After underperformance due to an overleveraged balance sheet and operational inefficiencies, HanesBrands (NYSE:HBI) stock has recently gained momentum, climbing over 17% in the past month. This resurgence is fueled by the initiation of asset sales, including the strategic sale of the Champion brand, which has provided the company with improved leverage ratios and investors with a beacon of hope.

Despite paving the way for a more streamlined HanesBrands, the company continues to struggle with its substantial debt. While the stock trades at an attractive valuation relative to its industry peers, investors may want to hold off until the company demonstrates positive results from its recent realignment.

HanesBrands Sells a Key Asset

HanesBrands is a global clothing consumer company that designs, manufactures, and sells everyday undergarments and sportswear through several known brands. However, the company has experienced a decline in its revenue, profit margins, and earnings per share in recent years.

In a strategic move, the company has agreed to sell its Champion brand’s intellectual property and other assets to Authentic Brands Group for approximately $1.2 billion. By doing so, HanesBrands can improve its financial stability and reduce its debt while concentrating on more attractive and solid investment opportunities in the undergarment industry.

The transaction of the Champion brand is due to be finalized in late 2024, subject to specific conditions being met. Under the terms of the expected deal, HanesBrands will continue to operate Champion in Japan under a licensing agreement with Authentic. The proposed agreement also includes additional payments based on performance metrics.

HanesBrands’ Financial Results & Future Outlook

The company recently reported its first-quarter results, revealing a revenue of $1.16 billion, a 16.5% decrease compared to the same period last year, missing expectations by $10 million. However, strong gross margin performance was a highlight, with the first quarter marked by the recovery to pre-inflation levels. This is primarily due to lower input costs as commodity and ocean freight inflation moderated, as so benefits from cost savings initiatives and the impact of the business mix.

The company also reduced inventory and strengthened its balance sheet, generating $26 million of operating cash flow. This helped non-GAAP earnings per share (EPS) of -$0.02 beat expectations by $0.06.

Its balance sheet also improved, ending the quarter with $1.2 billion of liquidity. It reduced leverage to 5.0x net debt-to-adjusted EBITDA, 0.4x lower than the prior year and 0.2x lower than year-end 2023.

For the second quarter of 2024, the company anticipates net sales between $1.335 billion and $1.375 billion and non-GAAP EPS between $0.07 and $0.11.

Despite the challenging environment, the company has reiterated its full-year 2024 guidance. It remains confident about strong profit on net sales of approximately $5.35 billion to $5.47 billion and adjusted earnings per share of roughly $0.42 to $0.48. Furthermore, the company plans to pay down more than $300 million of debt in 2024.

Is HBI Stock a Buy?

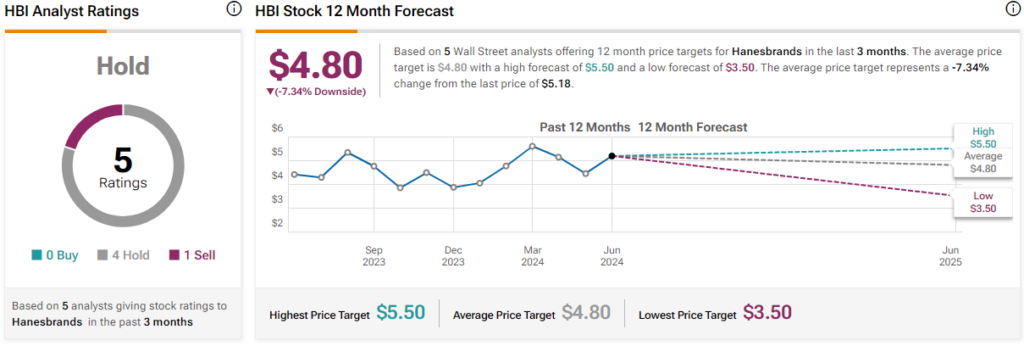

HanesBrands is currently rated a Hold based on the aggregate ratings and price targets assigned by five analysts over the past three months. The average price target for HBI stock is $4.80, representing a downside of 7.34% from current levels.

Analysts following the company have taken a cautious stance on the stock despite the recent Champion sale. For example, UBS analyst Jay Sole kept a Neutral rating and $5 price target on HanesBrands, stating the Champion brand sale as a positive. Still, the company needs to use it as a catalyst to generate higher margins by lowering its cost structure and interest expense.

As previously noted, the stock has steadily declined, losing over 71% in the past three years. Yet, a 17% upswing in the past month has the shares trading in the upper end of the 52-week price range of $3.54-$5.86. The shares continue demonstrating positive price momentum, trading above the 20-day (4.99) and 50-day (4.92) moving averages. The stock trades at a relative discount, with a P/S ratio of 0.34x, sitting well below the Apparel Manufacturing industry average of 1.04x.

Final Thoughts on HBI

HanesBrands’ decision to sell the Champion brand is a strategic solution to improve leverage ratios and entirely focus on investment opportunities in the innerwear market, where significant growth has been observed. The company anticipates that improved net sales and EPS, in addition to paying down considerable debt, might increase shareholders’ confidence. The shares trade at an attractive valuation, making them a potential target for value investors. However, potential investors may want to wait for confirmation of tangible positive results from its recent restructuring before buying the stock.