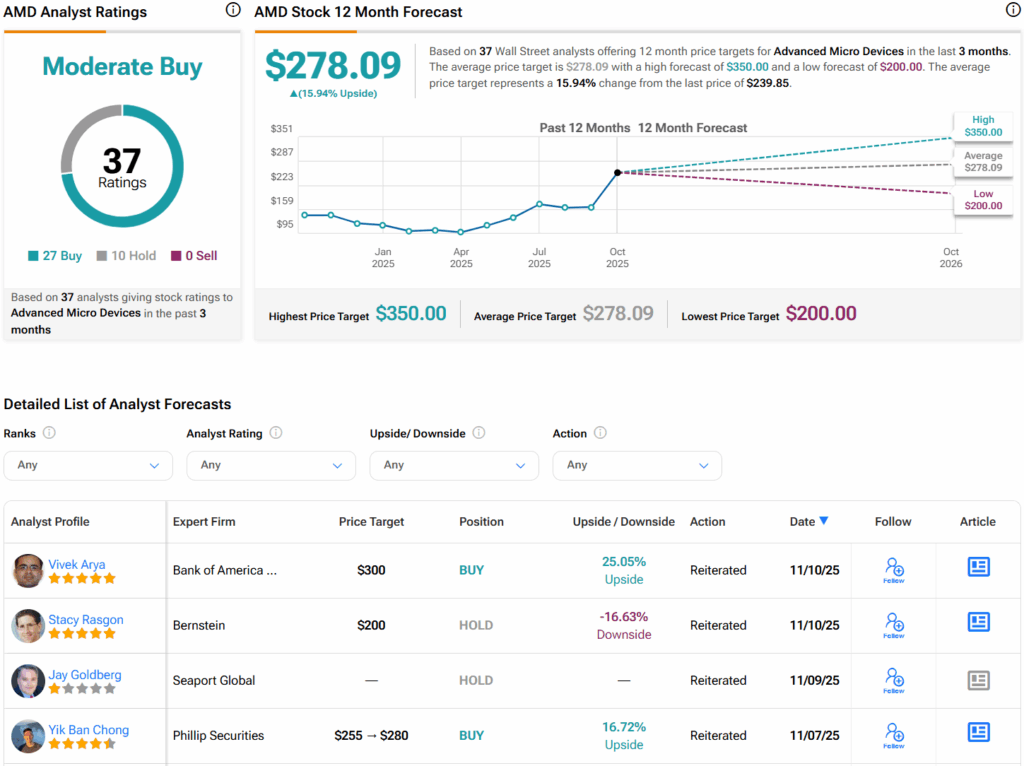

Is AMD a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMD stock based on 27 Buys, 10 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMD price target of $278.09 per share implies 16% upside potential.